Most business owners are unprepared for the moment that matters most: their exit.

Despite years of building value, developing teams, and adapting to market cycles, many owners reach a transition point without a plan. According to recent data, only 35% of businesses overall have a formal succession planning process, and more than 61% of family-owned businesses in North America lack a written succession plan altogether. Rather than a simple gap, it represents a critical readiness deficiency.

The Exit Planning process helps protect the owner’s wealth, the company’s value, and the legacy that’s been built. Yet most owners don’t know where to begin, and few advisors are prepared to guide them.

In this blog, we’ll discuss what Exit Planning involves, why timing is critical, and how experienced professionals play a pivotal role in helping owners prepare, execute, and succeed with Exit Planning.

What Is the Exit Planning Process?

| Exit Planning is a structured, advisor-led strategy that prepares a business owner, financially, operationally, and personally, for a successful transition out of their company. |

It’s not a single event or a retirement checklist, but a coordinated process built around the owner’s goals and timeline.

A well-created Exit Planning process includes:

- Business Valuation Methods: Establishing the enterprise’s value and identifying opportunities to enhance it.

- Tax and Financial Planning: Minimizing tax liabilities and aligning the transition with long-term financial goals.

- Legal Structure and Risk Mitigation: Ensuring ownership, contracts, and liabilities are structured to support a clean transition.

- Operational Readiness: Strengthening systems, teams, and leadership to maintain performance beyond the owner’s involvement.

- Personal and Post-Exit Planning: Helping owners define what comes next, financially and personally, to support a fulfilling life after the business.

A successful Exit Plan ensures the owner exits on their terms while protecting continuity, maximizing value, and supporting their long-term goals.

Importance of a Business Exit Strategy

Here’s why early, strategic planning makes a difference:

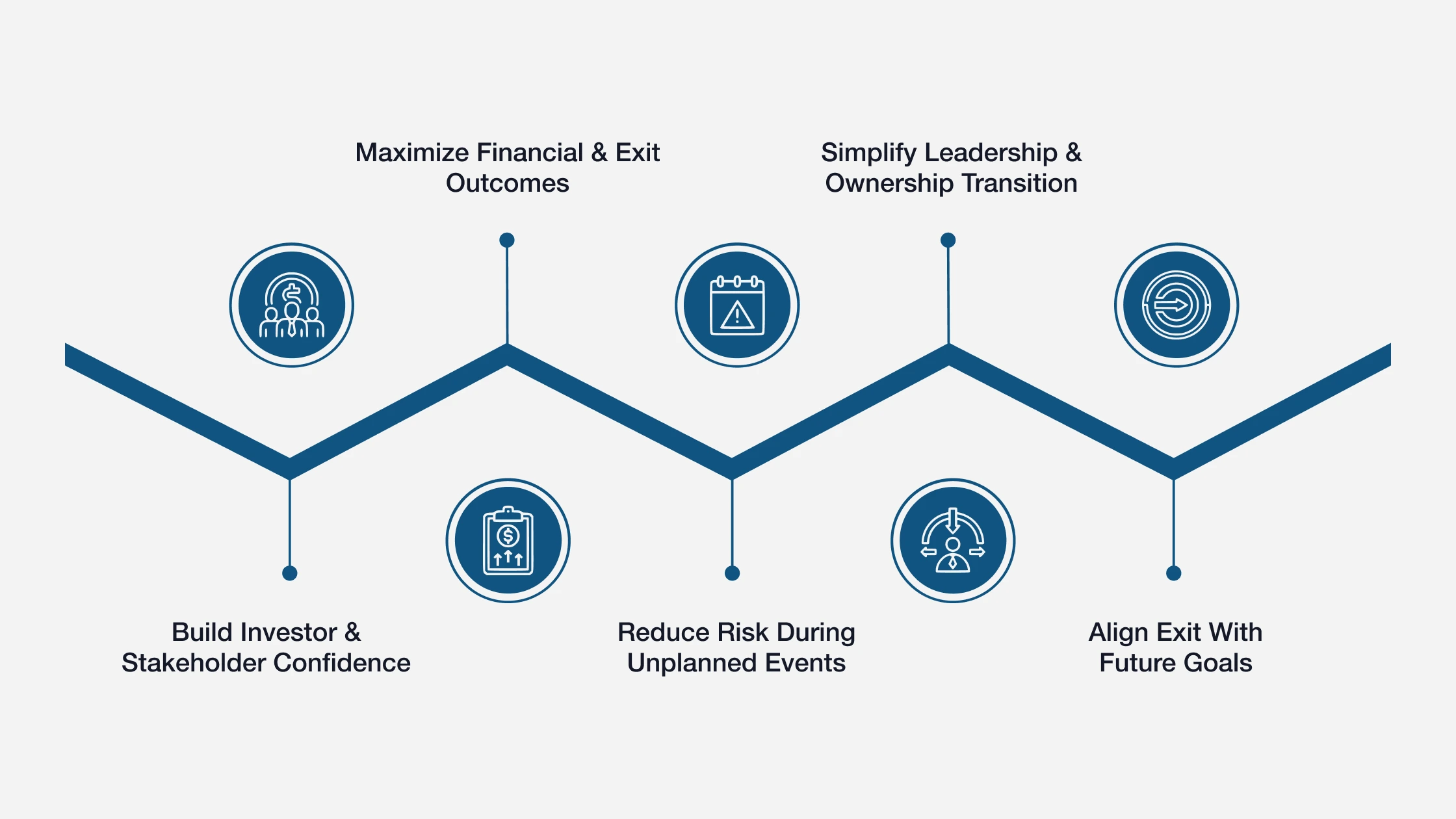

1. Build Investor & Stakeholder Confidence

A documented Exit Plan shows that the business is being built with foresight. Investors and partners are more likely to engage when they know the owner is thinking ahead about long-term continuity and return on investment.

2. Maximize Financial & Exit Outcomes

With the right strategy, owners can increase enterprise value, manage tax exposure, and exit on their terms. The ability to time a transition based on market conditions, not personal urgency, often leads to stronger deal terms and higher valuations.

3. Reduce Risk During Unplanned Events

Unexpected events, like illness, economic downturns, or leadership gaps, can threaten even well-run companies. An exit strategy provides a roadmap in uncertain times, allowing advisors to step in with clarity and prevent rushed or reactive decisions.

4. Simplify Leadership & Ownership Transition

Successful transfers require preparation. A defined strategy supports operational handoffs, reduces confusion among major stakeholders, and helps retain employee and customer confidence throughout the transition.

5. Align Exit With Future Goals

Every business owner eventually moves on. A strong strategy ensures that the transition supports larger life goals, whether that means retirement, a family succession, or a new chapter altogether.

Step-by-Step Look at the Exit Planning Process

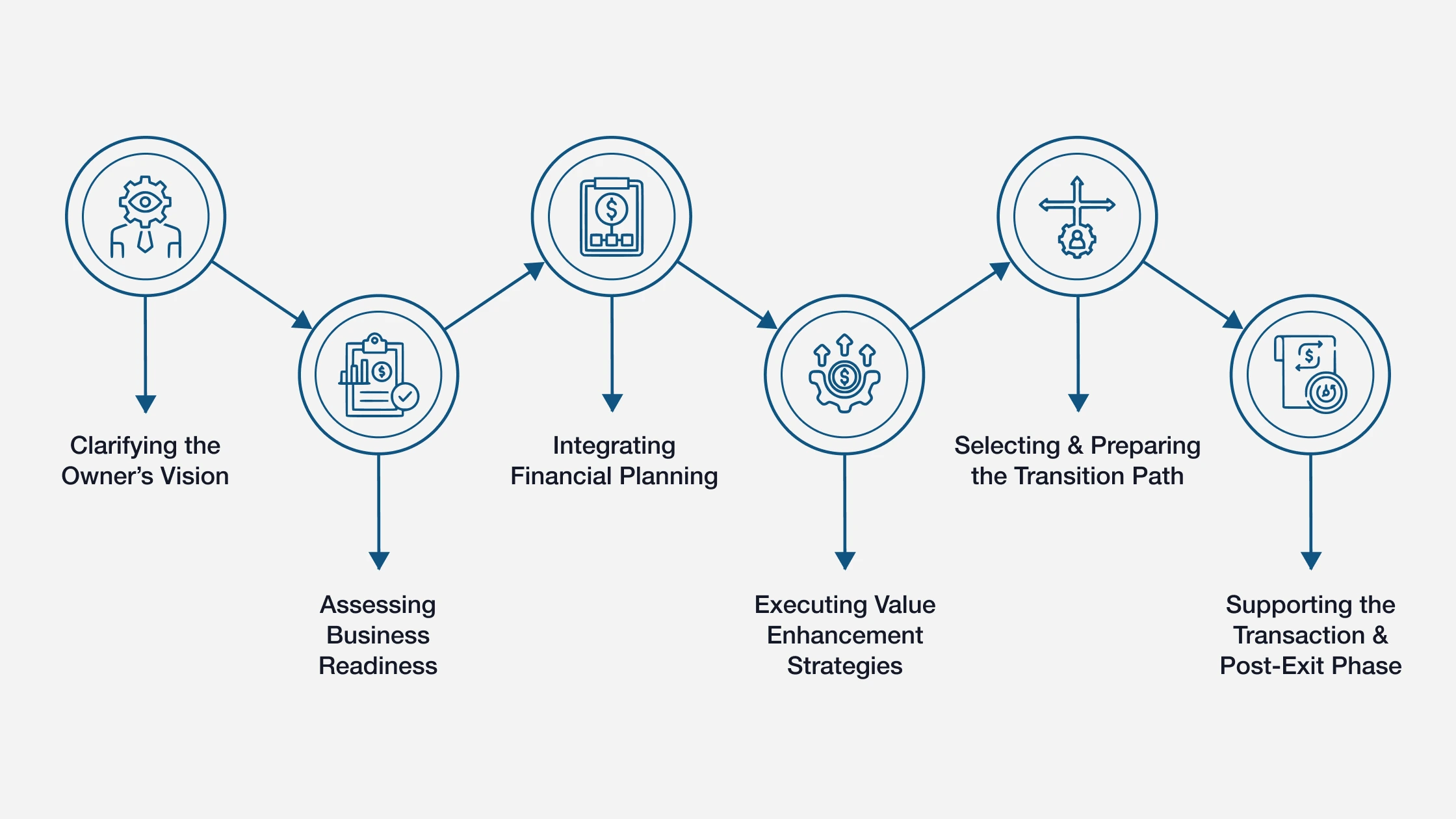

Exit Planning progresses through overlapping phases tailored to each owner and business. Advisors who bring clarity to this complex process empower confident, controlled transitions.

1. Clarifying the Owner’s Vision

Every engagement begins with the owner’s personal, financial, and professional goals. Without alignment on what the owner hopes to achieve, both within and beyond the business, there is no foundation for a meaningful plan. This step defines the “why” behind the exit and drives all decisions that follow.

Advisors must be prepared to ask difficult questions.

- Does the owner want to retire

- Does the owner want to stay involved in a reduced capacity?

- Does the owner want to fund another venture?

- Is there family involved?

- Are there philanthropic goals?

Establishing clarity here prevents missteps later and ensures that planning efforts are grounded in purpose.

2. Assessing Business Readiness

With goals in place, the next step is to assess the business’s readiness to operate without the owner. This means evaluating management depth, customer concentration, operational systems, financial reporting, and owner dependency. These factors have a direct impact on valuation and transferability.

This stage also helps identify value gaps, areas where the business may be vulnerable to a buyer or successor. Addressing these issues early gives the owner time to make meaningful improvements, which ultimately results in a smoother transition and higher return.

3. Integrating Financial Planning

Financial readiness for exit is an essential aspect of any effective Exit Planning strategy. Advisors need to model various exit scenarios, account for tax implications, and ensure that the proposed transition supports long-term financial goals such as retirement, estate planning, or wealth transfer.

4. Executing Value Enhancement Strategies

Once the business and financial baseline is clear, advisors can support efforts to enhance value. This might include diversifying revenue, formalizing leadership succession, or tightening operational processes. The goal is to reduce risk and increase appeal to potential successors or buyers.

These aren’t marginal improvements. Real value creation takes time and must be tailored to the owner’s chosen exit path. Advisors who understand how to prioritize improvements, based on deal terms and buyer expectations, bring measurable value to the process.

5. Selecting & Preparing the Transition Path

Owners often consider multiple exit options: family succession, management buyout, employee stock ownership plans (ESOPs), or third-party sale. Each option carries distinct tax, legal, and strategic considerations. Advisors play a central role in helping owners understand what’s feasible and how to prepare.

This is where the planning becomes tactical. Selecting a path is one thing; preparing for it is another. Internal transitions may require grooming a successor. External sales may require positioning the business in the market well in advance. Timing, documentation, and alignment with the owner’s goals are critical at this stage.

6. Supporting the Transaction & Post-Exit Phase

The final phase involves preparing for and managing the transaction itself. This includes coordinating with legal and tax professionals, managing due diligence, and keeping the process on track. Exit Planning advisors often serve as the steady hand during high-pressure moments.

But Exit Planning doesn’t end when the deal closes. Owners must be prepared for life after the business. That includes financial planning, legacy planning for business owners, and emotional readiness. Advisors who support this phase help ensure that the exit is financially successful and personally fulfilling.

The Importance of Timing in Business Exits

Timing influences every aspect of a successful exit. Here’s why early planning is essential.

1. Early Planning Drives Better Results

Early-stage Exit Planning helps owners avoid rushed decisions and control the terms of their transition. Waiting until the last minute limits options and increases the risk of unfavorable outcomes.

2. Prepare for the Boomer Shift

Roughly 10,000 Baby Boomers retire each day, many of them business owners. This wave is driving a surge in ownership transfers, increasing competition among sellers. Delaying planning could mean lower valuations, regardless of your company’s performance.

3. Respond to Market Realities

Rising interest rates and cautious buyer behavior are slowing deal flow. Strategic and financial buyers are taking longer and evaluating more critically. Well-prepared businesses stand out; those that aren’t get left behind.

4. Avoid the Cost of Reactive Exits

Health issues, burnout, or sudden market shifts can force owners into reactive exits. These transitions often happen under pressure, leaving no time to enhance value or resolve risks, leading to weaker deals or failed transactions.

Lead the Exit Planning Process with CBEC® Certification

Business owners need advisors who know how to lead real transitions. The Certified Business Exit Consultant® (CBEC®) designation, offered by the International Exit Planning Association (IEPA), equips professionals with the resources, structure, and insight required to manage complex exits from start to finish.

CBEC® certification is built around practical application. It’s planned for financial advisors, CPAs, consultants, attorneys, and part-time CFOs who want to deepen their expertise, expand client services, and deliver measurable outcomes in Exit Planning engagements.

As a CBEC® designee, you gain:

- In-depth Exit Planning expertise. Learn how to structure phased transitions, minimize tax exposure, and build value that owners can realize before, during, and after an exit.

- Real-world, experience-driven training. Apply frameworks immediately to client work. According to IEPA data, 66% of certified advisors break engagements into multiple phases for sustained value delivery.

- Access to exclusive tools and resources. Gain planning templates, financial models, case studies, and strategic methodologies used by top Exit Planning professionals.

- Ongoing support and peer collaboration. Join a nationwide network of certified practitioners with shared experience and continued education.

- Professional recognition and credibility. The CBEC® designation signals real competence in Exit Planning, an advantage that builds client trust and opens new advisory opportunities.

- Strong earning potential. 22% of CBEC® professionals report earning more than $250,000 annually from Exit Planning services alone.

If you’re advising business owners without a formal structure, or if you want to lead exit engagements with clarity and confidence, CBEC® certification provides the framework to do so, backed by a professional community focused on real results.

FAQs

- What is the CBEC® certification, and who is it for?

The Certified Business Exit Consultant® (CBEC®) certification is created for experienced professionals, like financial advisors, CPAs, consultants, attorneys, and part-time CFOs, who want to lead business exit engagements. It provides the tools, frameworks, and real-world strategies needed to manage complex transitions and support owners from early planning through final execution. - Do I need prior Exit Planning experience to apply?

No prior Exit Planning experience is required. The program is curated to support professionals from various backgrounds. While experience in finance, business operations, or client advisory work is helpful, the CBEC® curriculum provides foundational knowledge and applied strategies to build competence from day one. - How long does it take to earn the CBEC® certification?

The CBEC® program runs over six weeks, combining structured modules with practical applications. It’s fully online and built to accommodate busy professionals. Most candidates complete the training and pass the final assessment within 6 to 8 weeks, gaining skills they can apply immediately in real-world client engagements. - How does CBEC® certification impact my client relationships?

The CBEC® designation adds credibility and depth to your advisory work. Clients trust professionals with structured approaches and proven tools. Certification helps you lead higher-value conversations, support complex decisions, and build lasting client relationships rooted in strategy, execution, and results. - What support will I receive after becoming certified?

CBEC® designees gain access to exclusive tools, updated planning resources, and a nationwide peer network. IEPA also offers continuing education, case discussions, and marketing support to help you position your services effectively. You’re never alone. Support continues long after the certification is complete.