For business owners contemplating a future exit, whether through sale, succession, or merger, understanding your company’s Sustainable Growth Rate (SGR) is essential. SGR, sometimes referred to as G, reveals how fast a business can grow without jeopardizing its financial health. It is a powerful method to enhance value, avoid risk, and attract the right buyers or successors, and should be considered when planning a business exit.

There is often pressure to boost a business’s valuation before its exit. Still, growth that exceeds a company’s SGR or an unsuccessful implementation to scale can backfire, straining cash flow, weakening margins, and leading to higher debt loads, all of which are red flags to a potential buyer.

In this blog, we’ll discuss Sustainable Growth Rate, highlight over a dozen “G” factors with a short-term ROI, summarize how SGR plays into common exit strategies, and delineate how sellers can use SGR to maximize exit value.

What is Sustainable Growth Rate?

The Sustainable Growth Rate (SGR) is defined as the maximum rate at which a company can grow its revenue, earnings, or operations without requiring additional external financing. In other words, SGR measures how quickly a company can expand using its internally generated funds, such as retained earnings, without over-leveraging or diluting ownership. Sustained growers expand with greater consistency and tend to outlive other businesses.

SGR is calculated using the following formula:

| SGR = Return on Equity (ROE) × (1 – Dividend Payout Ratio) |

Where:

Return on Equity = (Net Income / Total Shareholder’s Equity) and represents how much return investors have realized relative to the profit the company has generated; and

Retention Rate = [(Net Income – Dividends) / Net Income] and represents the percentage of earnings that the company has not paid out in dividends. In other words, how much profit the company retains, as (Net Income – Dividends), is equal to Retained Earnings.

SGR measures how quickly a business can grow year-over-year. A higher growth rate factor indicates that a company has the capacity to expand significantly over the next 12 months.

13 Factors of Sustainable Business Growth With A Short-Term ROI

Achieving sustainable growth requires strategic foresight and the proper best practices. In a public policy white paper entitled “Sustained Growth Companies: Evidence and Implications,” Gary Kunkle, PhD, pointed out that sustained growers “differentiate themselves because their leaders tend to make better decisions” and suggested 50 best practices that distinguish “sustained growers.”

In June 2020, a Forbes Business Development Council, comprising thirteen entrepreneurs, further maintained on Forbes.com that embracing sustained growth principles can positively impact a business in the short term, with some of these best practices taking effect almost immediately.

The elements the Forbes Business Development Council believes business leaders should include in their growth strategy because of their quick return on investment include:

- Delivering Outstanding Customer Value.

- Having A Wide Geographic Customer Footprint.

- Recognizing Customer Needs.

- Continually Focusing on Customer Problem Solving and Feedback to Ensure Satisfaction.

- A Clear Articulation of Measurable Company Goals & Objectives.

- Understanding The Marketplace And How It Delivers Value in The Marketplace.

- Team Buy-In.

- An Employee “Ownership Mentality.”

- An Openness To New Ideas.

- Knowledge Sharing.

- Consistent Messaging.

- People And Purpose Connections.

- A Culture of Collaboration And Innovation.

How Does SGR Play Into Common Exit Strategies?

Here’s how SGR plays into common exit strategies:

1. Sale to a Strategic Buyer

Strategic buyers are seeking healthy, self-sustaining businesses that can scale effectively. A business that has grown beyond its SGR might show revenue growth, but could be struggling with poor liquidity, margin compression, or operational inefficiencies.

- An aligned SGR indicates the business is disciplined and growth is sustainable; and

- A well-managed growth trajectory reassures buyers that the business won’t collapse post-acquisition.

2. A Private Equity Exit

Private equity groups are also looking for businesses with financial discipline and significant growth potential. Exceeding the SGR without a clear plan for funding or profitability may raise concerns about the amount of capital required post-deal.

- Companies with controlled, sustainable growth often command better multiples, and

- Showing how the business has reinvested wisely and not exceeded its sustainable growth rate increases investor confidence.

3. Management Buyout (MBO) or Family Succession

Internal successors, such as management teams or family members, usually face capital constraints. If the business is growing faster than it can fund itself internally, the transition may lead to operational and financial instability.

- A manageable growth rate, on the other hand, makes it easier for successors to step in without overwhelming resource demands; and

- It allows time for leadership development and efficient risk transfer.

4. IPO or Public Listing

Going public requires both rapid growth and the ability to sustain it over time. Markets punish companies that show early promise and then collapse under the weight of over-expansion.

- SGR helps founders and executives pace growth in a way that can be justified and sustained in public markets; and

- It also ensures a healthy balance sheet, which analysts and investors closely scrutinize.

5 Proven Approaches for Utilizing SGR to Maximize Exit Value

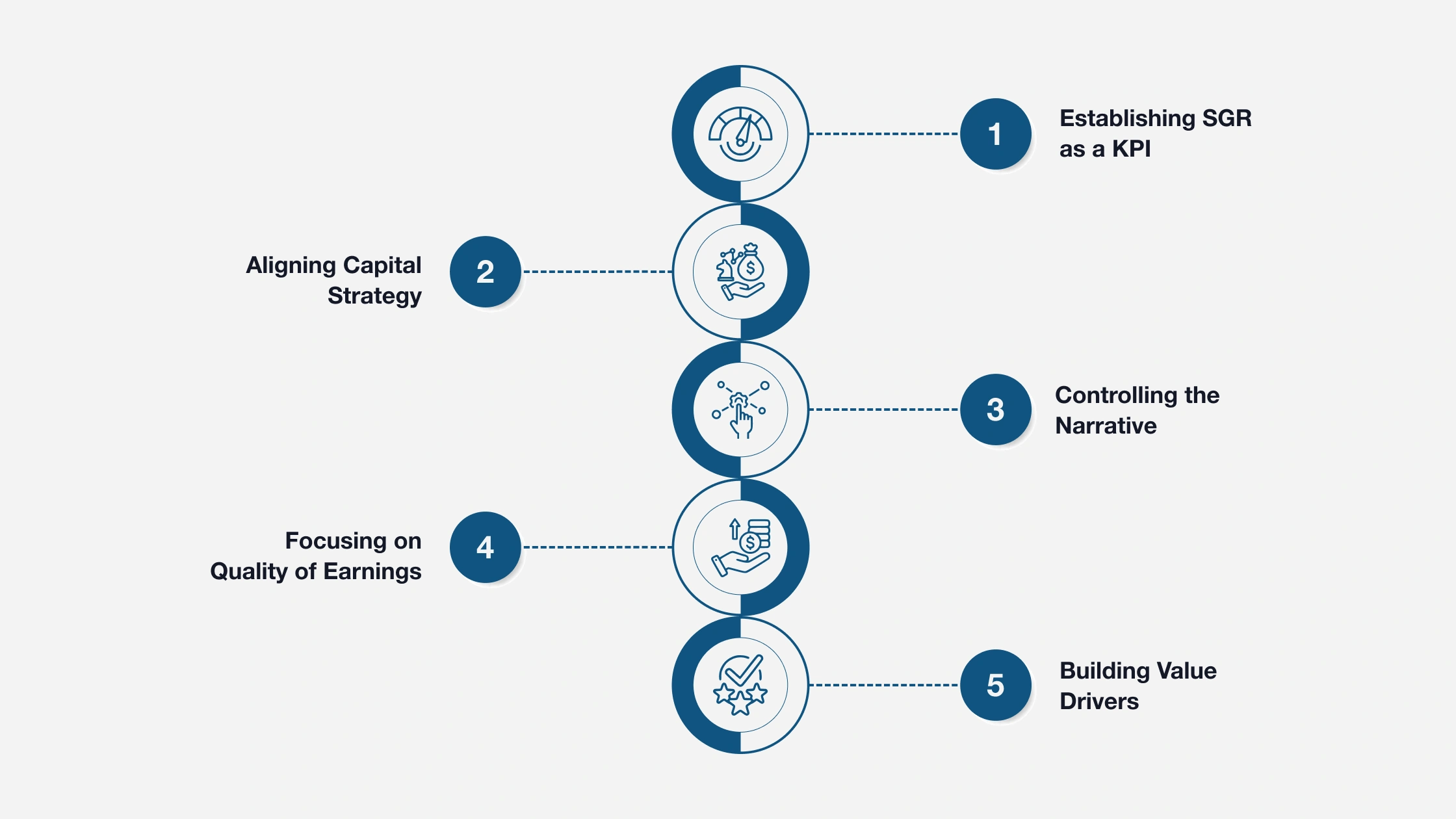

Establishing SGR as a key performance indicator (KPI), aligning your capital strategy, controlling the narrative, focusing on the quality of earnings, and building value drivers to accelerate SGR are all strategies to maximize a company’s exit value.

- Establishing SGR as a KPI: A company should understand its current growth capacity and compare it to its actual growth rate to determine whether you are over- or underextended.

- Aligning Capital Strategy: If growth ambitions exceed SGR, the business should plan for financing in a way that doesn’t compromise valuation, such as employing equity funding or utilizing “smart debt.”

- Controlling the Narrative: During due diligence, a company or business should demonstrate how it has grown responsibly and reinvested its earnings to strengthen the industry.

- Focusing on Quality of Earnings: Sustainable growth supports predictable cash flows, which are more comforting to acquirers than explosive but erratic growth.

- Building Value Drivers: A business should develop recurring revenue streams, leadership depth, and comprehensive operational systems to ensure profitable growth.

Ensure a Profitable Transition with Certified Consultants from IEPA

A successful business exit isn’t just about growing quickly; it’s about growing smart. Your Sustainable Growth Rate is one of the clearest indicators of exit readiness, regardless of the path you choose, whether it’s a strategic buyer, family succession, management buyout, or IPO.

Working with a Certified Business Exit Consultant (CBEC) provides you with the clarity to align your growth with your exit goals. A CBEC® can help you understand how valuation works, when to measure it, and how to ensure your business is positioned to attract the right buyers or successors.

Take the first step toward building an exit-ready business.

Find a Certified Business Exit Consultant® Now!

About the Author:

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.