Most business owners are unsure of how or when they’ll exit. But they know they want to. In fact, 75% of owners say they’d like to exit within the next decade, yet few have done the planning required to turn that intention into a successful transition.

That disconnect is where business exit strategy consulting comes in.

Advisors who understand ownership transitions can help clients preserve their wealth, protect their legacies, and drive value long before a transaction is even on the table. Exit planning involves structuring the business, its financials, and personal outcomes well in advance of the exit.

In this blog, we’ll break down what business exit strategy consulting entails, who it’s for, and how experienced professionals, such as financial advisors, consultants, CPAs, attorneys, and part-time CFOs, can integrate it into their practices.

What Is Business Exit Strategy Consulting?

| Business exit strategy consulting is a specialized advisory service that helps business owners prepare for and execute a successful transition out of ownership. |

It’s about aligning the owner’s personal goals, the company’s operational readiness, and the market realities to create a smooth, value-driven exit.

At its core, exit strategy consulting involves creating a plan that addresses the who, when, and how of the owner’s eventual departure. That includes preparing the business for transfer, identifying and vetting exit options, maximizing transferable value, managing tax implications, and ensuring the owner is personally and financially ready for life after the exit.

Consultants act as guides through this multi-year process. They lead conversations owners often avoid, about valuation gaps, successor readiness, and retirement expectations, and work with a team of specialists to bring it all together into a coherent, realistic plan.

For advisors, this consulting model is less about transactions and more about strategy. It requires long-term thinking, cross-disciplinary coordination, and the ability to manage change across business and personal dimensions.

Why Do Clients Need Exit Strategy Consultants?

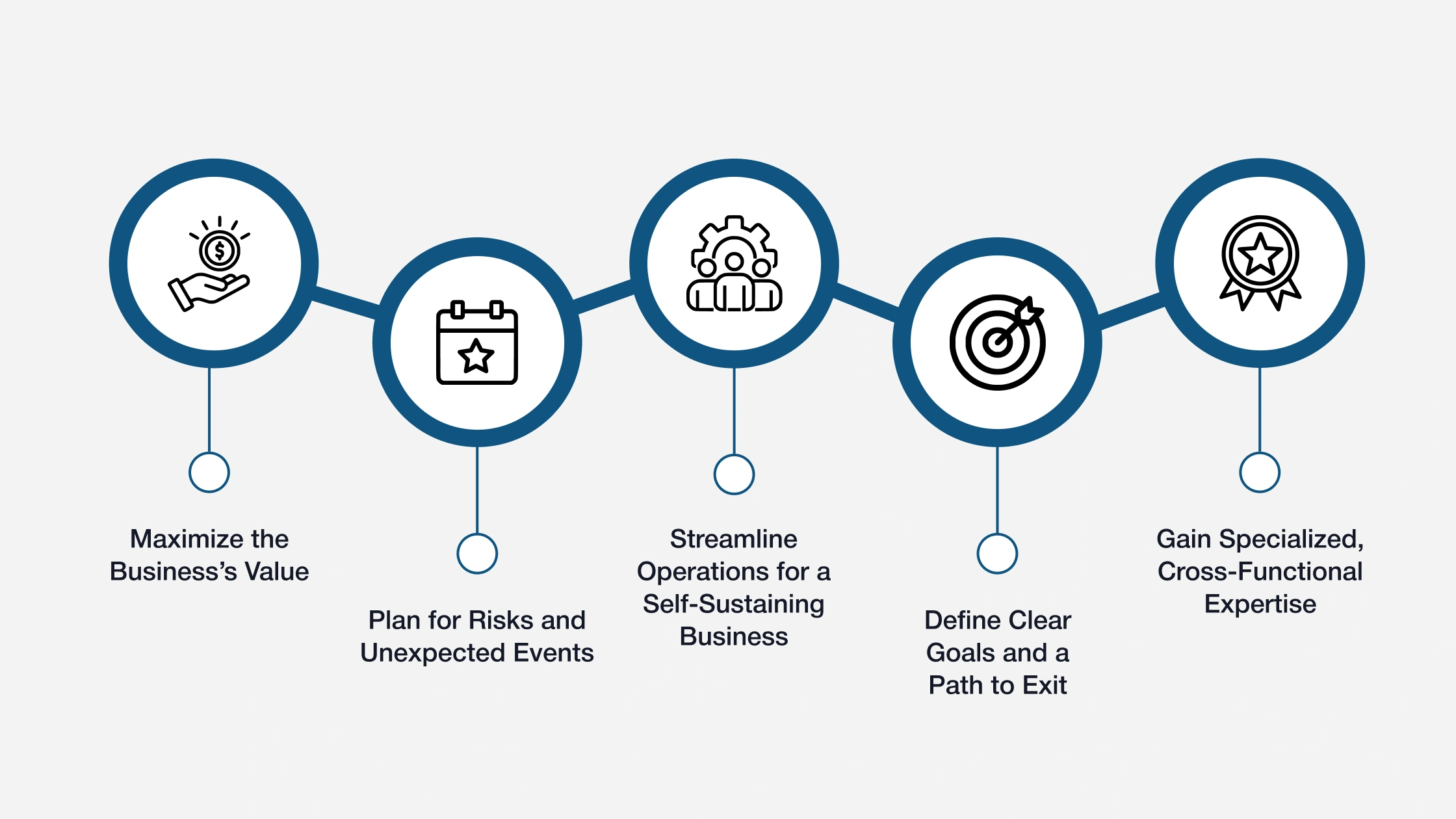

Most business owners delay exit planning until they’re forced into it. But by then, options are limited, and value often leaves the table. Exit strategy consultants help clients avoid reactive decisions and create intentional, strategic transitions. Here’s how they can deliver measurable impact:

Maximize the Business’s Value

Value doesn’t just come from top-line revenue. Factors like recurring income, customer diversity, margin strength, and owner independence drive it. An exit strategy consultant brings a buyer’s perspective to surface hidden risks and value drivers early. They help identify and close valuation gaps well before a sale is in play.

Whether the owner is looking to grow now or exit in five years, consultants provide a guide to increase business value, improving not just the eventual payout but also the business’s performance along the way. With expert input, owners can prioritize strategic investments and avoid missteps that erode value.

Plan for Risks and Unexpected Events

Most owners assume they’ll sell on their own terms, but health issues, economic downturns, unsolicited offers, or partner disagreements can fast-track an exit. Without a plan, that chaos often leads to rushed decisions and lost value.

Exit consultants help owners build readiness into every phase. They identify potential risks early, like key person dependencies, debt exposure, or outdated legal structures, and address them proactively. This kind of planning gives owners peace of mind and flexibility.

If the exit window opens sooner than expected, they won’t be starting from scratch. Instead, they’ll have a strategy that absorbs shocks and keeps deals from falling apart.

Streamline Operations for a Self-Sustaining Business

Businesses that run without daily owner involvement are far more attractive to buyers and successors. But many owners wear too many hats. Consultants help shift that dependency by guiding process improvements, leadership development, and documentation of core functions.

Over time, this transforms the business into a self-sustaining asset that can scale or transition more easily. It also improves performance and decision-making in the present.

Whether an owner plans to pass the business down or sell to a third party, a company that thrives independently is more valuable and more resilient. Exit consultants make that operational transformation both manageable and strategic.

Define Clear Goals and a Path to Exit

Many owners don’t know how they want to exit until the pressure is on. Some want a clean sale, others prefer to transfer to family, and some want to step back gradually while maintaining equity.

Without a clear plan, it’s easy to waste time chasing the wrong strategy. Consultants help owners clarify personal goals, like income needs, legacy preferences, and lifestyle vision, and align them with business realities. They map out a viable path to exit based on these goals, market conditions, and available structures. This clarity creates confidence. Instead of reacting to offers, owners lead with purpose, and advisors guide that path with structure and support.

Gain Specialized, Cross-Functional Expertise

Exit planning involves business valuation, tax strategy, corporate structure, estate planning, team alignment, and deal negotiation. Most business owners, and even many general advisors, don’t have deep expertise across all these areas.

Exit consultants coordinate with all business executives while offering specialized, experience-driven guidance. They act as the hub that pulls it all together. Their role is strategic and integrative, turning siloed advice into a cohesive exit roadmap. That level of insight is what helps deals close smoothly and owners feel prepared, not overwhelmed, throughout the transition. It also builds trust and opens long-term advisory relationships.

Skills and Resources You’ll Need to Become a Business Exit Strategy Consultant

Exit Planning is a discipline that requires broad expertise, deep client trust, and the ability to lead long, complex engagements. If you’re an advisor looking to shift from transactional services to high-value, long-term strategy, you’ll need more than technical knowledge.

You’ll need the mindset, frameworks, and resources to drive real outcomes across multiple phases of an owner’s transition. Here’s what it takes:

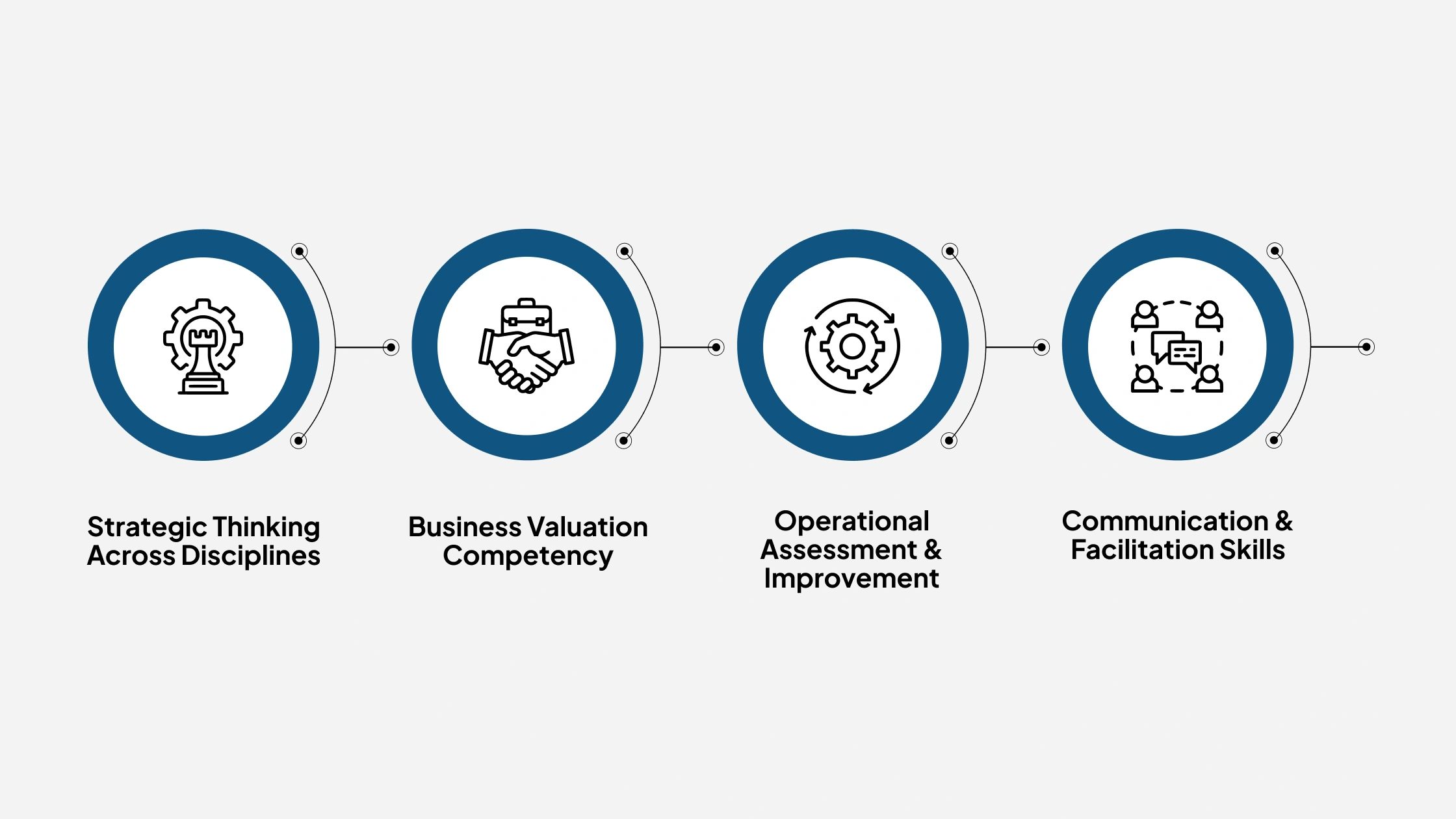

Strategic Thinking Across Disciplines

You’ll need to think like a CEO, investor, and dealmaker, often all at once. Exit planning intersects with tax, legal, operational, and personal financial domains. Consultants must be able to spot risks, connect dots, and design plans that work both technically and practically.

You need to map the right path based on the owner’s goals, timeline, and business realities. Strategic thinking means knowing when to lead, when to coordinate, and when to pivot.

Business Valuation Competency

Valuation isn’t a one-time event. It’s a process that drives every major exit decision. You’ll need to evaluate financials, identify value gaps, and explain what drives market price in ways owners understand.

This includes understanding common methods (like DCF or market comps), industry benchmarks, and how intangible factors like leadership strength or customer concentration impact perceived value. The goal is to guide owners toward improving the value.

Operational Assessment & Improvement

You need to help build a company that runs without the owner. That means being able to assess how reliant the business is on its founder, how effective its systems and leadership are, and how attractive it will be to a buyer or successor.

Exit consultants bring structure to operational planning through documented processes, talent development, and readiness audits that enhance transferability and scalability.

Communication & Facilitation Skills

Exit Planning is emotional. Owners may be hesitant, unprepared, or stuck in legacy thinking. Consultants must facilitate difficult conversations about mortality, wealth, succession, and legacy. The ability to listen, ask the right questions, and lead multi-party discussions with attorneys, CPAs, and family members is essential. You’re managing decision-making and alignment across people with competing priorities.

To deliver a consistent, high-quality experience, you need systems that guide the work. A proven process for Exit Planning, like the one taught through CBEC®, gives you repeatable frameworks to evaluate businesses, prioritize actions, and engage owners over time.

This includes assessment templates, engagement roadmaps, value gap analysis methods, and collaboration systems that keep the plan on track. Without structure, engagements can lose focus and stall. With the right resources, you stay in control and drive momentum.

How To Become a Business Exit Strategy Consultant

Stepping into the role of a Business Exit Strategy Consultant means taking responsibility for what may be the most critical financial decision of a business owner’s life. It’s not a part-time advisory role or a quick value-add. It’s a discipline that demands experience, structure, and credibility.

IEPA offers the Certified Business Exit Consultant® (CBEC®) designation, a program built specifically for professionals like financial advisors, CPAs, consultants, and part-time CFOs who want to deliver real value through structured Exit Planning. Unlike conceptual frameworks or one-size-fits-all courses, CBEC® training is led by active practitioners and built around real-world execution.

Through CBEC®, you’ll gain:

- A step-by-step approach to manage engagements from valuation through transition

- Practical methods to assess readiness, guide goal setting, and coordinate stakeholders

- A deep understanding of deal structuring, succession options, and tax planning strategies

- Support from a national network of peers who are actively serving owners

Becoming a certified Exit Strategy Consultant through IEPA transforms your service offering. You’re no longer solving for compliance or cash flow. You’re helping business owners secure their legacy, protect their wealth, and exit on their terms.

Help Owners Exit on Their Terms by Earning Your CBEC® Credential

Business owners are looking for guidance rooted in real strategy, real planning, and real-world results. With the Certified Business Exit Consultant® certification, you’ll be prepared to deliver exactly that.

CBEC® certification equips advisors to lead owners through valuation readiness, succession planning, deal structure, and post-exit outcomes, all with hands-on experiences and a structured engagement framework. And it pays off. According to IEPA data:

- 66% of CBEC® designees break engagements into multiple phases, helping owners see value at every step.

- 22% report earning over $250,000 annually through Exit Planning work alone.

If you’re ready to shift from transactional advice to transformational outcomes, the CBEC® path gives you the credibility, process, and support to lead.

Become the advisor that owners trust when the stakes are highest.