According to data cited in a business continuity survey, 90% of businesses that are unable to resume operations within five days after a disruption fail within a year.

Additionally, among organizations without a business continuity plan, 75% fail within three years following a major disruption.

These figures show that disruptions, whether caused by cyberattacks, supply chain breakdowns, system failures, or critical staff loss, can have severe consequences. Without a prepared continuity plan, recovery becomes uncertain, and enterprise value is at risk.

For advisors guiding owners through exit planning, this reality matters. Continuity planning protects near-term operations while safeguarding long-term exit strategies. It is not a side project but an essential component of preserving value.

What Is a Business Continuity Management Plan?

| A Business Continuity Management Plan (BCMP) is a structured framework that allows a company to continue operating or quickly resume critical functions during disruptions. It is comprehensive by design, covering financial systems, operations, technology, and people. |

A disaster recovery plan typically focuses solely on IT systems, whereas succession planning focuses solely on leadership. A BCMP combines both perspectives, ensuring a company is resilient as a whole.

Benefits of a Business Continuity Plan

Continuity planning is often associated with crisis management, but its advantages extend far beyond emergency response. For advisors, understanding these benefits enables you to demonstrate to clients how a Business Continuity Management Plan supports long-term stability and enterprise value.

1) Reduces Downtime & Maintains Revenue

Every hour of downtime translates into lost sales, interrupted services, and additional costs. A tested continuity plan minimizes these disruptions by ensuring critical functions can continue or be restored quickly. This protects revenue streams and avoids the financial instability that often accompanies unplanned interruptions.

2) Builds Trust with Stakeholders

Customers, employees, and suppliers expect reliability. A continuity plan demonstrates that the business is prepared to meet obligations, even during disruption. This strengthens relationships, fosters customer loyalty, and reassures employees that leadership has considered their safety and job security.

3) Protects Reputation & Market Position

Reputation can be quickly damaged if a business appears unprepared. Companies that recover faster from disruption maintain credibility in their industry and protect their competitive position. For advisors guiding clients toward exit readiness, this credibility is vital because it signals professionalism and preparedness to potential buyers or investors.

4) Enhances Valuation in Exit Planning

Continuity planning directly impacts enterprise value. Buyers want confidence that revenue and operations will not collapse if unforeseen events occur. A documented, tested plan demonstrates resilience, reduces perceived risk, and strengthens negotiation leverage. For owners considering a future sale or transfer, this can make a measurable difference in valuation.

For advisors, these benefits are opportunities to expand the scope of service, integrate continuity into exit planning conversations, and provide clients with practical methods that protect both present operations and future transition success.

Core Components of a Business Continuity Management Plan

Below are the core components of a business continuity management plan:

1) Risk Assessment & Business Impact Analysis

The process begins by identifying vulnerabilities such as natural disasters, cyber incidents, supply chain interruptions, or the unexpected loss of leadership. A business impact analysis ranks critical functions and estimates the time required to restore them.

2) Continuity & Recovery Strategies

Strategies include arranging alternate suppliers, ensuring backup systems, establishing remote work protocols, and assigning interim leadership. These steps allow the business to operate in a reduced but functional state while recovery unfolds.

3) Crisis Communication Plan

Effective communication determines how well a company navigates a crisis. A BCMP sets out how information will be shared with employees, customers, vendors, and stakeholders to ensure clarity and prevent reputational damage.

4) Testing and Updating

According to reports, only 7% of organizations in critical infrastructure sectors were able to recover from a ransomware attack within a week or less. Recovery timelines like these demonstrate the profound impact that disruptions can have on operations. Without regular testing and preparation, continuity plans are likely to fail when they are needed most.

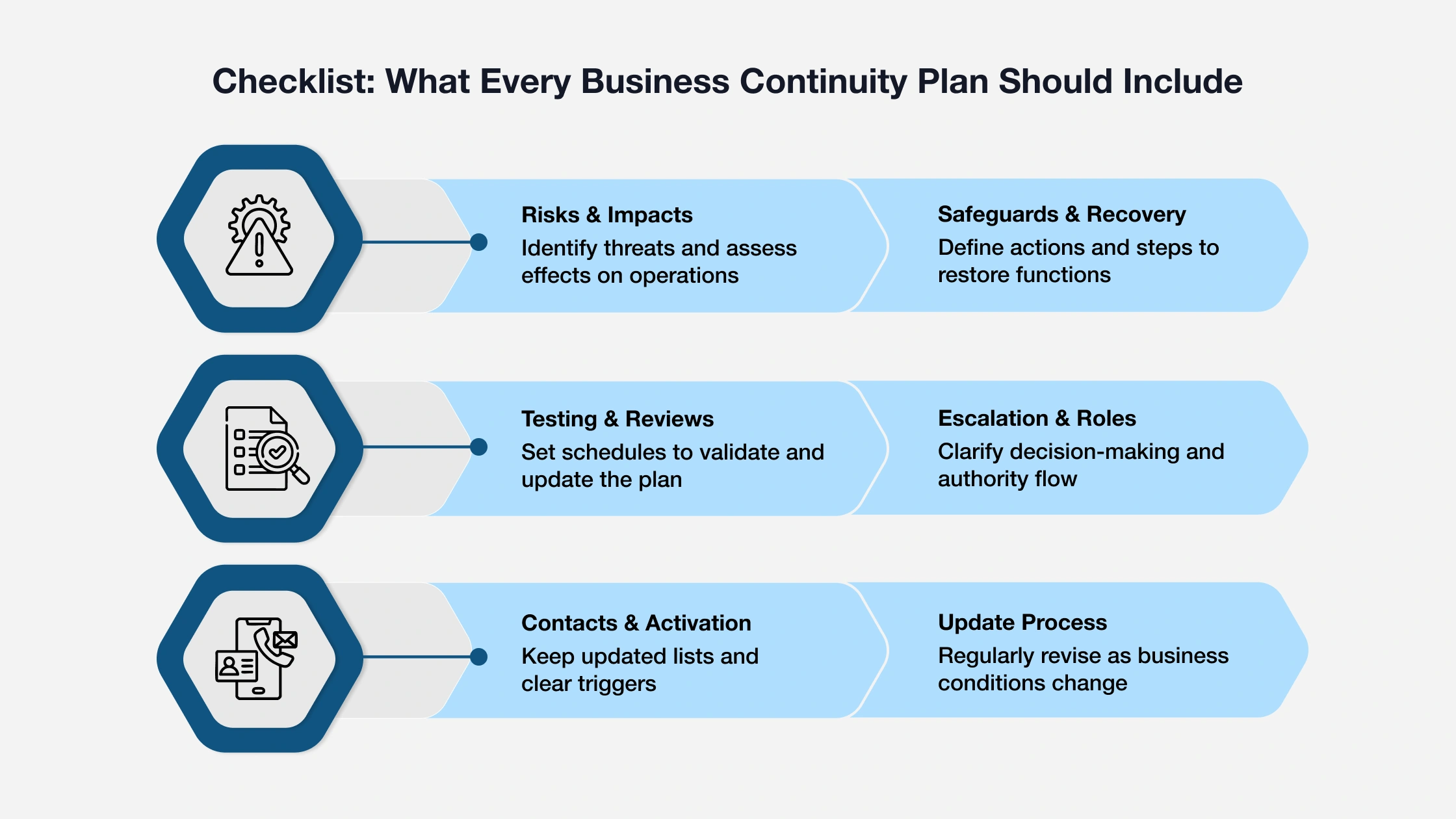

Building and Structuring a Business Continuity Plan

An effective Business Continuity Plan must do two things: clearly outline what it includes and follow a structured process for how it is created. Advisors who can guide clients through both aspects deliver real value.

Step 1: Assess & Identify Vulnerabilities

Map the threats most likely to disrupt operations, such as prolonged outages, cyber incidents, vendor failure, regulatory changes, or critical equipment loss. The output is a current-state risk profile you can revisit as conditions change.

Step 2: Run a Business Impact Analysis (BIA)

Identify time-sensitive processes, dependencies, and the consequences of downtime. Define recovery time objectives (RTOs) and recovery point objectives (RPOs) so you know which functions to restore first and how quickly.

Step 3: Define Recovery & Continuity Strategies

Choose methods to keep the business operating at a baseline and restore priority functions. Examples include alternate suppliers, manual workarounds, remote work enablement, system backups, and interim leadership coverage aligned to the BIA.

Step 4: Establish Governance & Assign Roles

Create an oversight team, clarify decision rights, name process owners, and set escalation paths. Document who activates the plan, who communicates updates, and who leads each recovery workstream.

Step 5: Document Procedures & Communication

Write concise, task-level procedures, include contact lists for internal teams and key vendors, and set activation criteria. Package everything in a format that teams can execute under pressure.

Step 6: Train, Test, & Update on a Schedule

Train the team, conduct exercises to validate assumptions, capture lessons learned, and revise the plan as the business, systems, and regulatory environment change. Make review and updates a recurring management activity.

How Does Business Continuity Strengthen Exit Planning?

Business continuity and exit planning are often viewed separately, but they reinforce each other in practice. Continuity secures today’s operations, while exit planning protects tomorrow’s value. Advisors who bring these two disciplines together give their clients a stronger foundation for transition.

Protect Enterprise Value in the Present

A Business Continuity Management Plan keeps operations steady during disruptions such as prolonged outages, supply chain breakdowns, or regulatory changes. By preserving financial performance and stakeholder trust, continuity protects the enterprise value that owners will ultimately depend on during their exit.

Strengthen Buyer Confidence in Due Diligence

Exit planning is about positioning a business for a successful transition, and buyers assess more than just financials. They focus on risk. A tested continuity plan demonstrates that resilience, reduces perceived risk, and provides leverage in negotiations, often translating into stronger valuations.

Reassure Successors During Ownership Transfer

For family transitions or management buyouts, continuity planning is just as essential. A documented plan reassures incoming leaders that systems are in place to sustain operations, employees, and customers. This stability reduces the risk of disruption during the handoff and gives owners peace of mind.

Guide Clients to Integrate Continuity With Exit Strategy

Advisors can elevate their role by showing how continuity fits naturally into exit planning. When continuity measures are framed as part of the broader exit strategy, clients understand that resilience is a strategic method that makes transitions smoother, safer, and ultimately more valuable.

4 Reasons Advisors Are Essential in Business Continuity Planning

Advisors contribute unique expertise and perspective that make them essential to building effective business continuity plans.

1. Bridge the Expertise Gap

Most business owners lack the time or technical knowledge to create a practical continuity framework. Advisors step in to guide the process, ensuring that continuity plans are not just theoretical documents but usable strategies that can be activated when needed.

2. Translate Disruptions Into Business Impact

Advisors can show clients the real financial and operational consequences of disruption. A CPA might model how downtime affects revenue and forecasts, while a consultant could uncover hidden vendor or supply chain risks. This translation helps owners see continuity as a business priority rather than an abstract exercise.

3. Protect Value and Reduce Risk

Continuity planning safeguards cash flow, reduces liability exposure, and preserves reputation. These protections directly strengthen enterprise value and prepare businesses for future transitions, making them more attractive to buyers and investors.

4. Elevate the Advisor-Client Relationship

Owners trust advisors who look beyond compliance and short-term issues. By integrating continuity into exit discussions, you position yourself as a strategic partner who ensures resilience today and higher valuation tomorrow.

5 Tips for Advisors on Getting Started with Business Continuity Planning

Advisors can take practical steps to guide clients into continuity planning. Here are five to start with.

- Begin with Risk Assessment and Impact Analysis: Work with clients to identify vulnerabilities and conduct a business impact analysis that highlights operational dependencies and critical functions.

- Assemble a Cross-Functional Continuity Team: Encourage owners to form a small team responsible for assigning roles, documenting recovery steps, and coordinating responses during disruption.

- Document Roles and Responsibilities Clearly: Ensure the plan clearly specifies who is responsible for what, including decision-making authority and communication responsibilities, in the event of a disruption.

- Review and Update the Plan Regularly: Stress the importance of testing and scheduled reviews so the plan stays aligned with evolving risks, regulations, and business conditions.

- Invest in Hands-On Training and Certification: Advisors who pursue structured, practitioner-led certification gain proven frameworks and case-based experience. This enables you to build continuity plans that work in practice, not just theory, and differentiates your advisory services.

Strengthen Continuity. Maximize Exit Value. Earn Your CBEC® Credential.

Owners are increasingly aware that disruptions can jeopardize both daily operations and long-term exit goals. They need advisors who can design continuity plans that work in practice, not just on paper.

The Certified Business Exit Consultant® (CBEC®) credential from IEPA prepares you to deliver that level of support. Through practitioner-led training, case-based learning, and structured frameworks, CBEC® equips you to:

- Build continuity plans that protect enterprise value and reassure buyers.

- Integrate risk management, succession planning, and continuity into one engagement.

- Guide owners through resilient transitions that secure both today’s operations and tomorrow’s outcomes.

Advisors who hold the CBEC® credential report stronger client relationships, phased engagements that show value over time, and increased revenue opportunities.

Become the advisor who protects value today and ensures successful exits tomorrow. Begin your CBEC® journey.