Business owners preparing for an exit in 2026 face a unique planning environment shaped by The One Big Beautiful Bill Act (“OBBBA”). The legislation introduces new tax rules, modifies deductions, expands exemptions, and adjusts planning windows, which can significantly influence exit outcomes.

This article summarizes the provisions of The OBBBA affecting business exits, outlines tax-planning strategies for 2026, highlights timing considerations, and provides a structured checklist Certified Business Exit Consultants (CBEC®) can use when advising business owners.

OBBBA Tax Changes Relevant to Exit Planning

Some of the new or modified provisions under The OBBBA that could impact business owners planning their exit include:

- The individual income-tax brackets under the “Tax Cuts and Jobs Act” (TCJA) are now permanent;

- Modified depreciation/expensing rules, like 100% bonus depreciation for qualified property placed in service after Jan 19, 2025, which is now permanent;

- The federal estate, gift, and generation-skipping transfer (GST) tax exemptions that are set to rise to about $15 million per individual (and $30 million if you file jointly) beginning January 1, 2026, and indexed thereafter;

- The expanded Qualified Small Business Stock (QSBS) rules under IRC §1202: the gain-exclusion cap rises (to $15 million for post-July 4, 2025 shares), the gross-assets test is higher (rising from $50 million to $75 million), and the holding-period / phase-in rules that loosen (to 50% for 3 years, 75% for 4 years, 100% for 5+ years) for stock issued after July 4, 2025.

- For pass-through business owners, namely, S-Corps, Partnerships, and LLCs, the §199A Qualified Business Income (QBI) deduction is made permanent; and

- Some of the new or expanded deductions or phase-outs that take effect in either 2025 or 2026, such as the itemized-deduction limitations, charitable-deduction floor, etc.

These changes could result in a different exit planning approach for a business owner who anticipates a sale or transition this year, in 2026, or shortly thereafter.

Top 7 Exit-Planning Tax Ideas for 2026

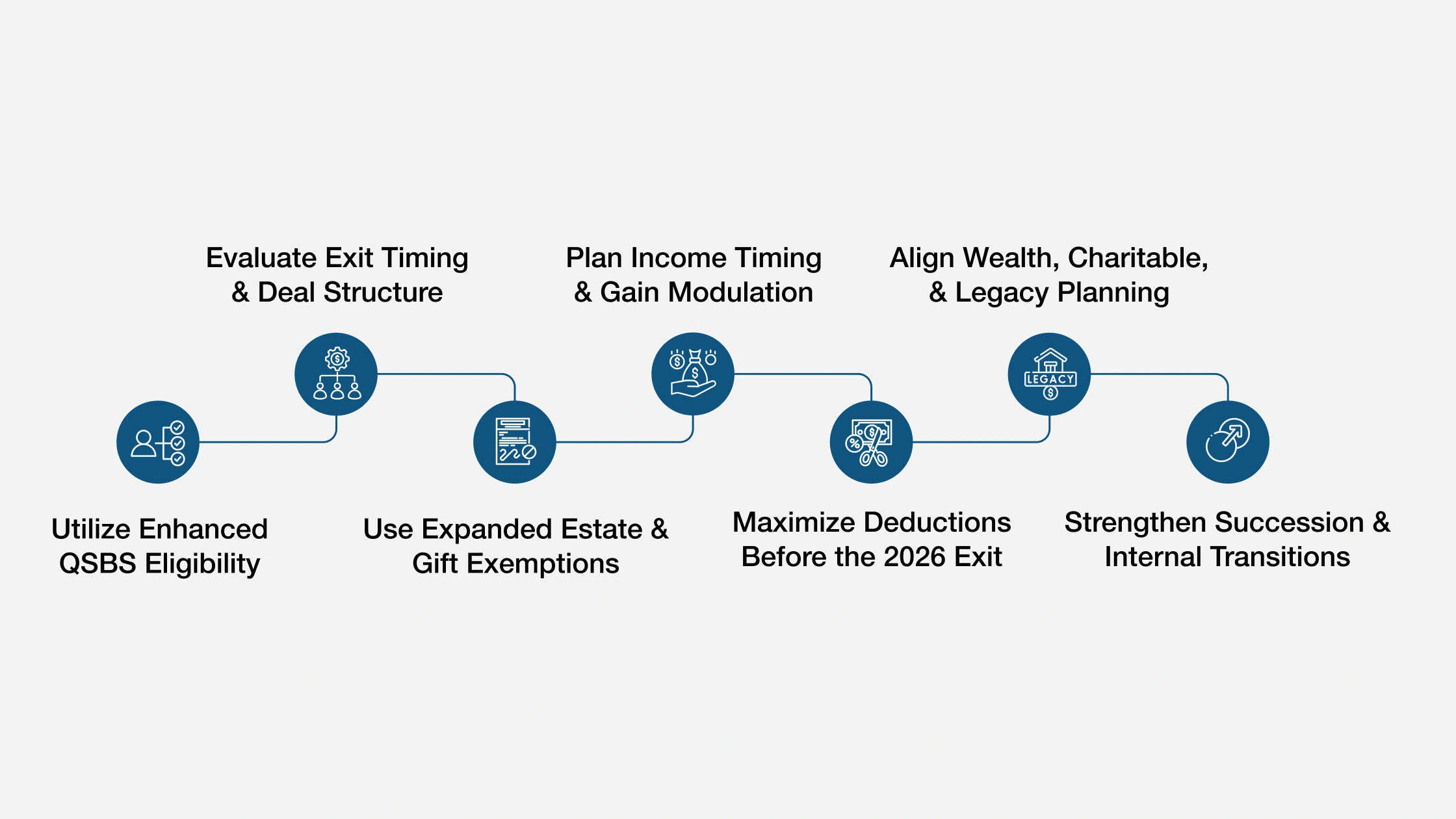

Given the updates under The OBBBA, here are several updated exit-planning strategies to consider for 2026.

1. Utilize Enhanced QSBS Eligibility

If your company is a C-Corp, issued initially, with gross assets of ≤ $75 million, then, beginning on July 4, 2025, shares in the business may qualify for the enhanced QSBS exclusion of 50% after 3 years, 75% after 4 years, and 100% after 5 years of holding.

If you’re targeting an exit in 2026, the sooner you issue or restructure into QSBS-eligible stock, the better your chances of hitting a favorable holding period, and you can get partial exclusion if the business hasn’t been a C-Corp for the full 5 years.

Additionally, the significantly higher cap and larger gross assets threshold broaden the pool of eligible companies.

Tax Planning Strategy: Talk to a financial advisor about converting to a C-Corp, if practical, and ensure original-issue stock, track holding periods, and avoid actions that “taint” QSBS eligibility.

2. Evaluate Exit Timing & Deal Structure

One of the most significant tax decisions in a business exit involves determining whether the sale is structured as an “asset sale” or a “stock sale.” For many sellers, a stock sale is preferable for two reasons: first, capital gains rates rather than ordinary income rates apply, and second, there is less depreciation recapture.

For buyers, on the other hand, the OBBBA makes bonus depreciation and full expensing more permanent and generous, making asset purchases and accelerated depreciation tax benefits even more critical. This, in turn, impacts how they value step-ups in basis, which could influence negotiations around the structure of the sale.

If the seller holds or retains assets separately, as in the case where the business owns real estate, splitting the transaction can allow for different tax treatment. For example, a property sale via §1031 or an installment sale can be treated differently from the sale of the operating business via stock.

3. Use Expanded Estate & Gift Exemptions

With the estate tax exemption rising to $15 million per individual in 2026, and remaining permanent under current law, business owners have a larger “tax-free” transfer space.

If a business owner expects a high value from the sale of their business in 2026, they should consider locking in gifting or trust transfers of their ownership interests before the sale to take advantage of the exemption, freeze value, and shift growth to younger generations, among other benefits.

Tax Planning Strategy: If a business owner expects high value from a sale in 2026, forming a Grantor Retained Annuity Trusts (GRATs), Family Limited Partnerships (FLPs), or Spousal Lifetime Access Trusts (SLATs) can make sense, as the business owner can reduce future estate tax drag and shift appreciation outside their estate, thereby retaining more post-tax value from their exit.

4. Plan Income Timing & Gain Modulation

Since the individual tax brackets are locked in under TCJA/OBBBA, business owners can reasonably plan the timing of the sale and recognition of gains to minimize bracket creep.

Suppose the sale can be structured as an installment sale, such as in the case where the business owner recognizes the gain over multiple years. In that case, he or she may smooth their taxable income, reduce the impact of high-income phase-outs, such as AMT and NIIT, and better manage Medicare IRMAA thresholds and other income-based phase-outs.

Suppose a business owner anticipates a higher-income year in 2026 and has the flexibility. In that case, they might want to accelerate or defer part of the transaction to a lower-income year, as the expanded standard deduction and other thresholds provide context for this decision.

5. Maximize Deductions Before the 2026 Exit

In the years preceding the sale, a business owner should consider investing in capital expenditures that qualify for 100% bonus depreciation, which is now permanent for property acquired after 2025, as this enhances cash flow, reduces taxable income, and improves valuation dynamics.

Tax Planning Strategy: Business owners should review and update their financial statements. For example, they should ensure that cost segregation, asset basis, depreciation recapture, and deferred taxes are all clearly documented, because buyers will evaluate “book vs tax” differences and negotiate for a step-up.

Business owners should also ensure that their corporate structure, including entity structure, contracts, lease agreements, and related-party transactions, is in order, so they are not surprised by an audit or seller-representation adjustments during due diligence. Good structure and attention to detail enhance both sale value and tax efficiency.

6. Align Wealth, Charitable, & Legacy Planning

When a business owner sells, they are likely to experience a significant liquidity event; accordingly, a business owner should plan how the cash-out proceeds impact their personal tax planning, estate planning, charitable giving, retirement planning, and other financial goals.

A business owner should also revisit their estate plan, including trusts, family gifting, and generation-skipping strategies, especially given the higher exemptions and the upcoming wealth transfer event.

Under the OBBBA, the rules governing charitable deductions are changing. Starting in 2026, taxpayers who do not itemize can deduct up to $1,000 (single) / $2,000 (married) for cash gifts, and itemizers will face a 0.5% of AGI floor.

Tax Planning Strategy: If you anticipate post-sale gains in 2026, you may want to bunch charitable donations in 2025 before the rule changes, and/or use donor-advised fund (DAF) strategies.

7. Strengthen Succession & Internal Transitions

If a business owner’s exit is to family, management, or to an Employee Stock Ownership Plan (ESOP), the tax‐planning elements differ. For example, using an ESOP, the business owner can enable a tax-deferred rollover for C-Corp sellers, reducing tax exposure while also providing employee incentives.

If a business owner is transferring ownership internally, they should consider valuation discounts, minority interest, marketability discounts, gifting strategies, and other tax-efficient structuring options, such as installment sales and trusts, as these have all been magnified under The OBBBA.

Tax Planning Strategy: Business owners should be encouraged to begin planning for their exit at least 3 to 5 years in advance to maximize the benefits of these tax strategies.

Important Timing and Traps to Watch

The OBBBA provisions phase in or change in 2026. Waiting may mean missing one-time opportunities or being subject to less favorable rules. For example, charitable deduction changes, including a 0.5% floor for itemizers, take effect in 2026.

- QSBS: If a business owner issues stock now and holds it for 3 years, they can get a 50% exclusion; but if they are too close to the exit event, they may miss even that benefit, so structuring now is important.

- Entity Conversion: For instance, switching from an S-Corp to a C-Corp may make sense for QSBS eligibility, but it has trade-offs, such as double taxation and lost pass-through benefits. A CBEC can assist its clients by doing the math.

- Alternative Minimum Tax (AMT) and Phase-Outs: OBBBA adjusts the AMT threshold for 2026 upwards, but high-income sellers need to model this.

- The State and Local Tax (SALT) Deduction Cap: For sellers in high-tax states, the temporary $40,000 SALT Cap (2025-2029) needs to be factored in. While it may seem less relevant to an exit, if a business owner itemizes and has other deductions, they could encounter higher SALT implications.

- Depreciation Recapture: If a sale is structured as an asset sale, recapture of depreciation can convert favorable capital gains into higher-taxed ordinary income. In short, structure matters!

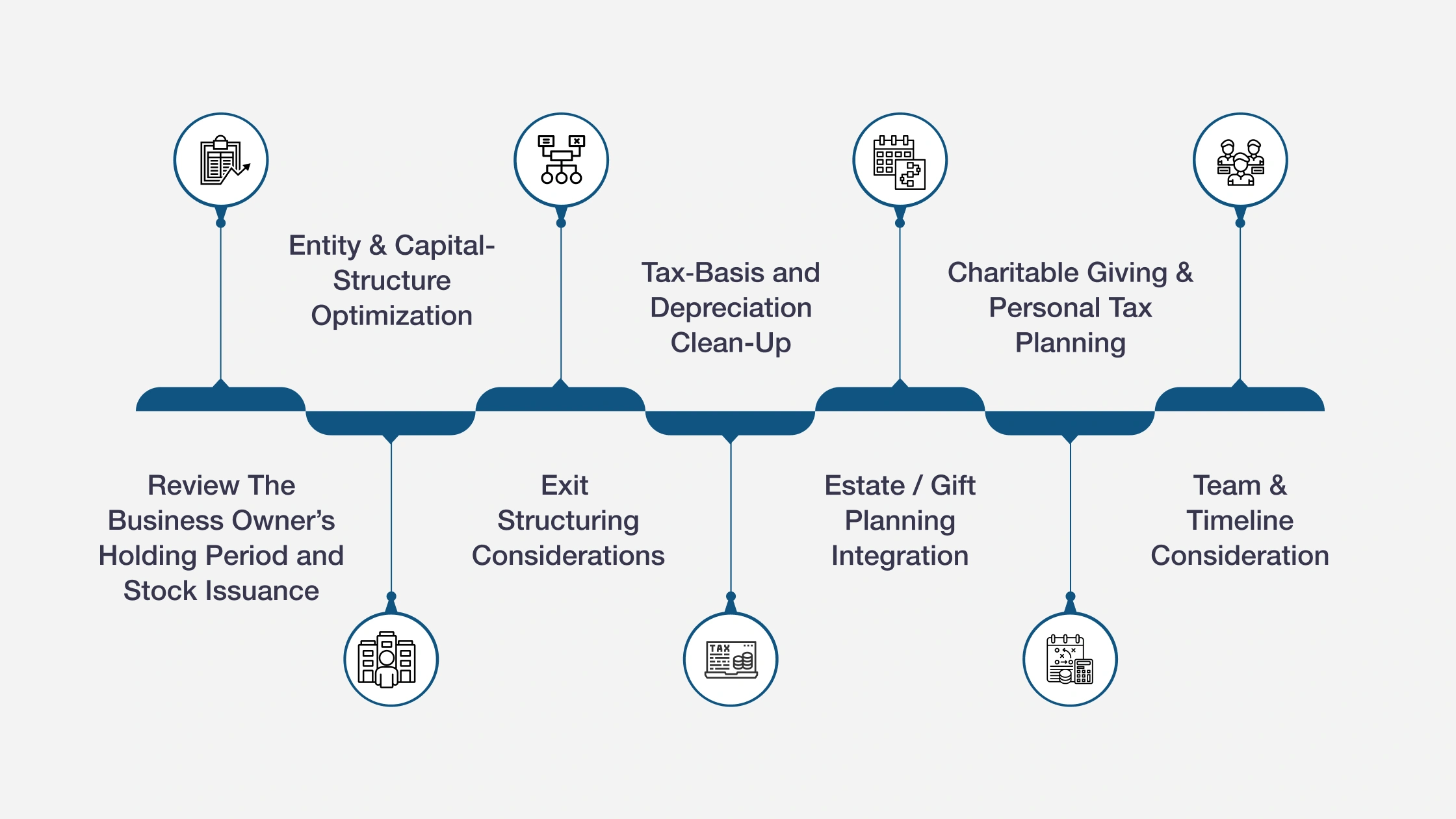

The CBEC’s Exit-Planning Checklist for 2026

Here’s a practical checklist a Certified Business Exit Consultant (CBEC) can work through, preferably with their team of advisors, including but not limited to tax, legal, M&A, wealth planning, and other experts who may be sitting around the table.

Review The Business Owner’s Holding Period and Stock Issuance

- If QSBS eligible, ensure shares are issued post July 4, 2025, and that the business can meet the 3-year, 4-year, or 5+-year holding period.

- Confirm the corporation meets the “gross asset test” – that is, ≤ $75 million after July 4, 2025, the “active business test,” etc.

- Ensure good documentation and tracking of issuance, transfers, basis, etc.

Entity & Capital-Structure Optimization

- Assess whether a C-Corp, S-Corp, Partnership, or LLC status is optimal for the business owner’s business-exit timeline.

- Consider an early restructuring, but model the tax implications first.

- Ensure shareholder agreements, redeemable stock, option plans etc., are properly documented.

Exit Structuring Considerations

- Evaluate “asset sale” vs “stock sale” possibilities: tax implications, buyer preference, and negotiation leverage.

- Consider timing: Will the business owner recognize a gain in 2026? Could he or she spread it over multiple years? Does an installment sale make sense for the business owner?

- Model the business owner’s taxable income for 2026: Will they hit higher brackets, NIIT, Medicare IRMAA? Can you adjust their timing or deductions in any way?

Tax‐Basis and Depreciation Clean-Up

- Review depreciation schedules, bonus depreciation elections, and recapture risks.

- Ensure financial statements align with tax basis, and document deferred tax liabilities.

- If the business owner is planning to make major capital expenditures in the short-term, consider making those acquisitions in early 2026 to capture full expensing.

Estate / Gift Planning Integration

- With the increased exemption part of The OBBBA, the business owner should update their estate / gift plan- including trusts, GRATs, FLPs, and/or SLATs.

- If you expect high value at exit, recommend that the business owner gift shares now to reduce taxes.

- Coordinate with the business owner’s wealth advisor: How much will they need net after tax? How much do they want to pass to heirs ? And how much do they want to give to charity?

Charitable Giving & Personal Tax Planning

- For personal tax years 2025 and 2026, consider bunching charitable donations in 2025 before the 0.5% AGI floor begins next year.

- If the business owner doesn’t itemize in 2026, albeit modest, the new above-the-line $1,000 / $2,000 cash-gift deduction may make sense.

- Consider donor-advised fund (DAF) strategies, especially if the business exit will produce a large capital gain in 2026.

Team & Timeline Considerations

- Engage your M&A advisor, tax advisor, valuation specialist, and estate-trust attorney early and often. (For the best results, start 3 to 5 years before the business owner’s planned exit. )

- Build Several Different Scenario Models: including “Best Case” Exit, “Stretch” Case, and “Potential Delay” Scenarios.

- Prepare the Business for Sale: Ensure that the business owner has clean financials, low owner-dependency, operations manuals, an effective management team, good vendor / customer diversification, etc., as all of these things enhance owner value and reduce the buyer’s risk.

Final Thoughts

A business exit is a major financial event. The OBBBA offers both opportunity and complexity. Higher exemptions, broader QSBS benefits, and permanent features, like full expensing and pass-through deduction permanence, give a Certified Business Exit Consultant more resources to increase a seller’s exit value, but timing, structure, and coordination are more important than ever.

In summary, a CBEC should keep the following ideas “top of mind” when working with business owners in 2026:

- If a business owner is planning an exit in the near term, encourage them not to wait. Many of the exit structuring decisions need to be in place now to fully benefit from QSBS, optimize entity structure, and maximize the timing of tax gains and deductions

- Assemble a multi-disciplinary team of advisors

- Focus in tandem on the business side of the transaction, including its structure, operations, opportunities for value enhancement, etc., and the personal side of the transaction, such as the owner’s mental readiness, wealth plan, post-exit income, taxes, and legacy

- Model different exit scenarios around things like timing, structure, and tax outcomes, and build flexibility into the plan to accelerate or delay the business owner’s exit based on changing market or tax-law developments

- Document everything: stock issuances, basis, shareholder agreements, valuations, asset purchases, depreciation schedules, etc. This matters enormously during audits, when valuing the business, and throughout negotiations with the buyer.

Become a Trusted Exit-Planning Expert with the CBEC® Credential

The Certified Business Exit Consultant® (CBEC®) certification provides the training, frameworks, and applied experience needed to guide business owners through complex transitions shaped by evolving tax law, such as the OBBBA.

As a CBEC® designee, you gain:

- In-Depth Knowledge of Exit Planning: Structure exit strategies that maximize value and improve tax efficiency.

- Hands-On Experience: Apply exit strategies across real scenarios, from QSBS timing to entity restructuring.

- Expert Insights and Resources: Access frameworks covering valuation, deal structuring, estate planning, and tax strategies.

- Professional Recognition: Earn a nationally recognized certification backed by the International Exit Planning Association (IEPA).

- Attractive Earning Potential: Many CBEC® professionals generate meaningful and recurring advisory revenue.

Strengthen your advisory impact, help business owners navigate OBBBA-era tax complexity, and guide them toward better exit outcomes.

Contact the International Exit Planning Association (IEPA) today to begin your CBEC® certification journey.

About the Author

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.