A Founder’s Vision for Longevity Over Liquidity

In 1976, at just 23 years old, David Weekley left a conventional builder’s career path to forge his own. When his supervisor offered him a company car instead of the bonus he had earned, Weekley chose independence. He and his brother, Dick, launched David Weekley Homes in Houston, Texas, with Weekley serving as salesperson, purchasing manager, and builder. From the start, Weekly sought to differentiate by focusing on design excellence rather than production volume.

Over the next five decades, that focus evolved into one of America’s largest privately held homebuilders, operating across 13 states and 19 markets, and recognized multiple times as one of Fortune’s 100 Best Companies to Work For. The business’s purpose, “building dreams, enhancing lives,” became the north star guiding both growth and governance.

From Business Success to Family Stewardship

For most of its history, David Weekley Homes was not viewed as a “family business,” but roughly ten years ago, David Weekley began asking a deeper question: could the company endure beyond his lifetime? A family conversation, and their enthusiastic desire to see it continue, shifted his thinking from “growth” to “generational sustainability.”

David Weekley and his brother established trusts and generational ownership structures over two decades ago. Each brother’s three children were included through generation-skipping trusts, ensuring that family wealth could persist without requiring direct managerial involvement.

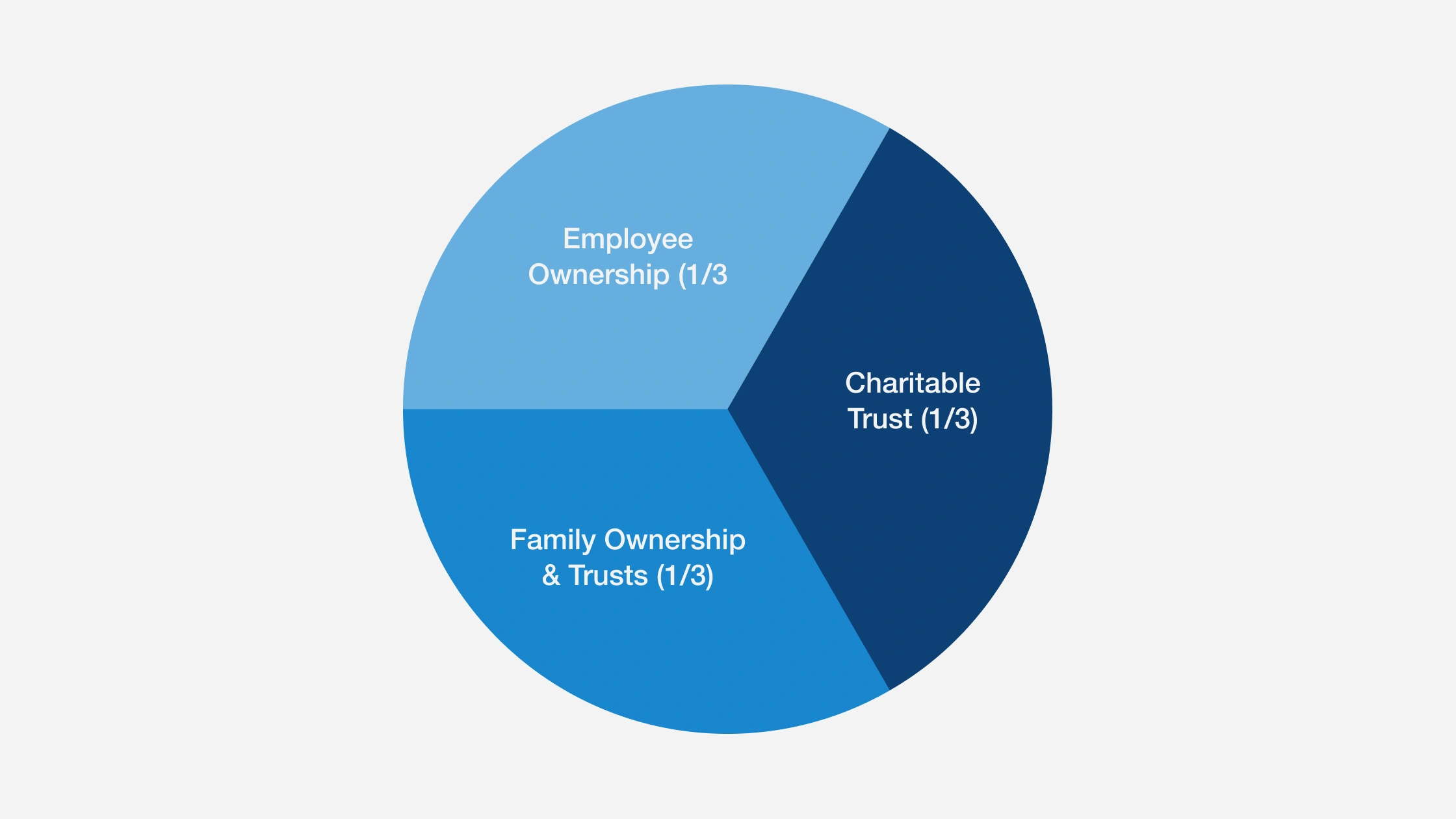

This thoughtful structure became the foundation for what Weekley calls a “thirds model”, a balanced, purpose-driven approach to succession.

David Weekly Homes’ Thirds Model: “Employees, Charity, and Family:”

Instead of pursuing conventional exit paths, going public or selling to a strategic buyer, Weekley created a three-part ownership framework designed to align purpose, people, and legacy:

- Employee Ownership (1/3): One-third of company stock is held by employees, with 15% in an ESOP and the rest directly owned by primary managers. This rewards loyalty and empowers those who built the business to share in its continued success.

- Charitable Trust (1/3): Another third is placed in a charitable trust, funding philanthropic causes aligned with Weekley’s lifelong commitment to give away half of his earnings. This ensures the company’s profits will continue to “enhance lives” long after his tenure.

- Family Ownership & Trusts (1/3): The remaining third stays with the family through generation-skipping trusts, providing continuity without requiring direct management control.

“I love the alignment,” Weekley explains. “When we do well, team members and charity win as well as the family winning.”

Transitioning Control Without Losing Culture

David Weekley still maintains full control of the company, but succession plans are well underway. Over time, governance will transition to a Family Stewardship Council, including three of the six family members and supported by an independent board of directors. The council will oversee the company’s purpose, long-term vision, and adherence to its founding principles.

Using this model, David Weekley separated ownership from management. His son serves as company president, while an outside CEO oversees daily operations. “You can be great owners,” Weekley says, “without presuming that you have to be the CEO of a $3.5 billion business.”

This approach preserves professional management while embedding family influence through governance, not control.

Sustaining the Mission: Building Dreams, While Enhancing Lives

Weekley’s philosophy centers on “forever improving.” The next generation has adopted this ethos, reframing it as “a team driven to excellence.” The Family Stewardship Council will function as a guardian of purpose, ensuring that the mission remains rooted in service to employees, customers, and the community.

Weekley’s structure also guards against mission drift, a risk common in family enterprises. By distributing ownership across family, employees, and philanthropy, he guarantees that no single interest dominates and that the business remains guided by shared values.

Major Lessons for Certified Business Exit Consultants CBEC®

David Weekley’s model offers powerful insights for exit planners and founders alike:

- Design an exit that reflects purpose, not just price: David Weekley rejected conventional liquidity events in favor of perpetuating his mission and culture.

- Build shared value through balanced ownership: By dividing ownership among

family, employees, and charity, he also aligned incentives and created resilience. - Separate governance from management: This plan ensures professional

leadership continuity while maintaining family stewardship and oversight. - Institutionalize culture and values: The Family Stewardship Council and

charitable trust embodies the company’s purpose beyond any single generation. - Plan decades in advance: By establishing trusts 20 years before his

transition, Weekly had ample time to assess, refine, and communicate the plan.

A Model for Legacy-Oriented Exits

David Weekley’s exit strategy is not a retreat; it’s a reinvestment in legacy. Rather than handing off a title, he architected a structure in which governance, ownership, and purpose reinforce one another. The “thirds model” ensures that employees, family, and philanthropy all share in the success, creating a living system planned to last 50 to 100 years.

For exit planners, it’s a reminder that a well-designed transition isn’t just about who gets what: It’s about ensuring the values that built the business endure long after the founder steps aside.

Help Business Owners Build Legacy-Focused Exits with CBEC® Certification

The Certified Business Exit Consultant® (CBEC®) designation gives advisors the resources, strategies, and real-world knowledge required to support founders through complex, purpose-driven transitions like the one David Weekley designed.

As a CBEC®, you gain:

- Deeper Exit-Planning Expertise: Understand how to shape legacy-oriented transitions, develop multi-stakeholder ownership structures, and build governance systems that endure.

- Applied, Practical Training: Gain hands-on experience in continuity planning, leadership succession, incentive alignment, and long-term value preservation.

- Professional Credibility: Hold a nationally respected certification endorsed by the International Exit Planning Association (IEPA).

- Expanded Advisory Revenue: Strengthen client relationships and unlock new advisory opportunities through comprehensive exit-planning guidance.

If you’re looking to strengthen your advisory practice and support owners in building exits that protect their culture, mission, and long-term vision, the CBEC® programme gives you the practical training to make that possible.

About the Author

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.