Protecting legacy and wealth feels like a future concern rather than an immediate priority for many business owners. That assumption carries real risk. About 85% of business owners have estate plans that are outdated or insufficient, leaving ownership transitions, family outcomes, and accumulated wealth exposed at the very moment they matter most.

Business exit planning and estate planning often evolve on separate tracks. One focuses on preparing the company for transition or sale, while the other addresses wealth transfer, taxes, and family intentions. When these efforts are not coordinated, gaps emerge. Ownership structures may conflict with estate documents, tax strategies may fall out of alignment, and successors may face uncertainty or dispute.

Firms that coordinate estate and business exit planning help owners close these gaps before they become problems. By aligning personal, family, and business objectives early, owners gain clarity, reduce risk, and create a transition strategy that protects both the value they’ve built and the legacy they intend to leave behind.

Why Estate Planning and Exit Planning Must Be Integrated

Exit planning and estate planning serve different purposes, yet they are tightly connected. One focuses on how and when ownership changes hands, while the other governs how wealth, control, and responsibility are transferred to the next generation or beneficiaries.

When these plans operate in isolation, even well-intended strategies can produce unintended consequences. Integration ensures that business decisions support personal goals and that wealth transfers occur smoothly, efficiently, and as intended.

Estate Planning and Exit Planning Address Different Risks

Estate planning concentrates on protecting personal wealth, minimizing tax exposure, and ensuring assets pass according to the owner’s wishes. Exit planning focuses on preparing the business for transition, maintaining value, and managing ownership change. Without alignment, estate documents may conflict with exit structures, creating confusion or delays at a critical time.

Misalignment Creates Tax and Liquidity Challenges

A business sale or ownership transfer can trigger significant tax obligations. If estate planning tools are not coordinated with exit timing and structure, owners or heirs may face unnecessary tax burdens or liquidity shortfalls.

Integration allows tax strategies, trusts, and ownership structures to work together rather than against each other.

Legacy Protection Requires Coordinated Decisions

Many owners care deeply about how their business and wealth impact family members, employees, and communities. Coordinated planning ensures leadership succession, ownership transfer, and wealth distribution reflect the owner’s broader legacy goals. Clear alignment reduces the risk of disputes and supports continuity long after the transition is complete.

7 Major Things to Know About Coordinated Estate and Exit Planning

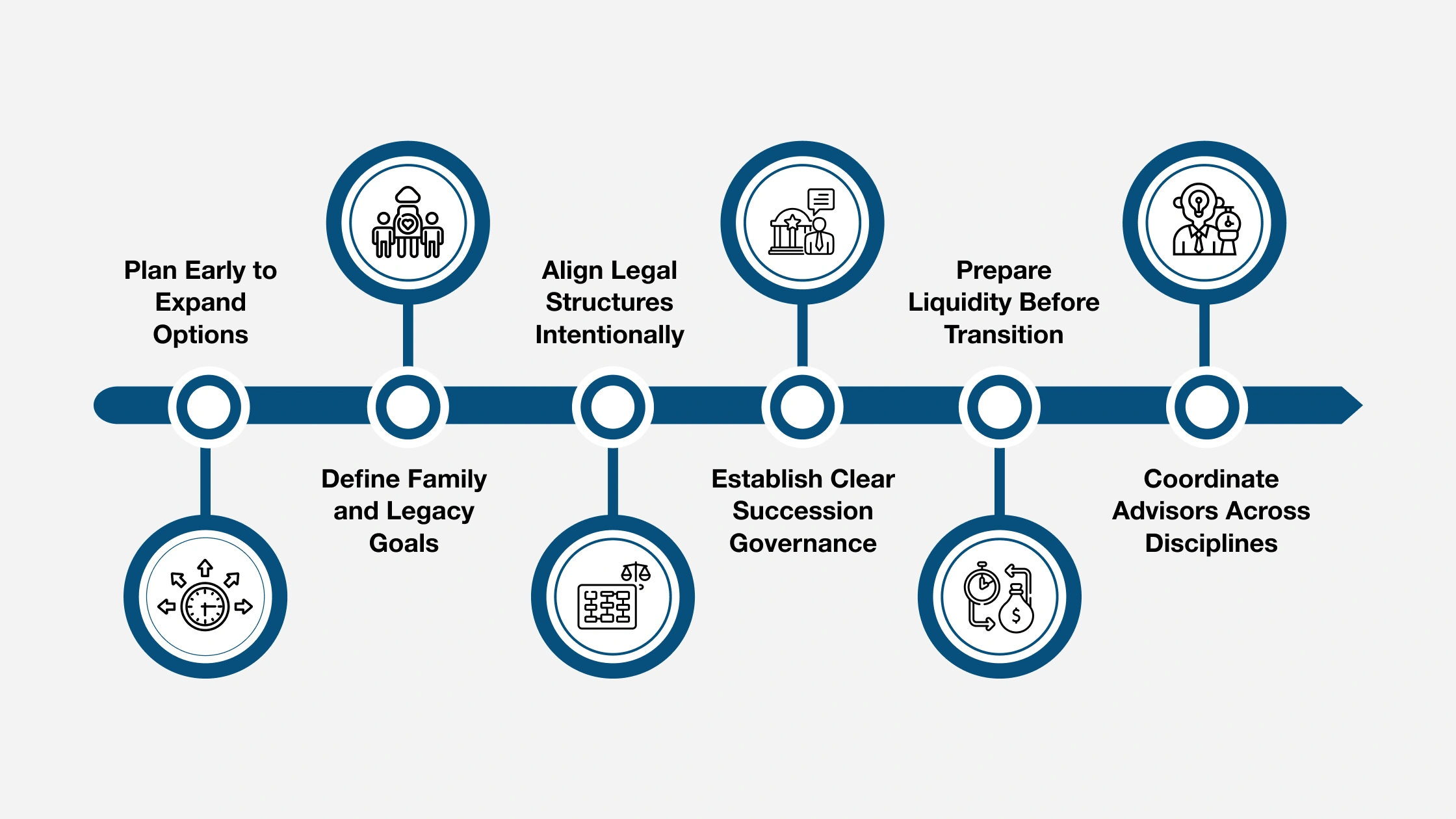

Coordinating estate planning with business exit planning requires more than updating documents or naming successors. It involves aligning legal structures, financial strategies, and personal goals so that ownership, leadership, and wealth transfer work together.

Owners who understand the core elements of coordinated planning are better positioned to protect value, reduce risk, and ensure their intentions are carried out as planned.

1. Plan Early to Expand Options

Starting coordination well ahead of a transition allows time to evaluate tax strategies, ownership structures, and succession paths. Early planning gives owners flexibility to adjust as business conditions or personal goals change, rather than being forced into decisions under time pressure.

When estate and exit planning begin early, owners can sequence actions intentionally. That may include restructuring ownership interests, introducing successors gradually, or transferring certain assets ahead of a sale. Time also allows strategies to mature, reducing exposure to rushed decisions that can undermine both wealth preservation and family harmony.

2. Define Family and Legacy Goals

Exit and estate plans are most effective when they reflect what the owner truly wants for family, employees, and future generations. Clarifying these goals early helps advisors design structures that balance financial outcomes with legacy priorities.

Without explicit alignment, plans often default to purely financial efficiency, overlooking emotional and relational factors. Coordinated planning creates space for honest conversations around fairness versus equality, involvement versus ownership, and the long-term role of family members. These discussions reduce misunderstanding and ensure the final plan reflects the owner’s intent, not just technical efficiency.

3. Align Legal Structures Intentionally

Wills, trusts, buy-sell agreements, and operating agreements should align with the exit strategy. When legal documents conflict, ownership transfers can stall or create disputes. Coordinated exit planning strategies ensure each structure supports the overall transition plan.

Alignment also prevents unintended consequences, such as triggering buy-sell provisions prematurely or transferring control in ways that conflict with estate directives. A coordinated review ensures documents reference each other correctly and reflect current business realities, helping transitions unfold smoothly when ownership changes hands.

Tax exposure does not end at closing. Estate taxes, capital gains, and future income considerations all influence how much wealth is ultimately preserved. Integrating tax planning into exit decisions helps owners manage both immediate and long-term impacts.

Planning allows owners to evaluate how transaction structure, timing, and estate tools interact. This approach reduces surprises for heirs and creates clarity around net outcomes. When tax strategies are considered alongside exit planning, owners gain confidence that wealth transfer aligns with both financial goals and family needs.

4. Establish Clear Succession Governance

Leadership transition affects business stability as much as ownership transfer. Coordinated planning addresses who will lead, how decisions will be made, and how accountability is maintained after the owner steps away.

Governance structures define authority, oversight, and conflict resolution. Without them, successors may struggle to lead effectively or face resistance from stakeholders. Proper planning ensures leadership transitions are supported by clear roles and expectations, protecting continuity and preserving enterprise value during and after the exit.

5. Prepare Liquidity Before Transition

Estate taxes or settlement obligations can create sudden cash needs. Coordinating liquidity planning with the exit strategy helps ensure heirs are not forced to sell assets or disrupt operations to meet financial obligations.

Liquidity planning considers how and when cash will be available, whether through sale proceeds, insurance, or retained earnings. This foresight protects both the business and the family, allowing transitions to occur on the owner’s terms rather than under financial pressure.

6. Coordinate Advisors Across Disciplines

Effective integration brings together legal, tax, valuation, and exit planning expertise. Firms that coordinate these disciplines reduce gaps, improve communication, and help owners move through the transition with greater clarity and confidence.

When advisors operate in silos, strategies may conflict or overlook important details. A coordinated team approach ensures decisions in one area reinforce outcomes in another. This alignment supports smoother execution and helps owners protect both legacy and wealth throughout the transition process.

How Coordinated Planning Protects Wealth and Legacy

Coordinating estate and business exit planning allows owners to move beyond isolated decisions and build a transition strategy that protects both financial outcomes and long-term intentions. When these plans are aligned, owners reduce exposure to risk, preserve value, and create stability for everyone connected to the business.

Tax Efficiency

When estate and exit plans are synchronized, owners can structure ownership, transfers, and transactions to manage tax exposure more effectively. Coordinated planning helps align estate tools with exit timing and deal structure, reducing unnecessary liabilities and protecting more of the wealth created through the business. This integrated approach also provides clarity around future tax obligations, allowing owners and heirs to plan with greater certainty.

Continuity for Business, Family, and Stakeholders

A cohesive strategy supports continuity beyond the transaction itself. Clear alignment between estate documents and exit plans ensures leadership transitions unfold as intended and ownership changes do not disrupt operations. Family members, employees, and other stakeholders benefit from stability, clear expectations, and reduced conflict, helping the business maintain momentum through and after the transition.

Liquidity Management

Liquidity planning is essential to prevent forced decisions at sensitive moments. Coordinating estate tools with exit planning ensures that cash is available to address estate obligations, fund buyouts, or support successors without requiring the sale of business assets under pressure. This foresight protects enterprise value while giving heirs the flexibility to carry out the owner’s long-term vision.

Work With CBEC® Trained Advisors to Coordinate Exit and Estate Planning

Protecting legacy and wealth requires more than good intentions. It demands advisors who understand how business exit planning and estate planning intersect and how to coordinate both into a single, disciplined strategy. The International Exit Planning Association (IEPA) equips professionals with the practical training needed to guide owners through these complex, high-stakes decisions.

IEPA’s Certified Business Exit Consultant® (CBEC®) program prepares advisors to move beyond isolated planning and deliver integrated outcomes for business owners:

- 66% of CBEC® advisors structure their exit planning engagements in multiple phases, supporting long-term coordination rather than one-time transactions.

- Over two-thirds of CBEC® advisors dedicate at least half of their practice to Main Street and lower middle-market owners, where estate and exit alignment has the greatest impact on legacy outcomes.

- 22% of CBEC® advisors reported earning more than $250,000 annually from exit planning services, reflecting the value owners place on experienced, integrated guidance.

When exit planning and estate planning work together, owners gain clarity, continuity, and confidence. Partnering with IEPA-trained advisors helps ensure those outcomes are intentional, coordinated, and built to last.

Connect with a Certified Business Exit Consultant® and begin planning your exit with confidence.