Selling a business is far less predictable than many owners expect. In fact, only 20 to 30% of businesses that go to market actually sell, a reality that emphasizes how often transactions stall or fall apart before reaching the finish line. One of the most common reasons is a disconnect between what owners believe their business is worth and how buyers evaluate that value.

A professional business valuation helps close that gap. It provides an objective view of the company, highlights strengths and weaknesses, and supports informed decisions around timing, pricing, and exit strategy. Yet valuation outcomes vary widely depending on who performs the analysis and how it is conducted.

Understanding how valuation firms operate, what methodologies they use, and how their work fits into the broader exit planning process is essential for owners preparing to transition. The right valuation partner helps position the business for a credible, successful exit.

Why Professional Business Valuation Is a Strategic Step

A business valuation is not just a pricing exercise reserved for the moment a sale is imminent. It is a method that helps owners understand how the market views their company and what factors truly drive its value. Professional valuation brings objectivity to the process, replacing assumptions with data and analysis that buyers, lenders, and advisors trust.

Beyond establishing a credible value range, a thorough valuation uncovers risks that can weaken a deal if left unaddressed. Issues such as owner dependence, customer concentration, inconsistent financial reporting, or operational gaps often surface during this process. Identifying them early gives owners time to make improvements rather than reacting under pressure during negotiations.

A professional valuation also informs broader exit planning decisions. It helps owners assess the feasibility of different exit paths and set realistic expectations that align business performance with personal goals. When used proactively, valuation becomes a foundation for a stronger, more predictable transition.

7 Things to Know About Valuation Service Providers

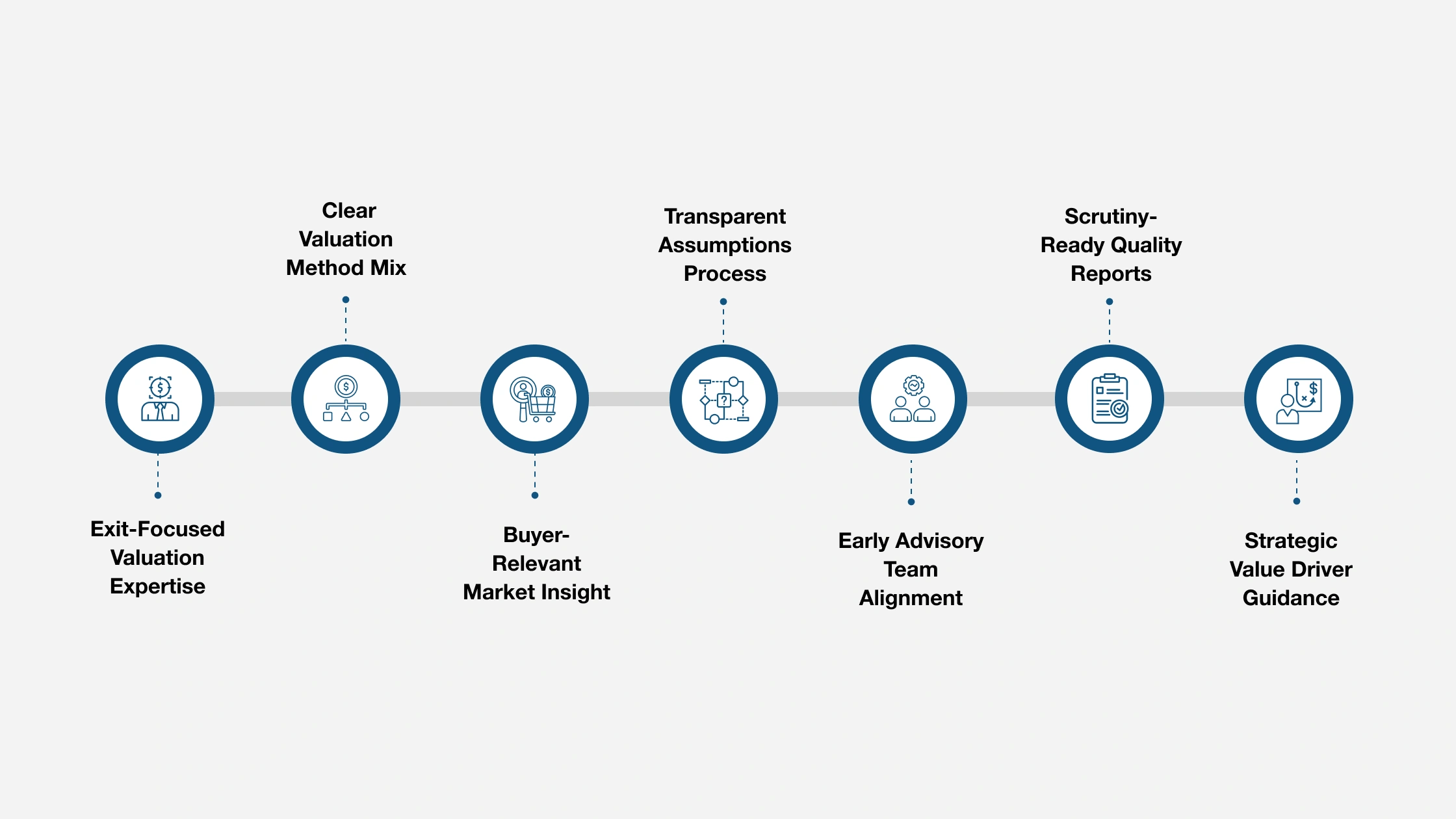

Not all valuation firms approach business exits the same way. Some focus narrowly on producing a report, while others take a broader view of how valuation supports negotiation, timing, and exit readiness. For business owners preparing to transition, understanding these differences is essential.

The right valuation provider helps clarify expectations, strengthen credibility with buyers, and surface issues that could affect value well before the sale process begins. Here are seven factors that will help you evaluate valuation service providers and choose a partner who supports not just a number, but a successful exit outcome.

1. Exit-Focused Valuation Expertise

When it comes to business valuation, the lowest fee rarely delivers the strongest outcome. Valuation is a specialized discipline that requires technical training, professional judgment, and real-world experience with transactions. Providers with recognized credentials and a track record of exit-related work are better equipped to deliver valuations that withstand buyer scrutiny and due diligence.

Experienced valuation professionals understand how financial adjustments, market conditions, and risk factors influence value. They also know how buyers interpret valuation reports and where challenges typically arise. Choosing a provider based solely on price can lead to unsupported assumptions, credibility issues, or a valuation that fails to hold up during negotiations.

2. Clear Valuation Method Mix

A credible valuation depends as much on the methodology as it does on the final number. Different approaches highlight different aspects of business value, and the right mix depends on the company’s size, industry, and exit goals. A qualified valuation provider should clearly explain which methods are used and why they apply to your business.

Standard valuation methodologies include:

- Income-based approaches, which focus on the business’s ability to generate future earnings or cash flow

- Market-based approaches, which compare the company to similar businesses that have sold in the market

- Asset-based approaches, which evaluate the value of the company’s tangible and intangible assets

Understanding these methods helps owners interpret valuation results more effectively and ensures the conclusion reflects economic reality rather than a one-size-fits-all formula.

3. Buyer-Relevant Market Insight

A strong valuation does not exist in a vacuum. Market conditions, industry trends, and buyer behavior all influence how a business is priced during an exit. Valuation providers with relevant industry experience can place your company in the proper market context, rather than relying solely on generic benchmarks or outdated data.

Providers who understand your sector can better assess competitive dynamics, growth prospects, and risk factors that affect valuation multiples. They also recognize how current economic conditions, capital availability, and buyer appetite shape deal outcomes. This perspective helps owners develop realistic expectations and positions the business more effectively when it is time to engage buyers or successors.

4. Transparent Assumptions Process

A valuation is only as strong as the clarity behind it. Owners should expect valuation providers to clearly explain how conclusions are reached, including the assumptions, adjustments, and data sources used in the analysis. When the process is transparent, owners gain confidence in the results and are better prepared to address questions during negotiations.

Transparent valuation reports also build credibility with buyers, lenders, and advisors. When assumptions are documented and methodologies are clearly articulated, the valuation is easier to defend and less likely to be challenged during due diligence. This openness reduces friction in the transaction process and helps maintain momentum as the exit moves forward.

5. Early Advisory Team Alignment

Valuation delivers the most value when it happens well before a business is taken to market. Early collaboration with a valuation provider allows owners to use the findings strategically rather than reactively. Instead of discovering issues during negotiations, owners gain time to address weaknesses and strengthen value drivers in advance.

When valuation professionals engage early, they can help identify operational gaps, financial inconsistencies, or risk factors that may affect buyer confidence. This insight informs broader exit planning decisions, including timing, positioning, and readiness. By treating valuation as a planning tool rather than a last-minute requirement, owners enter negotiations with greater clarity and control.

Early collaboration also supports better alignment across the advisory team. Valuation insights can guide conversations with legal, tax, and exit planning professionals, ensuring that decisions made in one area do not undermine value in another. When valuation is integrated into the broader exit roadmap, owners benefit from a coordinated strategy that strengthens their negotiating position and reduces surprises as the transaction progresses.

6. Scrutiny-Ready Quality Reports

Buyers rely heavily on valuation reports to validate pricing and assess risk. A well-prepared report clearly documents assumptions, financial adjustments, and valuation methods, allowing buyers to understand how value was derived. When reports lack detail or consistency, buyers may question the credibility of the valuation, slow the deal, or seek price reductions during negotiations. Strong reports help maintain momentum and reinforce confidence in the transaction.

Lenders also scrutinize valuation reports when financing is involved. Banks and other financing sources use valuation data to assess collateral strength, cash flow sustainability, and repayment risk. Reports that follow recognized standards and present clear, defensible conclusions are more likely to support favorable lending terms. Incomplete or unsupported valuations can delay approvals or limit financing options, affecting deal structure and timing.

Tax authorities examine valuation reports to ensure compliance and accuracy, particularly when valuations affect tax liabilities, estate planning, or ownership transfers. A defensible report with clear documentation reduces the risk of challenges, audits, or disputes. Quality valuations help owners navigate regulatory requirements while protecting against unexpected tax exposure after the transaction closes.

7. Strategic Value Driver Guidance

Experienced valuation professionals contribute far more than a final number. Their insights often shape broader exit planning decisions, including timing, deal structure, and market readiness. By analyzing value drivers and risk factors, they help owners understand which improvements can meaningfully impact outcomes and which changes may offer limited return.

Valuation experts also support coordination across legal, tax, and exit planning teams. Their analysis informs conversations around succession, ownership structure, and transaction planning, ensuring that decisions align with both market realities and personal objectives. When valuation is integrated into the advisory process, it becomes a strategic asset rather than a standalone report.

Start Building Your Exit Plan With a CBEC® Trained Advisor

A successful business exit does not begin with a transaction. It starts with clarity, preparation, and informed decision-making well before a sale is on the table. Advisors trained through the International Exit Planning Association (IEPA)’s Certified Business Exit Consultant® (CBEC®) program are equipped to help owners use valuation strategically, identify value gaps early, and align exit planning decisions with long-term personal and financial goals.

CBEC® trained advisors understand how valuation, timing, tax considerations, and deal structure work together across the full exit journey. Rather than reacting to buyer pressure or market constraints, owners gain a structured, phased approach that improves readiness, strengthens credibility, and supports more predictable outcomes.

Whether you are years away from a transition or beginning to evaluate your options, working with a CBEC®-trained advisor helps ensure your exit plan is intentional, informed, and built around what matters most to you.

Connect with a Certified Business Exit Consultant® and begin planning your exit with confidence.