Every business owner hopes to exit with maximum value and minimal stress. However, far too many begin that journey without first knowing what their company is really worth. Recent data from independent studies finds that 58% of small business owners have not had a formal valuation in the past year and have no plans to do so.

This gap in preparation helps explain why many businesses never find a buyer. Between 70% and 80% of small businesses listed for sale ultimately fail to sell.

This is where a comprehensive business valuation and a clearly defined exit roadmap come into play. Together, they provide owners with more than a number on paper; they create the context needed to make informed decisions, address value gaps early, and plan next steps with confidence.

In this blog, we will break down what a comprehensive valuation really involves, how it connects to exit planning, and why having both in place well before a transition can significantly improve outcomes.

Why Does Business Valuation Matter Before Any Exit Decision?

A business valuation gives owners clarity about the numbers. Many owners rely on assumptions when estimating the value of their company. That approach feels convenient in the moment, but it becomes costly during negotiations, succession planning, financing, or tax structuring. A formal valuation replaces guesswork with facts, helping owners anchor decisions to reality instead of perception.

A professional valuation also highlights the factors that impact the value of the final number. These insights reveal gaps and opportunities long before a deal is on the table. In many cases, the valuation becomes a roadmap to building stronger transferable value.

Without this step, owners risk entering the exit process blind, potentially overpricing the company, undervaluing it, or discovering deal-breaking weaknesses late in negotiations. A proper valuation gives owners the leverage needed to choose the right exit path and maximize their outcome.

What a Comprehensive Economic Valuation Looks Like

A meaningful valuation goes far beyond reviewing last year’s revenue or profit. It provides a full financial and operational picture of the company and its future potential. A comprehensive valuation assesses tangible and intangible assets, including

- Financial performance

- Customer relationships

- Intellectual property

- Processes

- Recurring revenue

- Market reputation

A valuation professional will generally analyze multiple areas such as historical financials, adjusted earnings, industry benchmarks, and market comparables. They may use methods like discounted cash flow, market multiples, or asset-based valuation depending on the size, structure, and maturity of the business.

This level of analysis helps answer major questions, like:

- Is the revenue sustainable?

- Is the business scalable without the owner?

- How would the company perform under new leadership?

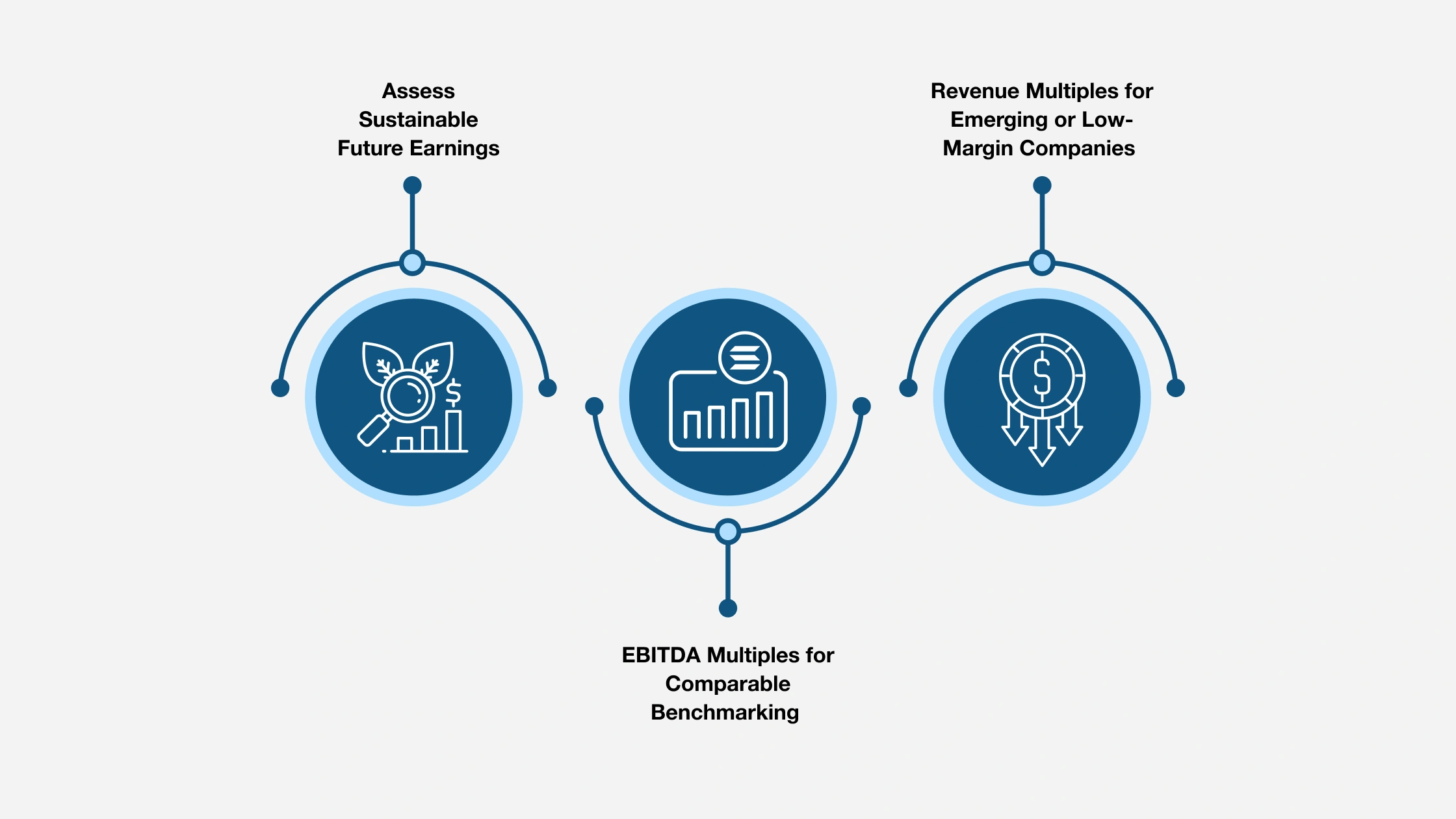

Common Valuation Methods Used in Exit Planning

A thorough valuation relies on structured methodologies that analyze financial performance, market comparisons, and future earning power. While no single method provides the full picture, using multiple approaches creates a more accurate, defensible valuation that supports informed exit decisions.

Assess Sustainable Future Earnings

The income approach focuses on the company’s ability to generate profit moving forward. Rather than relying solely on past numbers, historical earnings are adjusted to reflect the true ongoing performance of the business. Non-recurring expenses, one-time events, or discretionary owner spending are normalized to reveal sustainable earning power.

Once those earnings are established, a capitalization rate is applied based on business risk, stability, and growth expectations. This method ties today’s value to tomorrow’s earning potential and tends to benefit businesses with predictable revenue and strong financial discipline.

EBITDA Multiples for Comparable Benchmarking

The market approach answers a question nearly every owner asks: “What are companies like mine selling for?”

Using comparable transactions and industry benchmarks, a valuation expert applies an EBITDA multiple that reflects size, attractiveness, recurring revenue, leadership depth, and transferable processes. Because buyers often use this model during negotiations, it is one of the most relatable and practical valuation methods for owners preparing for a sale.

Revenue Multiples for Emerging or Low-Margin Companies

Some businesses generate significant demand or intellectual property value long before profitability stabilizes. Industries such as technology, early-stage services, or subscription-driven models often fall into this category.

A revenue-based multiple may provide a clearer valuation picture when profit fluctuations make EBITDA less meaningful. By applying a revenue multiple based on comparable companies in the same sector and size bracket, this approach offers a benchmark that reflects current market behavior and buyer perception.

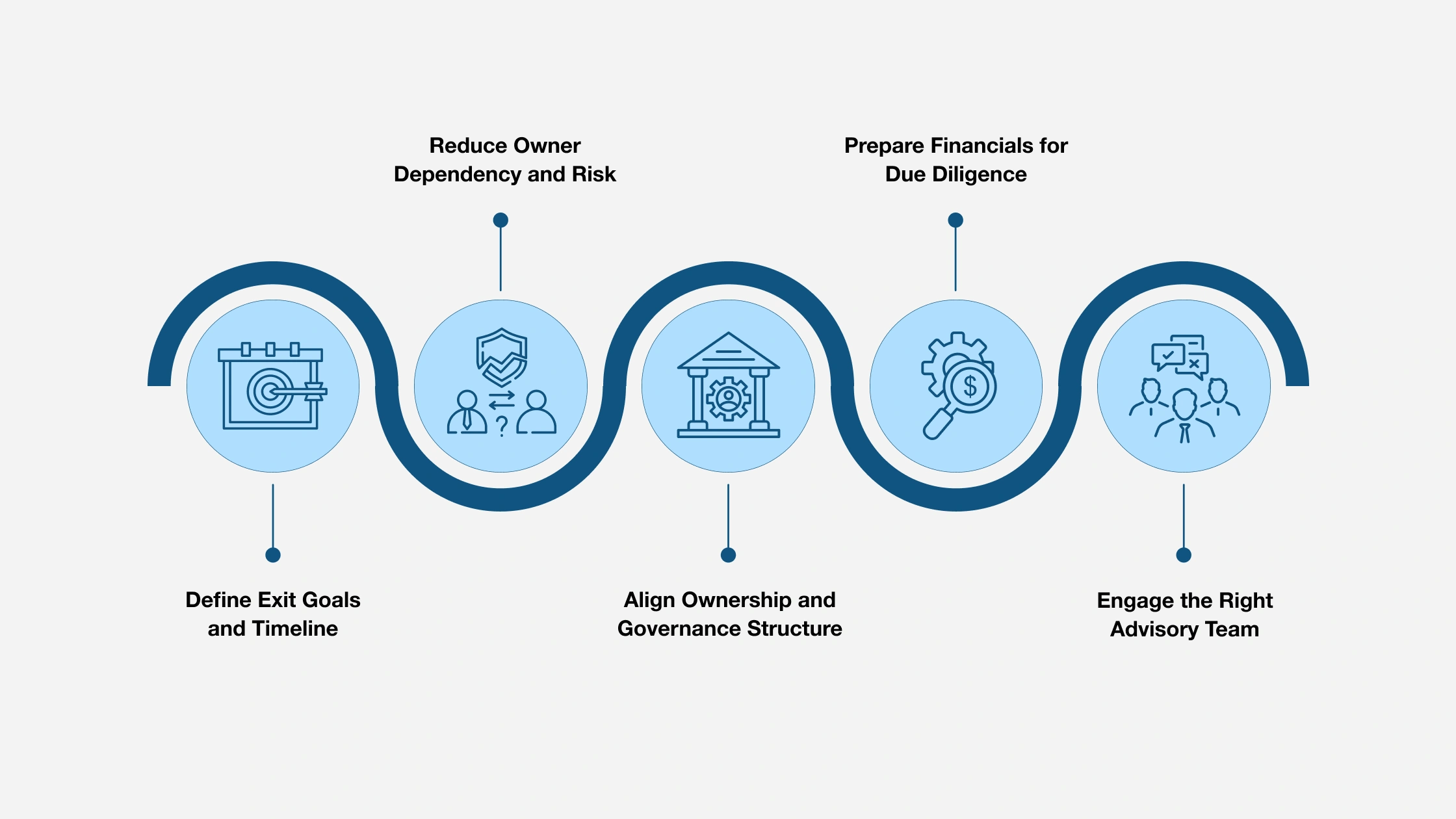

How Can Owners Build an Exit Roadmap After Valuation?

A business valuation tells you where you stand today, but a roadmap helps you move intentionally toward the exit outcome you want. Once you know your value, the next step is planning how to protect it, grow it, and eventually transfer it.

Define Exit Goals and Timeline

Every business exit begins with clarity. Owners must define what they want out of the transition, whether that’s full sale, partial sale, family succession, internal transfer, or a phased step-back. Timing matters just as much as strategy. A three-year runway looks different than a one-year exit or a ten-year plan.

Documenting personal financial needs, retirement expectations, lifestyle goals, and post-exit involvement helps narrow the viable options. Without this clarity, decisions become reactive, and that can reduce leverage and limit options later.

Reduce Owner Dependency and Risk

Transferable value depends on how well the company runs without the owner. Buyers and successors want confidence that leadership, systems, and processes will continue functioning long after the founder steps away.

This phase may include:

- Documenting standard operating procedures

- Delegating major responsibilities

- Strengthening leadership and management layers

- Building recurring revenue and predictable processes

When owners step out of day-to-day control, the business becomes more attractive, scalable, and less risky, which tends to increase valuation.

Align Ownership and Governance Structure

Ownership structure plays a defining part in how smoothly an exit unfolds. Before moving forward, owners should assess how shares, voting rights, legal agreements, and future decision-making authority align with their planned exit strategy. If there are multiple owners, outdated buy-sell agreements, unclear valuation language, or misaligned expectations, a transition can be delayed or derailed.

This stage may include updating entity structure, refining shareholder agreements, clarifying successor authority, and reviewing how ownership will transfer, all while weighing tax and financial consequences. Strong governance also signals stability to outside buyers, lenders, or future leaders. When ownership rules are documented, modernized, and legally sound, the business is positioned for a cleaner transfer with fewer surprises or disputes.

Prepare Financials for Due Diligence

Even strong companies lose leverage if their financials are incomplete, inconsistent, or unclear. Preparing for an exit often requires tightening accounting methods, updating reports, standardizing tracking, and identifying adjustments that reflect true earnings.

Buyers and advisors will examine revenue streams, cash flow, customer concentration, margins, contracts, and liabilities. The more organized and transparent your records are, the faster the process moves and the stronger your negotiating position becomes.

Engage the Right Advisory Team

A business exit touches multiple domains, such as legal, financial, tax, operational, and personal. Working with experienced advisors ensures your roadmap accounts for risks, tax outcomes, deal structures, and long-term wealth protection.

When the right team is aligned early, the owner gains clarity and coordination, successors gain confidence, and potential buyers see a well-prepared transition process rather than a loose plan.

Strengthening Your Advisory Practice With Exit Expertise

Business owners are asking deeper questions about succession, valuation, growth, tax implications, and personal outcomes, and they expect their advisors to guide those conversations with confidence. Exit Planning has shifted from an optional add-on to a core advisory capability, especially as more owners prepare for transition over the next decade.

Many advisors already support parts of the exit journey with consultation, yet few have a repeatable process or hands-on experience building a complete plan. That gap can limit impact and leave revenue on the table.

The Certified Business Exit Consultant® (CBEC®) designation helps close that gap by equipping advisors with:

- A proven, structured framework to guide clients through the full exit lifecycle

- Hands-on experience developing an actual exit plan with a real business owner

- Tools and processes that can be used immediately in client engagements

- Practical, practitioner-led training based on real transactions, not theory

- A growing network of peers, collaboration partners, and experienced faculty

- Higher earning potential, as many CBEC® advisors expand services and engagements

Experienced financial advisors, CPAs, business consultants, attorneys, fractional CFOs, M&A advisors, wealth managers, and exit-focused professionals who invest in Exit Planning expertise position themselves as long-term strategic partners and become the trusted guide owners rely on during one of the most meaningful decisions of their life and career.

Position Yourself as a Trusted Exit Advisor with CBEC® from IEPA

People across the country are expanding their services as more business owners seek structured exit support, and Exit Planning is quickly becoming a defining advisory capability. IEPA gives you a practical, proven framework to guide clients through valuation, planning, transition, and deal execution through practitioner-led training grounded in real experience.

Many professionals already see the impact. A growing percentage of CBEC® designees now specialize in preparing companies for market, and more than two-thirds report their client base is concentrated in Main Street and lower middle-market businesses, the very segment experiencing the highest transition activity. Engagement value is also rising.

A significant portion of certified advisors now charge five-figure fees for early-phase planning and build multi-phase engagements that create sustained advisory relationships.

If you’re ready to strengthen your advisory practice, deliver deeper value, and support owners at one of the most meaningful points in their journey, the next step is clear.