Exiting your business isn’t something you can “figure out” as you go. It’s a primary, multi-step process that demands thoughtful planning, strategic decisions, and timing. While most companies consider exit planning at the start-up phase, they fail to update it as the business grows.

Did you know that for every IPO, over 30 acquisitions happen yearly? The options for exiting a business are plentiful, and companies are constantly transitioning. Yet, many owners find themselves unprepared when the time to exit finally arrives. A surprising number don’t even have a clear exit strategy in place.

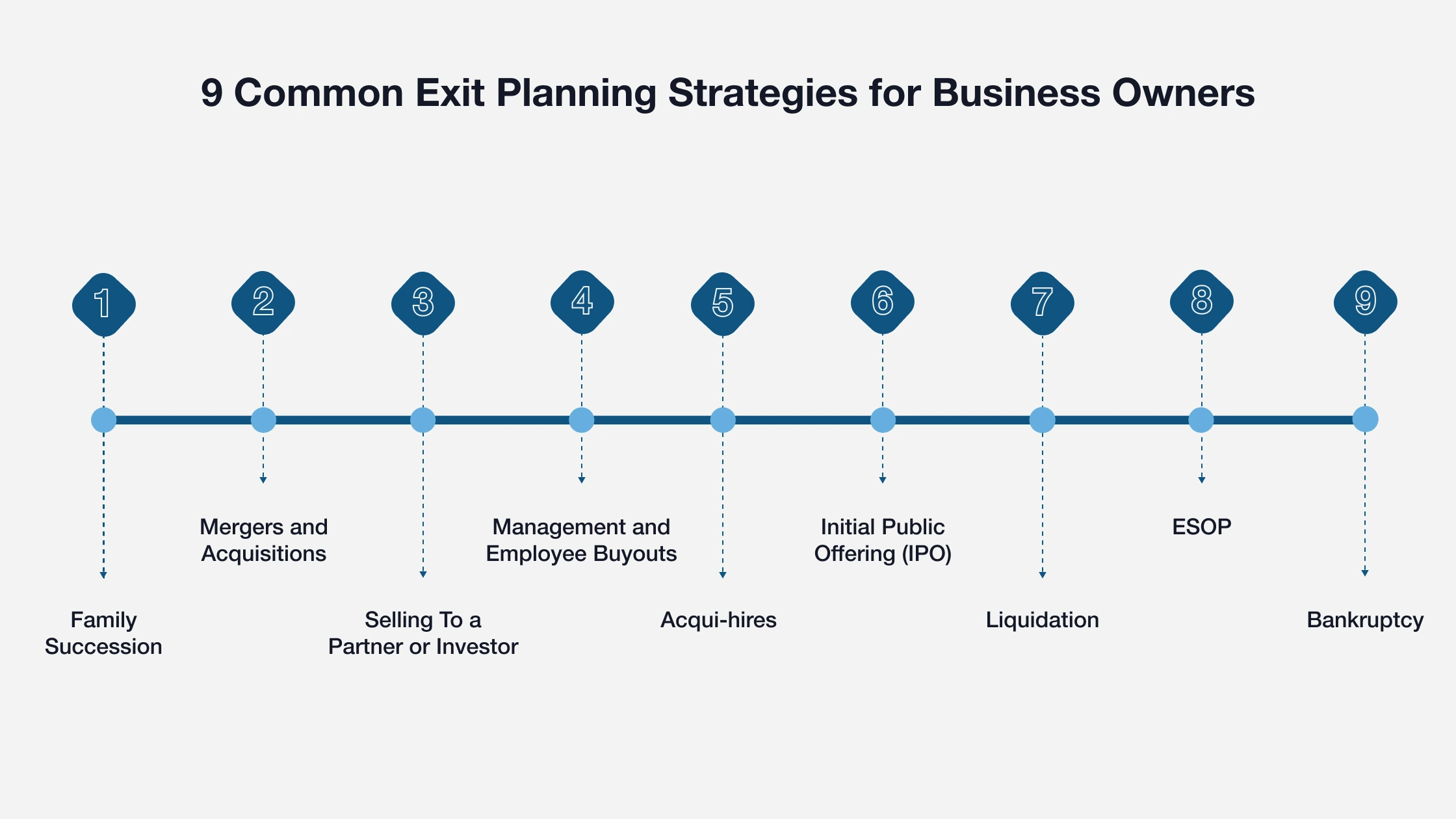

The nine major exit planning strategies for businesses include:

|

Let’s understand the major exit planning strategies and the primary considerations when deciding on a plan.

9 Common Exit Planning Strategies for Business Owners

Every business owner eventually faces the same question: What’s next? That answer depends on your goals, timeline, and the legacy you want to leave behind.

Several paths can lead to a successful exit. Some offer speed and liquidity. Others require patience but offer more control. Each strategy comes with trade-offs, and understanding them is the first step toward choosing the right one.

1. Family Succession

Passing the business to a family member is the most natural exit path. It keeps the company within your legacy, allows you to mentor the next generation, and often aligns with long-term family goals. But even with trust and familiarity, this strategy has its complexities.

Many owners assume a child or relative will eventually “take over,” but succession without structure rarely leads to a smooth transition. A strong plan includes clear roles, formal training, and honest conversations about leadership readiness. Financial considerations like valuation, buy-sell terms, and estate planning must also be mapped out well in advance.

Successful family transitions are less about keeping things the same and more about preparing the business (and the successor) to thrive without you. Family succession works best when treated like any other professional transition, planned, structured, and grounded in accountability.

Major questions to ask:

- Has your successor had meaningful leadership experience inside or outside the business?

- Are roles, ownership transfers, and responsibilities documented?

- Will your exit timeline allow for mentoring and knowledge transfer?

2. Mergers and Acquisitions

Selling to a strategic buyer or merging with another company offers a clear path to liquidity and growth. This route often appeals to owners looking for a clean break or a chance to stay on in a reduced role. Either way, M&A deals can deliver significant value if the contract is structured well and the buyer is aligned with your goals.

Many owners underestimate how selective buyers can be. They look beyond revenue and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Buyers want transferable value, stable leadership teams, clean financials, and growth potential. A business that’s too reliant on its owner or lacking operational maturity can raise concerns, even if the numbers look strong.

The M&A process itself requires preparation. Due diligence is rigorous, and negotiations can shift quickly. Deal terms need to reflect both risk and reward. That’s why experienced Exit Planners help owners position the business long before it hits the market.

Major considerations include:

- Does your business have systems and processes that operate without your daily involvement?

- Have you prepared financials, contracts, and key documents for buyer review?

- Are you clear on your walk-away number and post-sale involvement, if any?

3. Selling To a Partner or Investor

Some of the most seamless transitions occur when a vested stakeholder is already actively involved in the process. Selling your equity to a business partner, a major employee, or a private investor can offer flexibility, continuity, and fewer surprises than an external sale.

However, this doesn’t eliminate complexity. Valuation, as does the buyout structure, still matters, mainly if it’s financed over time. Expect detailed discussions around roles, responsibilities, and decision-making authority post-sale. Emotions can run high when relationships and money mix, so clear documentation and third-party guidance are essential.

This strategy often works best with a well-crafted operating agreement and a formal succession plan updated as the business grows. Selling to someone already invested in the company can be smart, as long as you treat it like a real transaction, not just a handshake deal.

Things to consider:

- Have you agreed on how the business will be valued—and by whom?

- Is a buy-sell agreement already in place, and does it reflect current realities?

- Can the buyer finance the purchase without putting strain on business operations?

4. Management and Employee Buyouts

When a leadership team or group of employees knows the business inside and out, they can be strong candidates to take the reins. A management or employee buyout (MBO or EBO) allows owners to exit while keeping operations stable and culture intact.

This strategy rewards loyalty and continuity but is not always simple to execute. Most employees don’t have the capital to buy the business outright. That means financing, often through seller notes, third-party lenders, or employee stock ownership plans (ESOPs), becomes part of the equation. Each option has tax, legal, and operational implications that must be carefully weighed.

The transition also hinges on leadership readiness. Technical expertise doesn’t always translate into strategic leadership. Owners must evaluate vision, values, and long-term fit. An employee-led buyout can protect the legacy you’ve built, but only when backed by a strong financial and operational foundation.

Consider the following before opting for this business exit strategy:

- Does the team have a shared vision for the business after your exit?

- How will the transaction be financed, and how will that impact business cash flow?

- Are leadership roles and responsibilities clearly defined post-transition?

5. Acqui-hires

When growth stalls or market shifts make a complete business sale unlikely, some owners pivot toward an acqui-hire. This approach involves selling the talent, not necessarily the company itself. Buyers, often larger firms, are interested in your people, not your product or infrastructure.

It’s a viable option when the team is your strongest asset. Engineers, designers, or leadership talent can command high value, especially in competitive industries. For the owner, an acqui-hire offers a soft landing. It protects employees, preserves relationships, and may include a retention bonus or a short-term role during the transition.

While this approach typically does not maximize business value, it prioritizes people over profit. Owners must consider the disposition of remaining assets, contracts, and client relationships. Legal and HR complexities often accompany the transition. Acqui-hires may not suit every situation, but they can be effective when the primary goal is employee continuity rather than financial gain.

Consider the following before opting for the acqui-hire option:

- Is your team highly skilled and attractive to more prominent players?

- Would a buyer be interested without the underlying business model?

- Are you prepared for limited payout potential compared to a complete acquisition?

6. Initial Public Offering (IPO)

Going public may sound like the pinnacle of success, and for some businesses, it is. An initial public offering (IPO) can create massive liquidity, attract new capital, and elevate brand visibility overnight. But the reality is that most businesses will never take this path.

IPOs require scale, infrastructure, and a level of regulatory compliance that most small—to mid-sized businesses simply aren’t built for. Preparing for public markets can take years, not months. It adds complexity and cost to financial audits, board governance, SEC filings, and investor relations. Once public, the pressure to hit quarterly targets can shift priorities fast.

The upside is clear: access to capital markets, high valuations, and potential for significant wealth creation. The trade-off is ongoing scrutiny and a shift in focus from ownership to shareholders. An IPO may be the most headline-worthy exit strategy, but it’s also the most complex—and the least common. Most business owners find better options closer to home.

Ask yourself these questions before taking your business public:

- Is your company large enough, with recurring revenue and growth potential, to attract public investors?

- Have you built a leadership team and board to handle public company governance?

- Are you ready to meet the transparency and reporting standards regulators require?

7. Liquidation

When other exit paths aren’t viable, or the business was built around the owner’s expertise, liquidation becomes the default. This approach involves selling assets, closing operations, and settling outstanding debts. It’s straightforward but leaves the most value on the table.

Liquidation doesn’t include a buyer for the business itself, and there’s no transfer of goodwill, client relationships, or future revenue potential. It’s often used when the company is no longer profitable or the owner doesn’t want to continue operations without a clear successor.

That said, liquidation can still be a clean and necessary choice. It gives the owner closure and may be the right move in scenarios involving burnout, declining industries, or a lack of interest from potential buyers. Liquidation may not be the most strategic exit, but in some cases, it offers a practical resolution that prioritizes simplicity over optimization.

Liquidation should be opted for only after thinking diligently about the following:

- Will the sale of assets cover outstanding liabilities?

- Are there tax implications to consider during the wind-down process?

- Could parts of the business—client lists or intellectual property—be packaged separately?

8. ESOP

Market volatility often complicates third-party sales. Valuations fluctuate, buyers hesitate, and deal terms become more conservative. An Employee Stock Ownership Plan (ESOP) presents a compelling alternative for owners seeking liquidity but still wanting to ensure continuity.

An ESOP allows a business owner to sell all or part of their company to a trust set up for employees, creating an internal buyer when external demand is less predictable. The structure can offer several advantages during turbulent conditions.

First, it can help preserve the company’s legacy and culture by transferring ownership to those who already understand the business. Second, it may create tax advantages for both the selling shareholder and the company, an essential factor in offsetting market-driven valuation pressures.

Major points to consider:

- Is an ESOP a viable internal buyer during market uncertainty?

- Can the ESOP structure help preserve company culture and legacy?

- Are there tax advantages available for the selling shareholder and the company?

9. Bankruptcy

Bankruptcy represents the most extreme form of exit, pursued when no viable alternatives remain. It can provide immediate relief from creditor pressure, pause legal actions, and create space to reassess financial obligations. However, it comes with significant tradeoffs.

Filing for bankruptcy may allow a business to restructure or discharge certain debts, but it doesn’t guarantee complete forgiveness. Creditors retain rights, and courts play a central role in determining how remaining assets are distributed. While the process can move quickly and requires less complexity than a whole business sale or internal succession, it limits control and significantly impacts reputation and credit.

For some owners, particularly those facing sustained losses or insurmountable liabilities, bankruptcy offers a way to reset. However, it should be considered part of a broader risk management conversation, not a standalone plan. Exit strategies built for volatile markets must include contingency planning, and bankruptcy should remain an option only after exploring all others.

Opt for bankruptcy only after considering the following:

- Will bankruptcy provide relief from creditor pressure or allow for restructuring?

- Are there any remaining alternatives to explore before filing?

- How will this impact your reputation, credit, and future business options?

Partner with Advisors Who Understand the Realities of Business Transitions

Exit planning is a complex, high-impact process that goes beyond strategy. From structuring deals to managing succession or ownership transitions, it requires professionals with firsthand experience and a clear understanding of what’s at stake.

That’s why experience matters.

If you’re a business owner preparing for an exit, our Certified Business Exit Consultant® (CBEC®) designees and candidates represent the most experienced group of exit consultants in the market today. Backed by the International Exit Planning Association (IEPA), these advisors bring insights from hundreds of real-world exit scenarios across industries, deal sizes, and economic conditions.

With the support of the International Exit Planning Association and our network of Certified Business Exit Consultant® (CBEC®) designees and candidates, you’ll have access to proven expertise and practical solutions for even the most complex transitions.

Ready to take the next step?

Find a Certified Business Exit Consultant®!

But…Do You Want to Lead Your Exit Strategy Instead of Relying Solely on Advisors?

Develop Comprehensive Exit Planning Expertise with CBEC® Certification

With IEPA’s CBEC® certification, you’ll gain the knowledge and practical experience to offer business owners the expertise they need when it matters most.

Here’s why it’s the right fit for you:

Proven, Practitioner-Led Training: Learn from experts who’ve successfully navigated the exit planning process.

Focused on Results: As per our findings, 66% of CBEC-certified advisors structure their engagements in multiple phases, ensuring they deliver long-term value.

Relevant for All Business Sizes: According to our research, over 2/3 of advisors place 50% or more of their business in the Main Street and Middle Market categories.

Attractive Earning Potential: Our studies show that 22% of CBEC advisors earned over $250,000 from exit planning services in 2024.

Hands-On Experience: Complete a real exit plan with a business owner to earn your CBEC®—practical experience that sets you apart.

Don’t just discuss exit planning—become the professional who makes it happen.