Over two-thirds of small and mid-sized business (SMB) owners in the U.S. will face a transition in the next 10 to 15 years, yet the majority have no exit plan in place.

That gap puts decades of work at risk. Without a clear strategy, SMB owners can be pushed into unplanned exits, accept lower valuations, or see transitions fail when the stakes are highest. Exit Planning often gets sidelined by daily demands. Delay narrows options and raises the cost of change, especially in businesses where owners remain central to operations and decisions.

Learning how to plan an exit strategy for a business early closes the readiness gap, preserves value, and keeps control with the owner.

In this blog, we will discuss why Exit Planning is essential for SMBs, how the process differs from larger companies, and what advisors, financial professionals, consultants, and part-time CFOs can do to help their clients exit with clarity, control, and value.

Why Exit Planning Matters for Small & Mid-Sized Businesses

Proactive Exit Planning protects business value, reduces risk, and sets the stage for a smooth transition. If you’re learning how to plan an exit strategy for a business, understanding owner dependency, buyer confidence, and succession planning is critical.

Reducing Owner Dependency

Many SMBs rely heavily on the owner as the primary decision-maker and operator. Exit Planning builds systems, trains successors, and reduces reliance on a single individual to safeguard value.

Preserving Business Value

Without preparation, unexpected exits caused by health issues, burnout, or market changes can erode value quickly. A plan keeps operations stable during transitions.

Improving Buyer Confidence

Buyers often view SMBs as higher risk due to relationship-driven revenue and undocumented processes. Exit Planning addresses these gaps to increase attractiveness and sale price.

Managing Family Business Dynamics

In family-owned companies, personal relationships can complicate decisions. Exit Planning aligns goals, structures, and roles early to prevent conflict during succession.

What Makes SMB Exit Planning Different

Exit Planning for small and mid-sized businesses requires a tailored approach that addresses resource limitations, owner dependency, and the need for early, structured preparation. If you’re mapping out how to plan an exit strategy for a business, you’ll need to factor in operational formalisation, financial transparency, and successor readiness early in the process.

Managing Owner-Centric Operations

In many SMBs, the owner serves as operator, strategist, and primary relationship manager. Transition planning must reduce this dependency to protect business continuity and value.

Formalizing Processes & Systems

Leaner teams and undocumented workflows can create buyer concerns. Documenting systems and ensuring operational consistency are essential well before a transition.

Strengthening Financial Transparency

Informal reporting may suffice internally, but it can deter buyers or lenders. Accurate, defensible financial statements are critical for due diligence and valuation.

Identifying & Preparing Successors

Lack of a clear leadership pipeline adds complexity to succession. Early identification and phased development of successors reduce transition risk.

The Core Elements of an SMB Exit Strategy

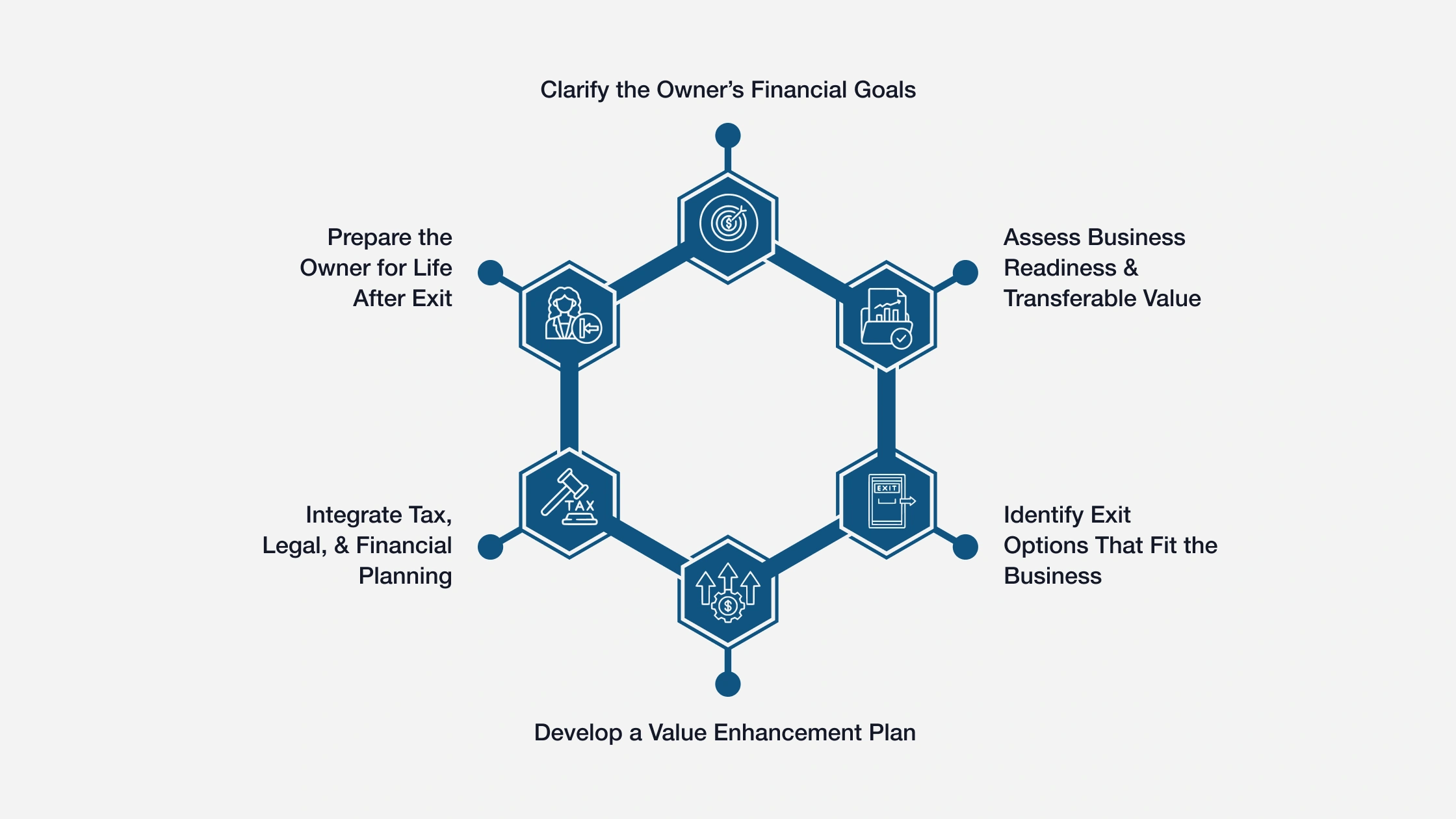

Below are the foundational elements every Exit Planner must address to guide owners toward a successful transition.

Clarify the Owner’s Financial Goals

Every Exit Planning engagement should begin by understanding the owner’s objectives. For some, it’s retirement. For others, it’s transferring the business to a family member or unlocking liquidity for new ventures, without clarity on the “why,” there’s no way to build a plan that fits.

These goals drive every decision that follows, from timing and structure to successor selection. Advisors must help owners articulate their objectives early and translate those into measurable planning targets.

Assess Business Readiness & Transferable Value

The next step is evaluating how ready the business is to operate without the owner. This includes assessing the quality of financials, operational systems, leadership team, customer dependencies, and overall owner involvement.

Many SMBs are heavily reliant on the owner’s relationships, decision-making, and institutional knowledge. Exit Planning requires a focus on reducing that dependency and building systems that make the business transferable, not just operational.

Identify Exit Options That Fit the Business

Not all exits look the same. Some businesses are well-positioned for a third-party sale; others may be better suited for internal succession, family transfer, or even an employee stock ownership plan (ESOP). The right option depends on the owner’s goals, the company’s structure, and the available resources.

Understanding the legal and financial implications and preparing the business accordingly is essential. Rushing this decision without exploring alternatives can lead to deal failure or an exit that falls short of expectations.

Develop a Value Enhancement Plan

Once a path is chosen, focus shifts to value creation. This may include improving margins, diversifying customer concentration, delegating responsibilities, or documenting processes. They’re operational improvements that increase the business’s attractiveness and reduce risk.

Integrate Tax, Legal, & Financial Planning

Too often, tax and legal considerations are addressed late in the process, leaving owners exposed to unnecessary costs and risks. Exit Planning requires proactive coordination between the advisor, tax professional, attorney, and wealth manager from the start.

This collaboration ensures the transaction is structured for efficiency, continuity, and post-exit financial stability. For SMB owners, these planning decisions can materially impact both deal value and long-term wealth preservation.

Prepare the Owner for Life After Exit

Many owners struggle with identity, purpose, and structure after stepping away. That’s why part of the planning process must include preparing the owner for what comes next.

This includes retirement planning, wealth management, and honest conversations about lifestyle, family roles, and legacy. Advisors who support this phase help ensure the exit is not only successful on paper but meaningful and sustainable in life.

3 Exit Strategies for Small & Mid-Sized Businesses

Selecting the right exit path is one of the most critical decisions a business owner will make, but it’s rarely straightforward. The size of the business, its financial profile, succession options, and the owner’s long-term goals all influence which strategy makes the most sense. There’s no one-size-fits-all approach.

Each of the three primary strategies represents a unique path, with different implications for value, control, and continuity. Understanding these differences is essential to helping owners evaluate their options, prepare accordingly, and align the outcome with their priorities and the future of their business.

1. Strategic Buyer

A strategic buyer is a competitor, vendor, or industry partner seeking to acquire a business for its strategic value, not just its financials. This may include expanding market share, entering a new region, or gaining access to proprietary products or customers.

Strategic buyers often pay a premium, but the sale process is typically more complex. Due diligence tends to be detailed, and the buyer may restructure teams or operations post-sale.

This type of exit can offer a clean break for owners, though it may involve trade-offs related to legacy and cultural fit. Advisors must help prepare the business for scrutiny and position it as an attractive, high-value opportunity within the buyer’s strategic framework.

| Pros | Cons |

| Potential for higher valuation | Cultural fit may be overlooked |

| Synergies can increase deal appeal | May lead to restructuring or layoffs |

| A clean exit is often possible | |

| Faster integration with buyers’ systems | |

| Industry familiarity reduces onboarding |

2. Financial Buyer

Financial buyers, such as private equity firms, family offices, and institutional investors, acquire businesses to generate a return over a defined investment period. These buyers may take a controlling interest or a minority position, depending on their strategy and how involved they expect current ownership and management to remain.

Their investment approach often follows one of two models:

3. Platform Investment

This is typically the buyer’s first acquisition in a specific sector. The business serves as a foundation for further growth and is expected to have strong leadership, operational scalability, and competitive positioning. Platform companies are carefully selected for their potential to anchor future expansion.

4. Add-On Investment

After establishing a platform, buyers seek additional businesses that complement the core company. These add-ons are often smaller and chosen for their ability to extend capabilities, enhance geographic presence, or create operational efficiencies. The goal is to build value through integration and strategic alignment.

Financial buyers are less focused on immediate synergies and more on long-term performance, value creation, and exit potential. Advisors working with owners must understand how to position the business within this framework to attract interest and negotiate favorable terms.

| Pros | Cons |

| Potential for continued owner role | Valuation based strictly on financial performance |

| Allows phased transition | May require seller financing or earnouts |

| Focus on growth and scale | Lengthy due diligence and financial scrutiny |

| Often retains current leadership | |

| Structured, professional process |

5. Employee Stock Ownership Plan (ESOP)

An Employee Stock Ownership Plan (ESOP) allows a business owner to sell all or part of the company to its employees through a qualified retirement trust. This creates an internal market for ownership, providing a transition path that rewards the workforce while preserving company culture.

ESOPs can offer significant tax advantages and are often structured as gradual exits, making them appealing to owners who want to stay involved during the transition. However, not every business is suited for this approach. ESOPs require strong cash flow, formal governance, and careful legal and financial planning.

| Pros | Cons |

| Preserves company culture and legacy | Requires strong, consistent cash flow |

| Offers tax advantages to the seller and the company | Complex legal and financial setup |

| Gradual transition allows the owner to stay involved | Valuation and structure require third-party expertise |

| Motivates and rewards long-term employees | |

| Internal buyer reduces the need for market exposure |

Common Mistakes SMB Owners Make While Exit Planning

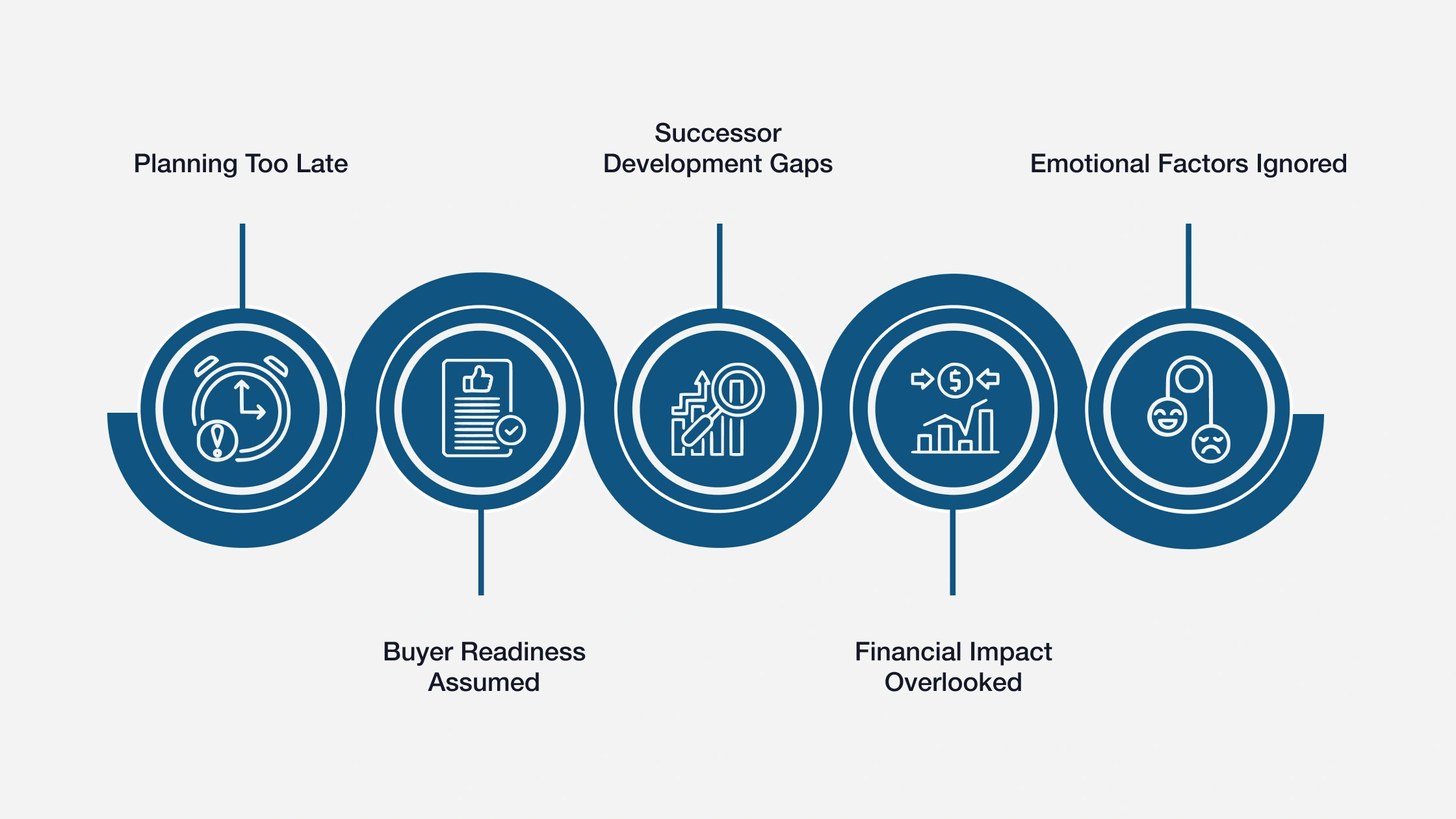

Even experienced business owners often enter the exit process with blind spots. They may assume the business will sell easily, that successors are ready, or that the numbers will simply work themselves out. In reality, missteps at this stage can be costly and frequently irreversible.

Below are some of the most common pitfalls SMB owners face, and how skilled advisors can help them avoid those outcomes through earlier, more structured planning:

Planning Too Late

Many SMB owners wait until retirement is imminent or circumstances force their hand. Without knowing how to plan an exit strategy for a business well in advance, the transition becomes reactive, reducing value and limiting options.

Buyer Readiness Assumed

Years of profitability don’t always equal buyer readiness. Issues like customer concentration, undocumented processes, or owner dependency can surface during due diligence and derail a deal. Without early evaluation, value is often left on the table.

Successor Development Gaps

Owners may assume someone will “step up” when the time comes, whether a family member or a key employee. But successors often lack the experience, funding, or alignment needed. Without planning, continuity is at risk.

Financial Impact Overlooked

Exit-related taxes, deal structure, and liquidity planning are frequently underestimated. Poor planning in this area can result in avoidable tax liabilities, reduced net proceeds, or challenges in funding retirement goals.

Emotional Factors Ignored

For many owners, exiting is deeply personal. Without support to manage the emotional and identity-related aspects of the transition, even well-structured deals can leave owners feeling unprepared for life after the business.

To help owners avoid these costly mistakes, professionals need real, hands-on exit planning experience. IEPA’s CBEC® Certification prepares advisors with the skills and resources to guide successful, value-protected transitions.

Help Owners Exit on Their Terms with IEPA’s CBEC® Certification

The Certified Business Exit Consultant® (CBEC®) certification, offered by the International Exit Planning Association (IEPA), gives financial advisors, CPAs, consultants, and part-time CFOs the resources, frameworks, and experience-driven insights needed to manage every phase of an exit.

CBEC® certification is built around real-world application, training professionals to guide owners from initial planning through execution and beyond.

CBEC® designees gain:

- A complete framework to structure and lead exit planning engagements

- Practical methods for valuation readiness, successor planning, and deal preparation

- Tax, legal, and financial strategies that integrate across advisory teams

- Confidence to lead conversations that most professionals avoid

- Ongoing support, resources, and a national peer network

According to IEPA data, 66% of CBEC® advisors break down their client engagements into multiple structured phases, ensuring value is delivered at every step. And the impact goes beyond service quality. 22% of CBEC® designees report earning over $250,000 annually through Exit Planning work.

Step into a leadership role in the Exit Planning space.

Contact Us Today!