Exiting a business is one of the most significant financial and personal decisions a business owner will make. Yet a recent study found that only 9% of businesses know how to select a business consultant.

Business owners rely heavily on the quality of guidance they receive from a business exit advisor, as selecting the right exit planning advisor is critical to protecting value, reducing risk, and ensuring the exit aligns with your long-term goals.

This article highlights seven essential considerations for selecting the right exit planning advisor.

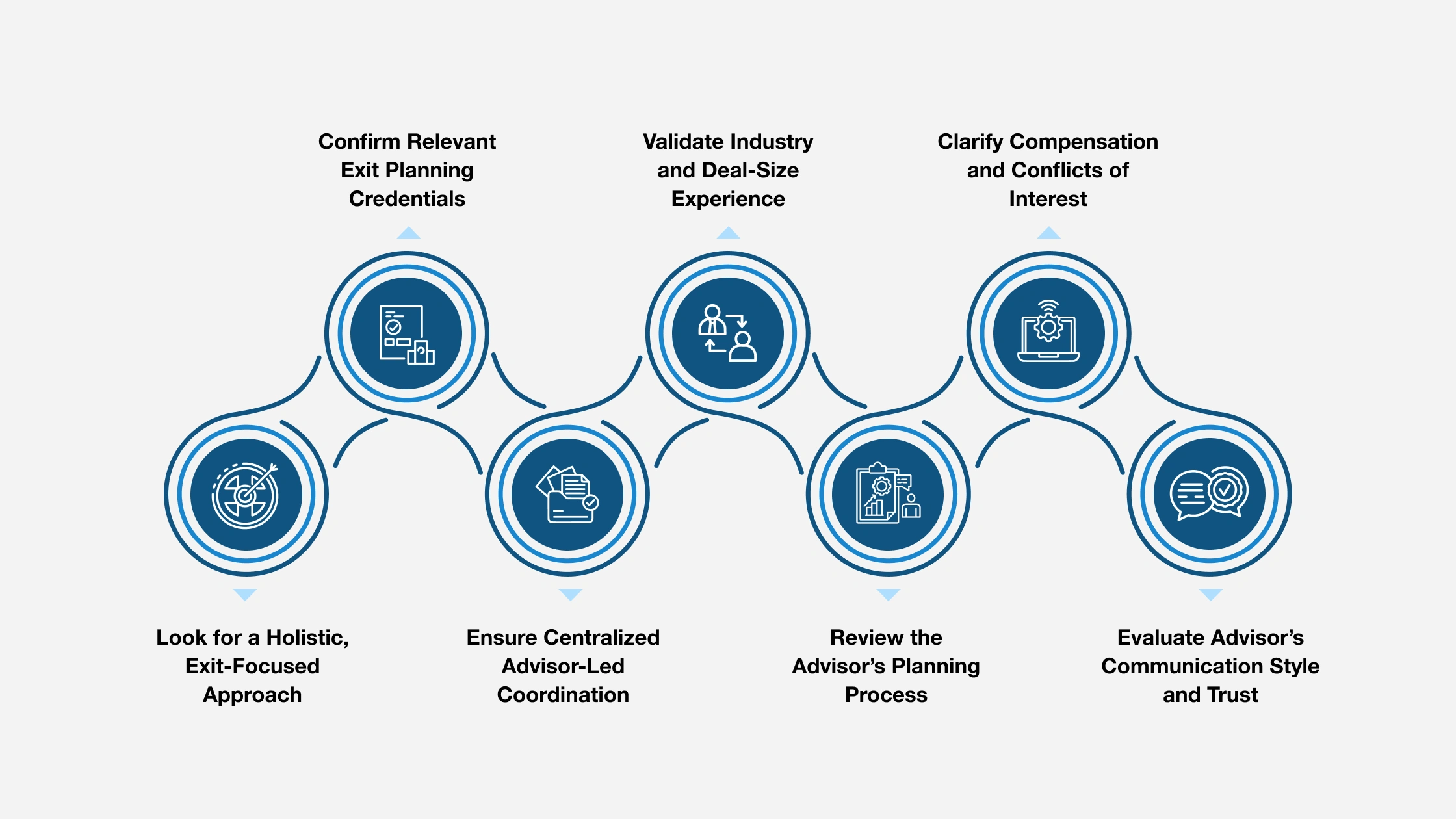

Seven Criteria for Selecting the Right Exit Planning Advisor

These seven criteria help business owners evaluate advisors with clarity, confidence, and long-term exit success in mind.

1. Look for a Holistic, Exit-Focused Approach

Exit planning is different from selling a business. A qualified exit planning advisor helps a business owner prepare years in advance for their business exit by aligning:

- Business value growth;

- Personal and financial goals;

- Tax efficiency;

- Risk management; and

- Succession or transfer strategy.

TIP: Be cautious of advisors who focus only on the transaction itself. The right advisor should help you maximize value before the exit and guide you through life after it.

2. Confirm Relevant Exit Planning Credentials

Exit planning is a specialized discipline. While no single credential guarantees expertise, relevant designations demonstrate formal training and commitment to best practices. Examples include:

- Certified Business Exit Consultant (CBEC®)

- CPA with exit or M&A experience

- Business valuation credentials (e.g., CVA, ASA)

- Financial planning designations (e.g., CFP®)

TIP: Ask how the advisor stays current with exit planning methodologies and market trends.

3. Ensure Centralized Advisor-Led Coordination

Effective exit planning requires coordination among multiple professionals, including:

- Accountants;

- Attorneys;

- Financial advisors;

- Valuation experts; and

- M&A professionals.

TIP: A strong exit planning advisor serves as the central coordinator, ensuring all advisors are aligned around a single strategy. They should collaborate openly rather than operate in silos or compete for control.

4. Validate Industry and Deal-Size Experience

Exit planning strategies vary significantly based on industry, ownership structure, and company size. Ask the advisor questions like:

- Have you worked with businesses like mine?

- What types of exits have you helped facilitate?

- What challenges commonly arise in my industry?

TIP: While exact industry matching isn’t always required, relevant experience improves foresight and decision-making.

5. Review the Advisor’s Planning Process

Certified Business Exit Consultants (CBEC®) follow The International Exit Planning Association’s Six-Step Exit Planning Process TM.

A professional exit planning advisor should be able to clearly explain:

- Their step-by-step planning process;

- How long preparation typically takes;

- What milestones should you expect; and

- How progress is measured.

TIP: Exit planning is often a multi-year journey. Avoid advisors who promise quick results without meaningful preparation.

6. Clarify Compensation and Conflicts of Interest

Transparency is essential. Ask how the advisor is compensated:

- Flat fee or retainer;

- Hourly consulting; and/or

- Success-based or transaction-based fees.

TIP: Understand whether they earn commissions or referral fees from other professionals or transaction partners. The best advisors are upfront about potential conflicts and prioritize your interests.

7. Evaluate Advisor’s Communication Style and Trust

Exit planning involves sensitive financial, personal, and legacy issues. Trust and alignment matter. Your advisor should:

- Listen carefully to your goals and concerns;

- Communicate clearly and proactively;

- Challenge assumptions constructively; and

- Function as a long-term partner, not just a consultant.

TIP: If you don’t feel comfortable after this conversation, the relationship may not be the right fit.

Plan Your Business Exit With Certified Advisors From IEPA

Choosing an exit planning advisor is about more than finding someone to sell your business; it’s about finding a qualified, trusted professional who can help you exit on your terms, at the right time, and with confidence.

By focusing on the business exit advisor’s experience, process, collaboration, and trust, business owners can significantly improve both the outcome of their exit and their readiness for the next chapter.

A well-planned exit is rarely accidental: It is the result of right strategy and the right guidance.

Knowledgeable investors and business leaders understand the nuances behind valuation. Certified Business Exit Consultants® (CBECs) can help demystify the concept of business valuation and guide you on the type and frequency of business valuations for your business when planning your exit.

Find a Certified Business Exit Consultant® Now!

About the Author:

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.