Every successful business exit tells a story of strategy, timing, and the delicate balance between value and legacy. For Certified Business Exit Consultants (CBEC®), studying real-world cases reveals how thoughtful planning can lead to outcomes that satisfy both financial and personal objectives.

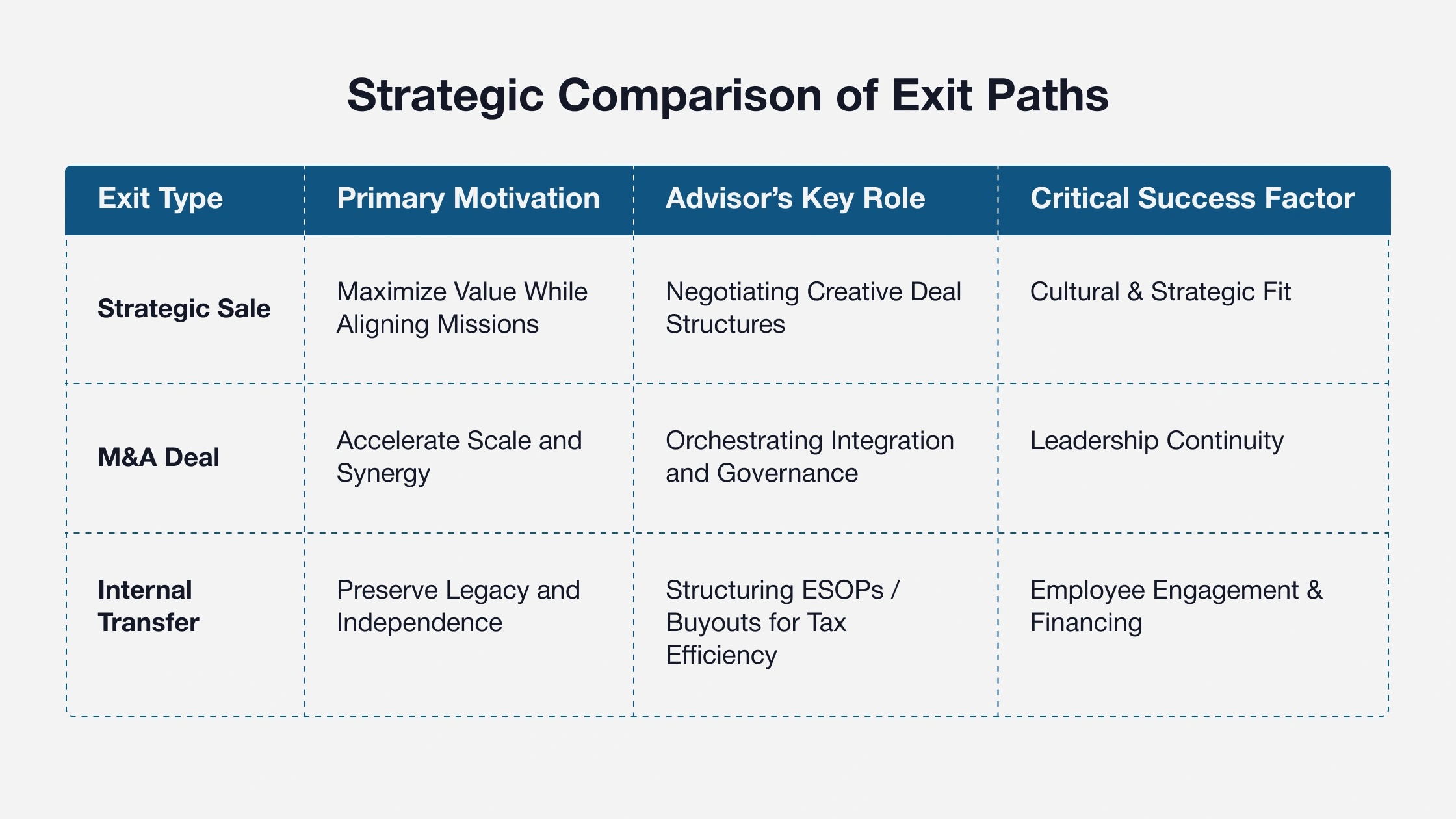

In this blog, we’ll review three notable business exits: a strategic sale, an M&A transaction, and an internal transfer. Each example illustrates how expert planning, advisory insight, and alignment of vision shaped the success of the transition.

Case Study #1: Ben & Jerry’s Sale to Unilever – A Sale to a Strategic Buyer

In 2000, global conglomerate Unilever acquired Ben & Jerry’s for $326 million. The Vermont-based ice cream company, founded in 1978, had grown rapidly but struggled to balance its social mission with shareholder demands. The founders wanted liquidity but were determined to protect the company’s unique culture and values.

Why It Worked

- Strategic Fit: Unilever wanted to expand its premium ice cream portfolio and utilize Ben & Jerry’s strong brand identity.

- Deal Creativity: The agreement preserved Ben & Jerry’s independent board and social mission, an uncommon feature in large acquisitions.

- Advisory Insight: Advisors structured governance terms to safeguard brand integrity, proving that non-financial goals can coexist with financial objectives in major deals.

The Major Takeaway for CBECs

Strategic buyers often pay premiums for synergy and brand value. However, preserving a founder’s vision may require creative deal terms and governance frameworks. Certified Business Exit Consultants must think beyond valuation and think about the quantitative aspects of the sale, like legacy, brand identity, and cultural continuity.

Case Study #2: Disney’s Acquisition of Pixar – An M&A Deal

In 2006, The Walt Disney Company acquired Pixar Animation Studios for $7.4 billion in stock. Pixar had revolutionized animation but faced distribution tensions with Disney, its long-time partner. The merger reunited the companies and brought Pixar’s leadership into Disney’s management structure.

Why It Worked

- Mutual Value Creation: Disney gained innovation and creative power; Pixar gained global distribution and resources.

- Leadership Continuity: Steve Jobs became Disney’s largest shareholder, while Pixar’s creative team maintained autonomy.

- Cultural Integration: Disney chose to preserve Pixar’s creative culture rather than absorbing it, ensuring sustained innovation.

The Primary Takeaway for CBECs

In M&A transactions, long-term success depends on cultural and operational integration. Certified Business Exit Consultants should help clients assess alignment beyond the numbers. Governance and leadership continuity are just as critical as deal structure and valuation.

Case Study #3: W.L. Gore & Associates – Internal Transfer (ESOP)

W.L. Gore & Associates, the company behind GORE-TEX fabrics, took a unique approach by gradually transitioning ownership to an Employee Stock Ownership Plan (ESOP) instead of selling externally.

Why It Worked

- Preserving Culture and Independence: The ESOP structure allowed Gore to remain privately held while protecting its innovation-driven culture.

- Employee Engagement: Broad employee ownership improved motivation, retention, and recruitment.

- Tax Advantages: Both the company and the founders benefited from significant tax incentives under the ESOP model.

The Major Takeaway for CBECs

Internal transfers like ESOPs or management buyouts work best when owners value independence and cultural preservation. Certified Business Exit Consultants should educate clients early about how these options function, including their financing structures, governance, and long-term sustainability.

Take Charge of Your Exit Strategy with CBEC® Certification

Every exit is unique, but the CBEC’s purpose remains the same: to align an owner’s financial goals, vision, and legacy with the right transition strategy. Whether the situation calls for negotiating a corporate acquisition or guiding a private internal transfer, the Certified Business Exit Consultant’s depth of knowledge in valuation, deal structure, and psychology is what transforms complexity into clarity and uncertainty into success.

The Certified Business Exit Consultant® (CBEC®) certification equips professionals with the frameworks, resources, and hands-on experience needed to manage real-world business exits successfully.

As a CBEC® designee, you’ll gain:

- In-Depth Knowledge of Exit Planning: Learn to design strategies that maximize value, reduce risk, and ensure smooth transitions for owners and stakeholders.

- Hands-On Experience: Apply proven methodologies to real-world client engagements, building confidence and credibility.

- Expert Resources: Access exclusive frameworks covering valuation, tax efficiency, succession, and deal structuring.

- Professional Recognition: Earn a certification recognized nationwide as a mark of excellence and expertise.

- Attractive Earning Potential: Many CBEC® professionals report significant revenue growth from Exit Planning services.

Strengthen your advisory impact, expand your professional opportunities, and guide business owners through their most critical transition with confidence.

About the Author

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.