Approximately 75% of business owners regret selling their company within the first year, highlighting the consequences of rushed or poorly structured exits, not just financially, but emotionally and strategically.

Whether you are an advisor guiding clients or a business owner preparing your own exit, the risks are clear: leaders walking away with less than expected, deals collapsing under scrutiny, and transitions that weaken both growth and legacy. The choice between an ESOP a third-party sale is one of the most consequential decisions in the exit process, and making it with the right preparation is essential to securing the best outcome.

In this blog, we’ll understand the differences between ESOPs and third-party structures in terms of tax, liquidity, and control. We’ll look at which approach fits best depending on client goals, why planning five to ten years ahead matters, and how you can position yourself as the trusted advisor through data-driven modeling and strategic oversight.

By utilizing this analysis, you’ll be prepared to lead clients through the most consequential financial decision of their careers, ensuring they exit with both confidence and value intact.

What Is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a qualified retirement plan governed by the Employee Retirement Income Security Act (ERISA). It invests primarily in the stock of the sponsoring company, serving both as a tax-qualified benefit plan for employees and as a corporate finance tool for ownership transition.

Major Features of an ESOP

- Trust Ownership: Shares are held in a trust on behalf of employees, who accrue allocations over time based on pay or service.

- Financing Mechanism: ESOPs are commonly financed through bank loans or seller financing. The ESOP trust borrows money to purchase shares, and the company repays the loan through tax-deductible contributions.

- Regulatory Oversight: Annual independent valuations are required. Trustees must act as fiduciaries to ensure fair treatment of plan participants.

- Owner Exit Profile: ESOPs allow owners to diversify wealth, create liquidity, and transfer ownership gradually while retaining business continuity.

ESOPs are widely used in mid-market privately held companies, particularly in sectors where employee retention, culture, and long-term sustainability are priorities.

Tax Considerations in an ESOP Sale

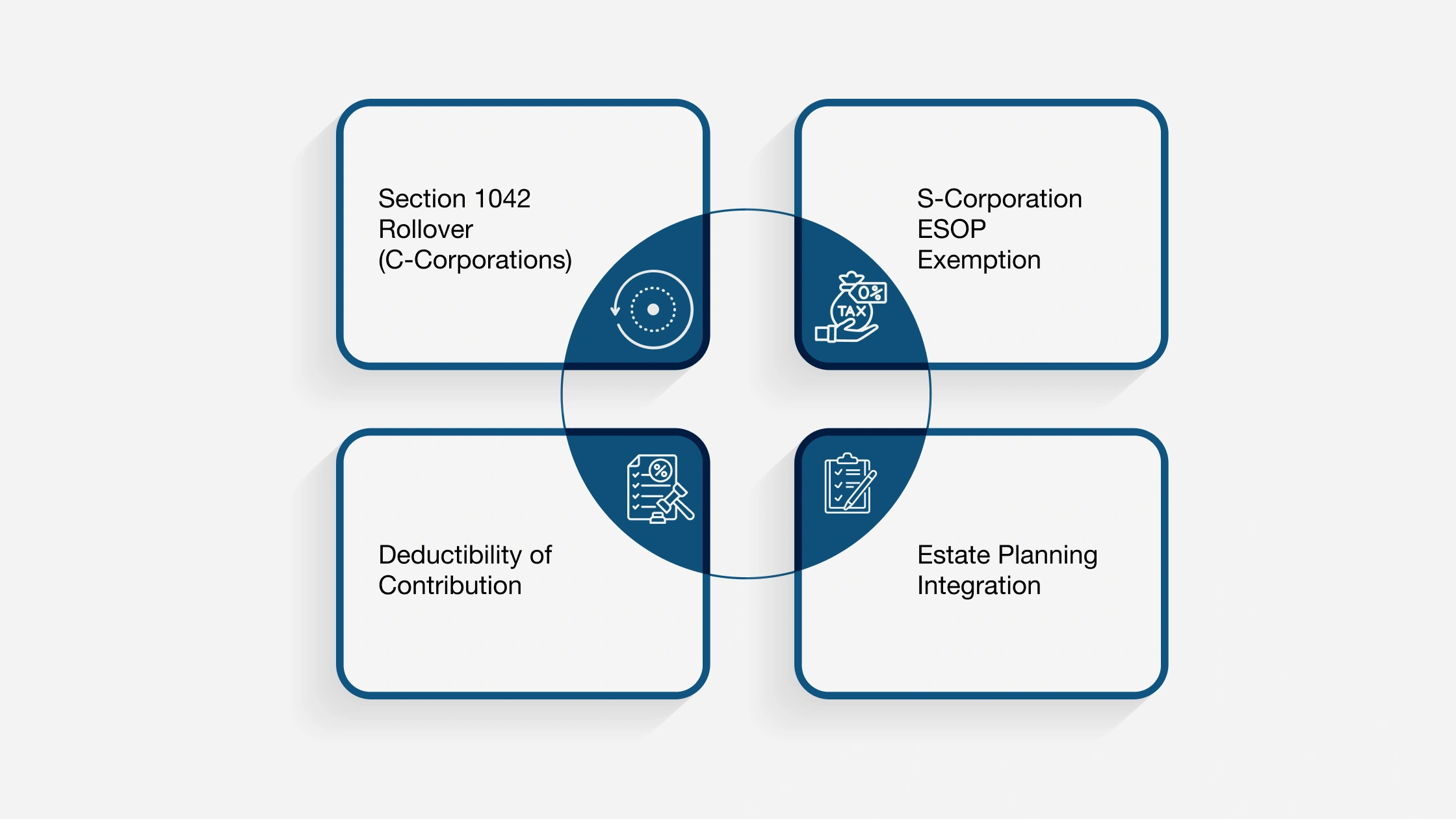

An ESOP offers several tax advantages that are unique compared to other exit strategies:

- Section 1042 Rollover (C-Corporations): Allows owners to defer federal capital gains taxes if proceeds are reinvested in Qualified Replacement Property (QRP). This deferral can last until death if assets receive a step-up in basis.

- S-Corporation ESOP Exemption: ESOP-owned portions of S corporations are exempt from federal income tax. At 100% ownership, the company pays no federal income tax, creating significant cash flow advantages.

- Deductibility of Contributions: Contributions to repay ESOP loans (both principal and interest) can be tax-deductible, up to 25% of participants’ compensation for principal and unlimited deductible interest.

- Estate Planning Integration: Section 1042 reinvestments can be coordinated with estate plans to minimize long-term exposure.

Example: A $10 million C-corporation sale to an ESOP with a 1042 election could defer $2–3 million in capital gains taxes, allowing more wealth to remain in the owner’s estate plan.

What Is a Third-Party Sale?

A third-party sale refers to the transfer of company ownership to an external acquirer. Buyers may be strategic acquirers, competitors, suppliers, or customers, or financial buyers such as private equity firms.

Major Features of a Third-Party Sale

- Transaction Types: Deals are structured as either stock sales (share transfer) or asset sales (purchase of specific assets and liabilities). Each structure has significant tax and legal implications.

- Valuation and Pricing: Pricing is determined through negotiations, comparable transactions, and competitive bidding. Earnouts, holdbacks, or contingent payments are often included.

- Due Diligence Requirements: Buyers conduct comprehensive reviews of financial, legal, and operational records. This process is extensive and may require significant management involvement

- Owner Exit Profile: Third-party sales usually provide maximum liquidity at closing, though owners are often required to stay temporarily under employment or consulting contracts.

Third-party sales are most common in industries with active M&A markets and among owners who prefer immediate liquidity and a full exit from control.

Tax Considerations in a Third-Party Sale

While often producing the highest upfront gross value, third-party sales create greater tax exposure:

- Capital Gains Liability: Stock sale proceeds are taxed at federal long-term capital gains rates plus the 3.8% Net Investment Income Tax.

- Asset Sale Double Taxation: For C-corporations, asset sales trigger corporate-level tax (21%) followed by shareholder-level tax upon distribution.

- Ordinary Income Exposure: Elements such as covenants not to compete or personal goodwill can be taxed at ordinary income rates.

- State Taxes: In high-tax jurisdictions, additional 8–13% liabilities may apply, further reducing net proceeds.

Example: A $10 million third-party stock sale may leave the seller with closer to $7 million after federal, state, and NIIT liabilities, compared to higher after-tax liquidity in a properly structured ESOP.

ESOP vs Third-Party Sale: A Comparative View

The decision between an ESOP vs third-party sale impacts transaction complexity, cost, tax treatment, liquidity, and ownership continuity. Here are the major areas where the two approaches differ:

| Factor | ESOP Sale | Third-Party Sale |

| Transaction Complexity | Requires ESOP plan, trust agreements, financing, and ongoing compliance. | Requires marketing, due diligence, purchase agreements, escrow, and buyer negotiations. |

| Costs & Buyer Risk | No broker fees; certainty of buyer through ESOP trust. | Broker fees (2–6%); risk of not securing a suitable buyer. |

| Tax Deferral | Section 1042 rollover (C-corps); S-corp ESOP exemptions. | No deferral; immediate capital gains taxation. |

| Ongoing Taxation | ESOP-owned S-corp income exempt (up to 100%). | Fully taxable at corporate or owner level. |

| Liquidity Structure | Allows partial/staged exits with seller financing. | Generally requires full transfer and immediate change of control. |

| Net Liquidity | Often higher after-tax when structured effectively. | Often reduced by federal, NIIT, and state taxation despite higher gross proceeds. |

1. Transaction Complexity

ESOP: Establishing an ESOP requires plan documents, trust agreements, financing arrangements, and annual compliance reviews. Independent valuations are mandatory every year, and trustees must meet fiduciary standards under ERISA. While complex, ESOP requirements are standardized and supported by established legal and valuation frameworks.

Third-Party Sale: Selling to an outside buyer involves preparing confidential information memoranda, extensive due diligence, purchase agreements, and often negotiation of escrow or holdback provisions. The process can be highly disruptive to management and more unpredictable, as deal terms vary widely with each buyer.

2. Transaction Costs and Buyer Risk

ESOP: ESOP transactions avoid brokerage commissions. Because the buyer is the trust established for employees, there is no need to market the business or compete for external offers. This reduces uncertainty about finding a qualified buyer.

Third-Party Sale: Conventional sales often involve investment bankers or business brokers, whose fees range from 2% to 6% of the transaction value. There is also the risk of running an extensive sale process without securing an acceptable buyer, especially in cyclical industries.

3. Tax Deferral Opportunities

ESOP: C-corporation owners may qualify for Section 1042 rollover treatment, which allows them to defer capital gains taxes by reinvesting in Qualified Replacement Property. S corporations owned by ESOPs can also operate partially or entirely tax-free at the federal level, depending on ESOP ownership percentage.

Third-Party Sale: No comparable deferral exists. Proceeds are immediately subject to federal capital gains tax, the 3.8% Net Investment Income Tax, and applicable state taxes.

4. Ongoing Taxation of Business Income

ESOP: In S-corporation ESOPs, the ESOP-owned share of earnings is exempt from federal taxation. At 100% ESOP ownership, the company pays no federal income tax, creating significant long-term cash flow advantages for debt repayment and reinvestment.

Third-Party Sale: Post-sale, business income remains subject to ordinary corporate or pass-through taxation. Buyers benefit from depreciation and amortization deductions, but no broad exemptions exist.

5. Liquidity and Exit Flexibility

ESOP: ESOPs allow staged exits. Sellers often combine bank financing with seller notes, receiving partial liquidity upfront and additional payments over time. This staged structure can be aligned with retirement or estate planning goals.

Third-Party Sale: Buyers usually require a full transfer of ownership at closing. While some deals include earnouts or consulting contracts, owners generally lose control immediately and receive most liquidity upfront.

6. Net Liquidity to Owner

ESOP: Because of tax deferrals and exemptions, net liquidity after an ESOP transaction can exceed what owners achieve in third-party sales, even if the gross purchase price is slightly lower. Effective planning maximizes this advantage.

Third-Party Sale: Although third-party buyers may pay a premium in competitive markets, net proceeds are often reduced by immediate federal, state, and NIIT obligations. Without advance structuring, owners may forfeit millions to taxes.

Why Timing and Preparation Matter Years Before a Transaction

Both ESOP and third-party sales require early planning. Tax advantages such as the Section 1042 rollover or S-corporation conversions cannot be implemented at the last minute, and third-party sales without preparation often create double taxation or unfavorable allocations.

Industry best practice recommends starting Exit Planning five to ten years in advance. This window provides time to align tax strategies, strengthen financial reporting, and prepare the company for a smoother transaction and stronger valuation. This allows time to:

- Conduct valuations that highlight performance gaps.

- Strengthen financial reporting and governance to withstand buyer or trustee scrutiny.

- Implement estate and succession planning to align with wealth-transfer goals.

- Position the business to achieve the most favorable tax outcome under either an ESOP or a third-party sale.

Owners who delay planning face compressed timelines, limited options, and a higher risk of leaving significant value on the table. That is why advisors benefit from specialized training, such as IEPA’s CBEC® certification, which equips them to lead clients through complex tax, valuation, and deal-structuring challenges.

According to IEPA data, 66% of CBEC-certified advisors structure client engagements in multiple phases, ensuring that value is built gradually rather than rushed. The majority of certified advisors serve Main Street and lower middle-market businesses, with over two-thirds placing 50% or more of their clients in that category.

This shows that Exit Planning is not reserved for the largest companies; it is most often applied where planning is needed most.

Strengthen Your Advisory Practice with Exit Planning Expertise from IEPA

As a financial advisor, CPA, consultant, or part-time CFO, you know that owners weighing an ESOP vs a third-party sale face more than just tax mechanics. Liquidity, legacy, and regulatory challenges all come into play, and poor planning can significantly diminish enterprise value. That’s where your role becomes critical.

The Certified Business Exit Consultant® (CBEC®) designation from the International Exit Planning Association (IEPA) gives you the frameworks, resources, and credibility to lead these conversations with confidence. You’ll be equipped to model tax-sensitive outcomes, mitigate risks, and deliver real results for owners preparing to exit.

With the right training, you can guide owners through:

- Scenario Modeling: Comparing after-tax outcomes under both ESOP and third-party structures.

- Integrated Coordination: Ensuring legal, tax, financial, and estate strategies are aligned.

- Value Building: Identifying performance gaps well before the sale to increase multiples.

- Compliance Oversight: Navigating ERISA, IRS, and deal requirements to avoid costly mistakes.

- Risk Management: Addressing challenges like owner dependency, weak reporting, or buyer-driven allocations.

If you want to expand your advisory impact and help owners preserve value while exiting on their terms, CBEC® is the next step.