Did you know that an estimated 75–80% of businesses that go to market never sell? The reasons vary from incomplete financials, weak transferable value, owner dependency, poor timing, or simply a lack of preparation, but the outcome is the same. Many owners find themselves facing limited options just when they expect new opportunities. After decades of building a business, most assume the exit will simply “fall into place” when the time is right.

But exits rarely unfold that way. The process is layered, emotional, and often more complex than starting the business itself. There are decisions about value, timing, leadership, taxes, succession, deal structure, wealth planning, and life after ownership, and each one affects the final outcome.

Owners who approach this process without expert guidance often face surprises they didn’t anticipate: stalled deals, lower offers, avoidable tax burdens, or transitions that disrupt the business and sometimes the family.

Working with a team of experienced advisors changes that trajectory. It turns the exit from a stressful, reactive event into a structured strategy that protects value, reduces risk, and supports the legacy that an owner has spent years building.

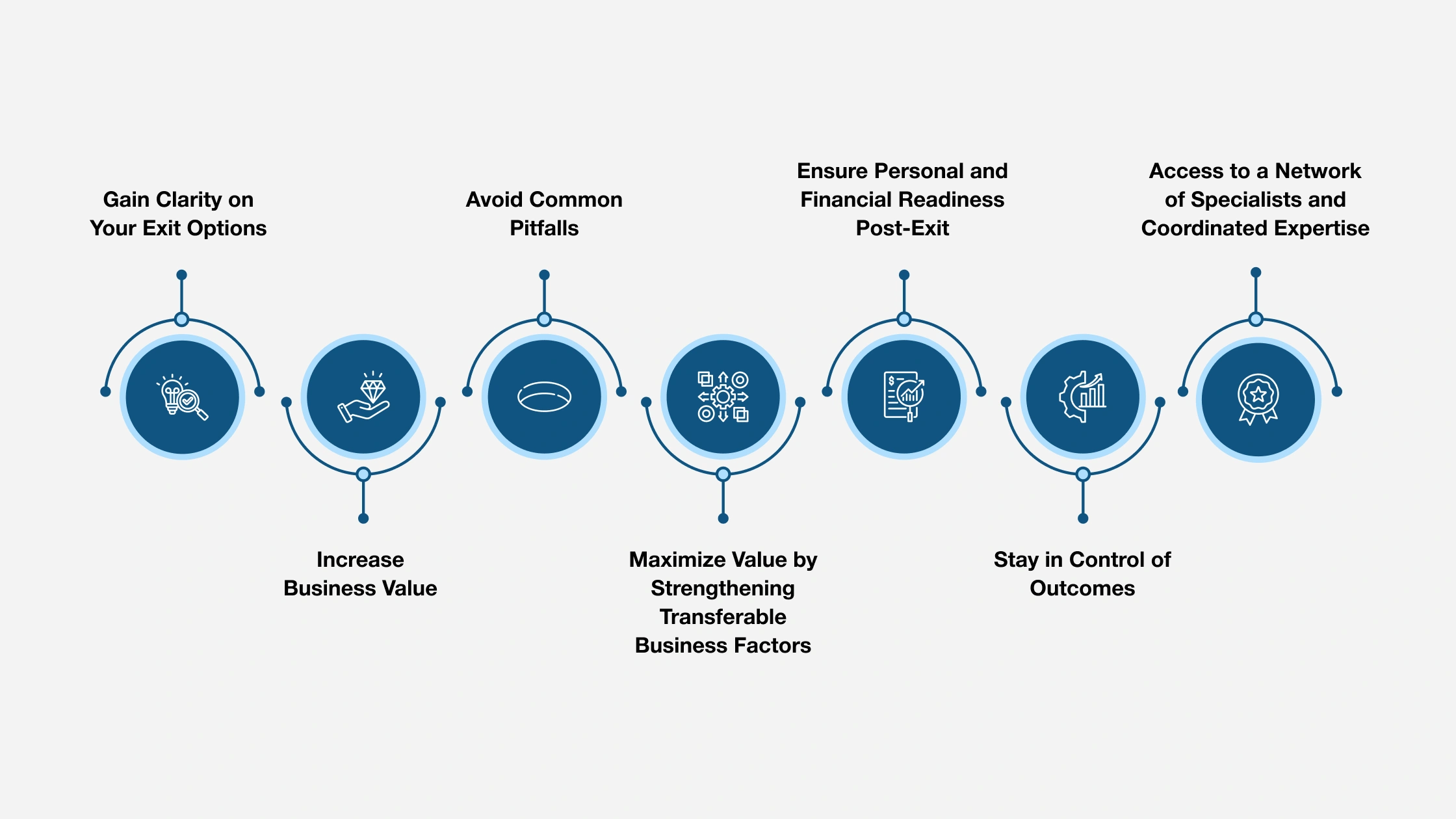

Advantages of Working with Professional Advisors for Exit Planning

Here are the benefits business owners gain when they bring experienced advisors into the exit planning process. A coordinated team helps connect strategy, timing, valuation, and personal goals so the transition is structured. With expert support, owners protect what they’ve built and move toward an exit with confidence rather than uncertainty.

1. Gain Clarity on Your Exit Options

Most owners underestimate the number of exit paths and the range of possible outcomes. A professional advisor helps sort through options such as:

- Selling to a third party

- Transferring ownership to the family

- Structuring a management buyout

- Planning a phased exit

Each path carries unique considerations around taxes, timing, valuation, leadership continuity, and deal structure. Without guidance, owners often gravitate toward the most familiar option rather than the one that delivers the best long-term result.

Advisors help compare scenarios objectively, highlight trade-offs, and align decisions with personal priorities, whether that means maximizing liquidity, preserving legacy, securing employee continuity, or maintaining involvement over time.

2. Increase Business Value

A strong business doesn’t automatically translate into substantial transferable value. Buyers pay a premium for organizations that run smoothly without the owner, have predictable cash flow, documented systems, and a leadership team capable of driving growth.

Professional advisors help identify gaps that may reduce valuation, such as customer concentration, unclear financial reporting, dependency on the founder, or operational inefficiencies. More importantly, they help build a plan to fix those gaps well before the business goes to market.

With expert guidance, owners can strengthen recurring revenue, improve margins, reduce risk, and position the company as a stable, scalable asset. The result is often a more attractive business and stronger negotiating power when it’s time to transition.

3. Avoid Common Pitfalls

Many owners exit only once, which means they face a steep learning curve at the very moment the stakes are highest. Without guidance, it’s easy to make avoidable mistakes, like undervaluing the business, choosing the wrong buyer, ignoring tax implications, or entering negotiations without a clear strategy.

Professional advisors bring experience from multiple transactions, allowing them to anticipate issues long before they become deal breakers. They help owners prepare documentation, strengthen due diligence readiness, and navigate emotional decision points that can derail progress.

Instead of learning through costly trial and error, owners benefit from a proven process that reduces delays, minimizes risk, and ensures the exit stays aligned with the intended financial and personal outcomes.

4. Maximize Value by Strengthening Transferable Business Factors

A business is most attractive when it can operate, grow, and generate profit without relying heavily on the current owner. Professional advisors help assess what buyers look for, whether that’s predictable revenue, depth of leadership, clear financials, documented processes, or a diversified customer base.

These elements, known as transferable value drivers, often determine whether a business receives a standard offer or a premium multiple. Advisors help owners identify weaknesses, implement improvements, and measure progress over time so the company becomes a stable, low-risk asset in a buyer’s eyes.

Strengthening these factors widens the pool of qualified buyers and supports more favorable deal outcomes when the owner is ready to transition.

5. Ensure Personal and Financial Readiness Post-Exit

Selling or transitioning a business is a personal milestone. Many owners are so focused on the transaction that they overlook what comes next. Without preparation, the shift away from daily decision-making, leadership responsibility, and routine can feel disorienting.

Professional advisors help owners align the exit with personal goals, lifestyle plans, wealth strategy, and long-term financial security. They ensure the proceeds of the sale are structured to support plans, protect assets, and minimize tax consequences.

This guidance helps owners step into the next chapter with confidence, knowing both their finances and life goals are intentionally supported beyond the exit.

6. Stay in Control of Outcomes

A well-prepared exit is intentional. When owners attempt the process alone, timing is often dictated by external pressures such as market shifts, buyer demands, declining energy, or unexpected personal events. Working with professionals allows owners to set the pace rather than respond to it.

Advisors help evaluate market conditions, determine the right time to engage buyers or successors, and structure the deal to reflect the owner’s priorities. With expert support, decisions become strategic rather than rushed, and negotiations unfold from a position of strength.

Instead of feeling pushed into an exit, owners maintain control, ensuring the transition reflects both their long-term goals and the value of what they’ve built.

7. Access to a Network of Specialists and Coordinated Expertise

An exit involves many moving parts, including legal agreements, tax planning, valuation analysis, wealth strategy, operations, and leadership transition. No single advisor covers all of these areas well. That’s why having coordinated professional support matters.

An experienced exit advisor acts as the central point of guidance, bringing together specialists such as attorneys, CPAs, valuation experts, M&A professionals, and wealth planners. Instead of receiving fragmented advice, the owner benefits from a unified strategy where every decision supports the larger goal.

This coordinated approach prevents duplication of effort, avoids conflicting recommendations, and ensures nothing falls through the cracks during due diligence or negotiation. With the right team in place, the exit becomes organized and strategic.

Why Work With a CBEC® Certified Exit Planning Advisor

Working with advisors matters, but hiring someone who understands the full complexity of an exit makes the process far more effective and far less stressful. IEPA-trained Certified Business Exit Consultant® (CBEC®) professionals bring practical, structured experience to help owners transition with confidence rather than uncertainty.

CBEC® advisors complete a rigorous practitioner-led program planned around actual execution, not just theory. Every candidate must build a real exit plan during certification, ensuring they graduate with hands-on capability and a repeatable process.

CBEC® professionals are trained to support owners with:

- A standardized, real-world exit planning framework

- Guidance across valuation, tax considerations, deal structure, and ownership transition

- Resources and templates created for succession, readiness assessment, and timing strategy

- A holistic approach that balances financial outcome, personal goals, and operational continuity

Instead of navigating in silos, owners gain a coordinated partner who understands how each decision today affects value, timeline, and outcomes later.

A well-planned exit deserves a well-qualified advisor, and CBEC® appointees are prepared to guide owners through every step.

Work With a CBEC® Advisor Who Can Guide the Full Exit Process

The right advisor brings structure, clarity, and confidence, and that’s what Certified Business Exit Consultant® (CBEC®) professionals are trained to deliver.

Data from IEPA shows how this expertise translates into meaningful client work. Many CBEC® advisors are already applying exit planning as a dedicated service:

- Nearly 26% help prepare companies to go to market

- More than two-thirds support Main Street and lower-middle-market clients, where most transition activity occurs.

- Engagements also reflect increasing value, with a notable portion of certified professionals charging $10,000 to $25,000 for initial planning phases, a sign of the depth of work and trust business owners place in skilled guidance.

If you’re considering a transition in the coming years, partnering with a certified expert ensures your exit is intentional, well-planned, and aligned with your goals, not rushed or reactive.

Your business has been built with discipline and commitment. Your exit deserves the same level of preparation.

Find a Certified Business Exit Consultant® and start planning with confidence.