One critical and often overlooked component of exit planning is insurance. The right insurance strategies do not just protect against risk; they can preserve enterprise value, smooth the transition for successors, and safeguard the owner’s personal wealth post-exit.

Insurance plays an essential role in mitigating financial, legal, and operational uncertainties that can derail even the most carefully structured exit plan. From protecting business assets to facilitating buy-sell agreements and funding succession, insurance can be the bridge between a plan that looks good on paper and one that actually works in practice.

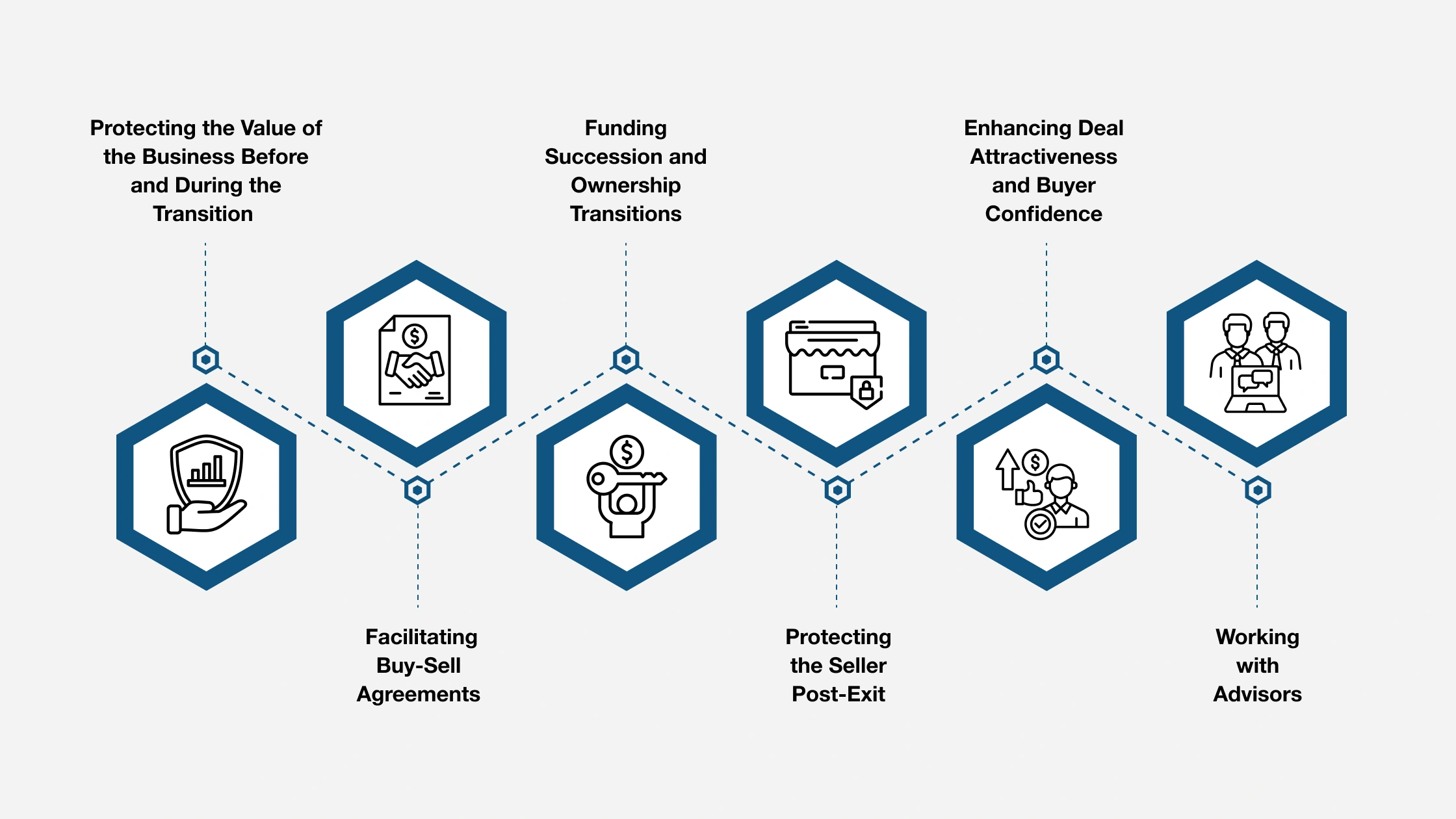

This article highlights six points about how a seller can effectively use insurance when planning a business exit.

How Insurance Safeguards Business Value During the Transition

Safeguarding company value becomes increasingly important as the exit timeline approaches. Even a single unexpected disruption, such as the loss of a key employee, a lawsuit, or operational damage, can lower valuation or delay a deal entirely. Strategic insurance coverage minimizes these risks, protects financial performance, and reassures potential buyers that the business is resilient and ready for transition.

1. Protecting the Value of the Business Before and During the Transition

Leading up to an exit, maintaining a strong risk management posture is vital, as unexpected events, such as the death or disability of a key employee, a major lawsuit, or property damage, can quickly reduce the value of a business and scare off potential buyers.

The different types of insurance that can be purchased as a risk mitigation solution include:

- Property and Casualty Insurance: which ensures physical assets and operations are protected from disruption;

- Errors and Omissions (E&O) / Professional Liability Insurance: which reduces exposure to client disputes or claims, and buyers closely scrutinize during due diligence; and

- Key Person Life Insurance: which protects the company from financial loss if a crucial executive or founder dies or becomes disabled before or during the sale process.

Certified Business Exit Consultants® (CBECs) who recommend these coverages demonstrate to a seller that he or she are focused on what, in most cases, is a business owner’s biggest asset, while also conveying to prospective buyers that the business is well-managed, resilient, and prepared for contingencies, which, furthermore, boosts buyer confidence and perceived value.

2. Facilitating Buy-Sell Agreements

For partnerships or multi-owner businesses, Life & Disability Insurance is an important method for executing buy-sell agreements. An adequately funded Buy-Sell Agreement ensures that if an owner dies or becomes incapacitated, their share of the business can be purchased without straining the company’s liquidity or forcing a fire sale. Surviving partners can retain control of the business, and the deceased owner’s family receives fair compensation without needing to stay involved in the operation.

In other words, Life & Disability Insurance can ensure liquidity, turning what could be a financial crisis into a structured, predictable transition.

3. Funding Succession and Ownership Transitions

In family businesses or management buyouts (MBOs), insurance can be used creatively in several different ways to fund ownership transitions.

Life Insurance policies can be used to equalize inheritances when one child takes over the business and others do not. Disability Insurance can provide replacement income to an existing owner unable to continue working, avoiding strain on the business or successors. Whole or Permanent Life Insurance with cash value can provide flexible liquidity to fund buyouts or retirement income for the selling owner.

These exit and succession strategies help reduce reliance on external financing or earn-out provisions, which can complicate deals and introduce risk.

4. Protecting the Seller Post-Exit

After a sale, the former owner may still face liabilities from their time running the company when “warranties, representations, or indemnification clauses” are part of the sale agreement.

Insurance strategies to mitigate a seller’s post-exit risk include:

- Tail (Runoff) Coverage: extends protection under prior liability policies (especially Directors & Officers or E&O insurance) for claims made after the sale;

- Directors & Officers (D&O) Insurance: protects personal assets if legal issues arise from prior management decisions; and

- Personal Umbrella Policies and Estate Planning Insurance: shield wealth accumulated from the sale and ensure long-term family protection.

CBECs should recommend a well-structured insurance review during the exit planning phase to identify and close these gaps.

5. Enhancing Deal Attractiveness and Buyer Confidence

From the buyer’s perspective, a company with robust insurance coverage signals operational maturity and lower risk. Even when insurance is in place, a buyer should still ask:

- Are there active or potential insurance claims pending?

- Does coverage align with the size and nature of the business?

- Are key-person dependencies mitigated through the insurance policies in place?

Businesses that can demonstrate a proactive insurance strategy often negotiate from a stronger position, experience smoother due diligence, and command higher valuations.

6. Working with Advisors

Integrating insurance into the exit planning process requires collaboration among the Certified Business Exit Consultant, the business owner, an experienced insurance advisor, an accountant, and an attorney. This multidisciplinary approach ensures that policies align with the exit structure, which determines whether the business is sold as an asset or a stock sale. Ownership and beneficiary designations are accurate post-transition, and the tax implications of insurance proceeds are responsibly managed.

An insurance review should ideally occur 2 to 3 years before the anticipated exit to allow time for adjustments, premium optimization, and proper alignment with the business owner’s succession goals.

Advance Your Exit Planning Expertise with IEPA Certification

Insurance can make the difference between an exit plan that succeeds and one that collapses under pressure. Business owners depend on advisors who understand not only deal structure and succession, but also the insurance strategies that protect value, fund transitions, and safeguard wealth long after the sale closes. The Certified Business Exit Consultant® (CBEC®) program equips professionals with the training and real-world application needed to guide owners through these high-stakes decisions.

Through CBEC® certification, advisors gain:

- A comprehensive curriculum that covers insurance-driven exit solutions alongside valuation, succession, tax planning, deal structuring, and value acceleration

- Practical training led by active practitioners, not academics or theorists

- Hands-on certification requirements, including completion of a real exit plan for a real business owner

- Tools, templates, and proven engagement processes to lead complex exits confidently

- A peer network of experienced exit planners focused on measurable impact, not volume of certificates issued

Owners want advisors who can anticipate risk, safeguard value, and align insurance with the exit structure, not advisors who discover gaps after a deal is already in motion. The CBEC® program gives you that capability.

Take the next step toward becoming the exit planner business owners rely on when decisions matter most.

Enroll in the upcoming CBEC® session and build the expertise to lead stronger, safer, and more successful exits.

About the Author

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.