Most entrepreneurs focus heavily on launching and scaling their businesses, but give little thought to how they will eventually exit them. Yet, an exit strategy is one of the most critical components of long-term business success. It provides direction, preserves value, and ensures a smooth transition for both the owner and the organization.

Despite its importance, studies reveal that 48% of business owners have no formal exit strategy in place, and 58% have never had their business appraised. This lack of preparation leaves owners vulnerable to forced or unplanned exits, which can be caused by factors such as illness, divorce, or sudden market shifts.

Developing a well-structured exit plan is about shaping decisions today. By understanding available exit options, entrepreneurs can align business growth with personal financial goals, reduce risks, and position themselves to achieve a transition on their terms.

Why Does Exit Planning Matter?

Exit planning is a framework that impacts daily decisions, long before a transition is on the horizon. For small and mid-sized business owners, the company often represents their largest financial asset.

In fact, up to 80% of an owner’s net worth may be tied to the business, underscoring the importance of protecting and maximizing that value. Without a plan, owners risk undervaluing their life’s work or leaving successors and employees unprepared.

A structured exit strategy helps owners:

- Protect Value: Ensure the business is attractive to buyers, investors, or successors.

- Mitigate Risks: Address vulnerabilities that could erode value, such as over-reliance on the owner.

- Plan Financially: Align the business exit with personal wealth and retirement goals.

- Strengthen Continuity: Provide stability for employees, customers, and stakeholders during transition.

- Expand Options: Maintain flexibility in choosing the best timing and method of exit.

With thoughtful preparation, an exit strategy becomes less about leaving and more about building long-term resilience and legacy.

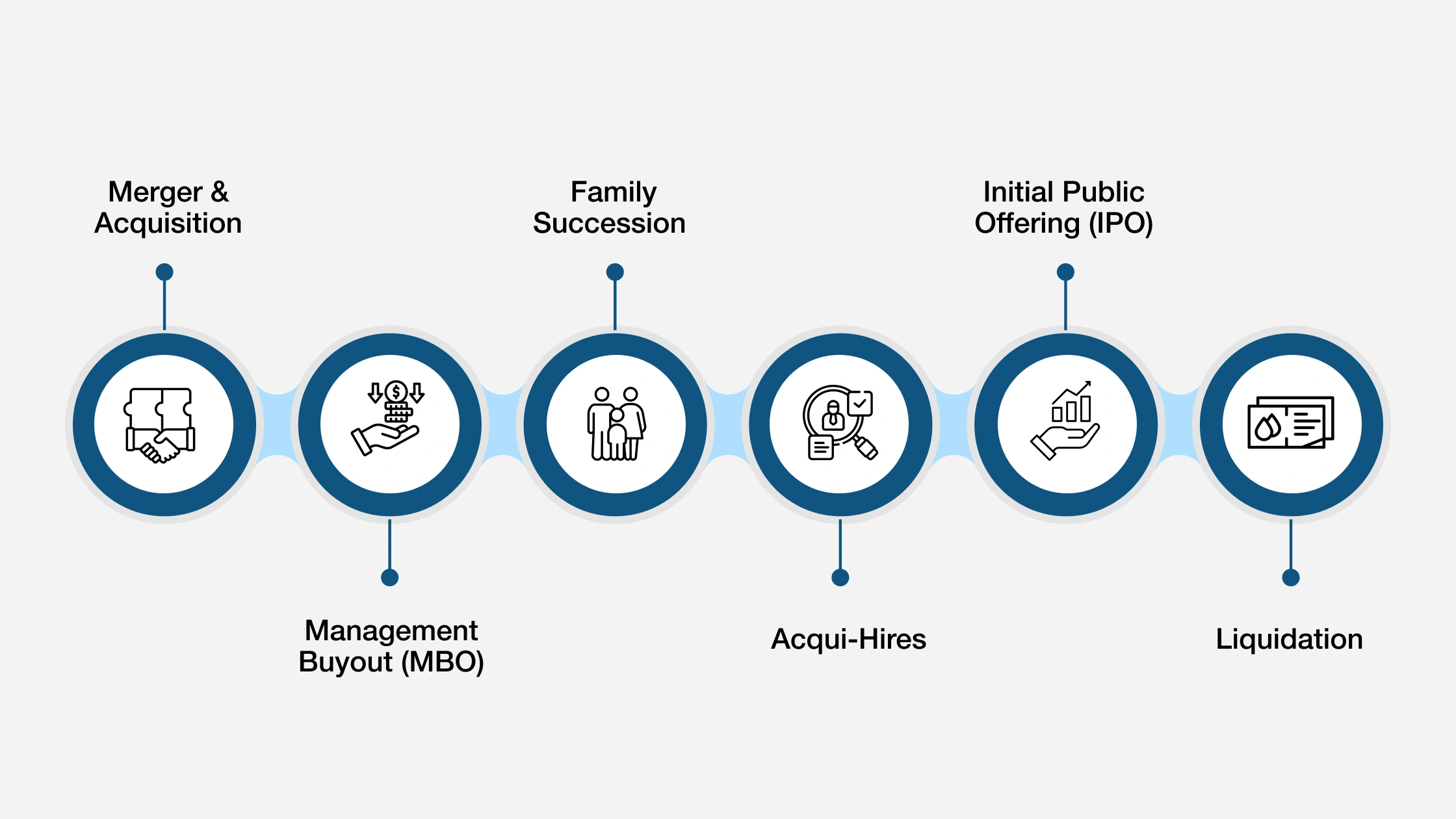

6 Smart Exit Strategies to Maximize Value and Secure Your Legacy

Every business journey eventually reaches a transition point, and the way an owner chooses to step away can define both their legacy and financial outcome. Exit strategies depend on personal goals, market conditions, and the unique characteristics of the business. Below are six of the most common approaches entrepreneurs consider when planning their exit.

1. Merger & Acquisition

Mergers and acquisitions (M&A) are a common exit path for entrepreneurs, particularly those seeking to maximize financial return or align their business with a larger strategic player. In this type of transaction, a business is either absorbed by another company or combined with it to create a stronger, more competitive entity.

Buyers are often competitors, larger corporations, or private equity firms aiming to expand their market share, acquire new capabilities, or capture operational efficiencies.

Advantages

The advantages of an M&A exit often include the potential for higher valuations, primarily when the buyer identifies strong synergies or growth opportunities. For many entrepreneurs, it also offers reassurance that their company will continue to operate with greater resources and broader market access.

In some cases, owners can negotiate an ongoing role in a reduced capacity, providing continuity without the demands of full ownership.

Disadvantages

However, M&A deals also bring challenges. The process can be lengthy and complex, requiring rigorous due diligence, careful negotiation, and compliance with regulatory requirements.

Integration between companies may present difficulties if there are cultural or operational mismatches. In addition, business owners should be prepared for the possibility of losing control over decision-making once the deal is finalized.

2. Management Buyout (MBO)

A management buyout occurs when the existing leadership team acquires the business from the current owner. This option is often appealing to entrepreneurs who want to ensure continuity, as buyers are already familiar with the company’s operations, culture, and long-term goals. Because the management team has firsthand experience, the transition can be smoother compared to selling to an outside party.

Advantages

One of the main advantages of an MBO is stability. Employees, customers, and partners experience fewer disruptions when the leadership team remains in place. For the owner, this path offers peace of mind, knowing the business is in the hands of trusted professionals.

It can also preserve the company’s legacy while rewarding managers who have been instrumental in its growth.

Disadvantages

Financing the deal can be challenging, as management teams may not always have the necessary capital to purchase the business outright. This often leads to seller financing, private equity support, or complex funding arrangements, which may take time to negotiate.

Additionally, while continuity is a strength, the lack of new perspectives from external buyers could limit growth opportunities after the transition.

3. Family Succession

Passing the business to a family member remains one of the most conventional exit strategies, particularly for owners who value legacy and continuity. This approach enables the founder’s vision and values to endure through the next generation, while also ensuring the enterprise remains in trusted hands.

For many owners, it represents both a personal and professional milestone, the culmination of years of hard work and the opportunity to build multigenerational wealth.

Advantages

The benefits of family succession are clear: continuity of leadership, preservation of company culture, and the chance for heirs to benefit from established business equity.

Customers and employees often find reassurance in knowing that leadership will remain within the family, which can strengthen loyalty and long-term relationships.

Disadvantages

However, this option also carries complexities. Not all family members may share the same commitment or capability to lead the company, which can create internal tension. Careful succession planning, leadership training, and clear governance structures are crucial for avoiding conflict and ensuring a smooth transition.

Additionally, the owner must balance family dynamics with sound business judgment, particularly when deciding who will take over and how ownership shares are distributed.

When executed with transparency and preparation, family succession can provide stability and legacy preservation, but without careful planning, it risks undermining both the family’s relationships and the business’s future.

4. Acqui-Hires

Acqui-hires represent a distinctive exit strategy where the primary goal of the transaction is to acquire a company’s skilled workforce rather than its products, services, or assets. This approach is particularly relevant for businesses with highly specialized talent that is in demand, such as technology firms, engineering consultancies, or niche service providers.

For business owners, an acqui-hire can offer a practical exit path while ensuring the continuity and growth of their team’s careers in a larger organization.

Advantages

One of the main advantages of an acqui-hire is that it provides employees with stability and new opportunities, preserving their professional growth and maintaining morale during the transition. Business owners can exit without the extensive restructuring often required in other sales strategies, and the company’s core talent is placed in an environment where their expertise is valued and can continue to flourish. This can be especially appealing for firms whose value lies in intellectual capital rather than physical assets or market share.

Disadvantages

Despite these benefits, acqui-hires may not deliver the high financial returns associated with traditional business sales. Owners may need to accept a lower sale price because the transaction focuses on talent rather than the company’s products or revenue streams.

Without proper oversight, misalignment can lead to turnover or dissatisfaction, undermining the intended benefits of the transaction.

5. Initial Public Offering (IPO)

An Initial Public Offering (IPO) enables a private company to offer its shares to the public for the first time, thereby opening access to capital markets and creating liquidity for owners and investors. Businesses with strong growth potential, a scalable model, and robust financial performance often consider this exit strategy.

Going public can enhance the company’s visibility, attract new investors, and provide a platform for long-term growth and expansion.

Advantages

The benefits of pursuing an IPO are substantial. Owners can realize significant financial gains by selling equity at market value while maintaining a stake in the business for future growth. Public listing also enhances credibility and brand recognition, potentially opening doors to new partnerships, customers, and talent.

The influx of capital can fund expansion initiatives, acquisitions, or innovation projects, strengthening the company’s competitive position and long-term viability.

Disadvantages

Preparing for public markets requires extensive legal, accounting, and regulatory compliance, which can be time-consuming and costly. The business must adopt rigorous corporate governance practices and adhere to transparent reporting standards, with ongoing scrutiny from shareholders, analysts, and regulators.

Additionally, market volatility can affect share price, limiting the owner’s control over valuation and timing. The pressure to meet quarterly expectations can shift focus from long-term strategy to short-term results, potentially affecting decision-making and company culture.

6. Liquidation

Liquidation is the process of closing a business and selling its assets to satisfy outstanding debts and obligations. This exit strategy is typically pursued when other options, such as a sale or succession, are not feasible, or when the company is heavily reliant on the owner’s personal expertise and cannot continue without them.

While it provides a clear and structured way to exit, liquidation generally results in lower returns than other strategies and should be considered carefully as a last-resort option.

Advantages

One of the main benefits of liquidation is its simplicity and finality. Owners can settle debts, close operations, and receive cash from the sale of tangible and intangible assets without needing to negotiate with buyers or manage complex transitions.

It can also offer closure and a definitive end to the business, freeing the owner to pursue new ventures or retire without ongoing operational responsibilities. Liquidation may be appropriate in declining markets or industries where continued operation is not financially viable.

Disadvantages

Selling assets individually rarely captures the full worth of the business, and intangible assets such as client relationships, brand equity, or proprietary knowledge may be lost entirely. Employees face job insecurity, and customers may experience service disruption.

Additionally, tax implications and the need to satisfy creditors can complicate the process. Without careful planning, liquidation can diminish the overall financial and reputational legacy of the business.

How Can Advisors Guide Clients to Successful Exits with IEPA?

Helping entrepreneurs plan an exit means guiding them through critical choices. The right strategy depends on:

- Owner goals – retirement, legacy, or reinvestment

- Business maturity – operational readiness and stability

- Market factors – timing, valuation, and industry conditions

- Continuity needs – employee, customer, and stakeholder impact

Advisors who understand these factors can recommend whether a merger, management buyout, family succession, or other path best fits the client’s situation.

This is where the International Exit Planning Association comes in. Through the Certified Business Exit Consultant® (CBEC®) program, advisors gain:

- Practical, phased training to structure multi-step exit plans

- Hands-on experience completing a real exit plan with an owner

- Methods to anticipate risks and protect company value

- Credibility as a trusted advisor that entrepreneurs can rely on

With CBEC® certification, you’re equipped to lead owners through one of the most important transitions of their lives, while expanding your own impact and opportunities as an advisor.

Position Yourself as the Advisor Business Owners Turn to for Exit Planning

With structured training and hands-on experience, CBEC® certification sets you apart as a trusted advisor in a competitive market.

By earning your CBEC®, you can:

- Deliver Structured, Multi-Phase Exit Plans – 66% of CBEC® professionals structure their engagements in multiple phases, ensuring your clients receive long-term value and actionable strategies.

- Specialize in Main Street and Mid-Market Businesses – Over 2/3 of CBEC® advisors focus at least 50% of their practice on these segments, giving you the knowledge to work with businesses of all sizes.

- Demonstrate Tangible Results – CBEC® professionals report significant financial impact, with 22% earning over $250,000 from exit planning services in a single year.

- Gain Practical, Real-World Experience – The certification includes completing a real exit plan with a business owner, preparing you for actual client engagements.

- Elevate Your Professional Credibility – CBEC® designation signals that you are part of a select group of highly trained, experienced exit planning specialists.

Position yourself as a go-to expert for exit planning and expand your impact, no matter whether you are an accountant, CPA, financial planner, wealth manager, business consultant, M&A advisor, or a corporate lawyer. Start your CBEC® journey today and transform how you help business owners achieve successful transitions.