Choosing a successor is one of the most consequential decisions a business owner will ever make. It’s not just about who fills the role, but about how the business survives, grows, or declines after the handoff. And when succession goes wrong, the cost is huge. According to research, poorly executed CEO transitions are responsible for nearly $1 trillion in lost market value every year among S&P 1500 companies.

While your business may not be part of that index, the lesson applies across the board: unclear plans, mismatched successors, or delayed decisions can threaten years of hard work. That’s why succession planning must begin long before a departure date is on the calendar, with a clear framework, aligned leadership, and a successor who is ready to lead.

In this blog, we’ll walk through how to evaluate and select the right successor for your business, how to prepare them for the transition, and what role trusted advisors can play in getting it right.

Why Does Successor Choice Matter?

Leadership transitions carry real consequences. The successor you choose inherits the responsibility to preserve enterprise value, maintain momentum, and protect the legacy you’ve built. A misaligned or unprepared successor can disrupt internal teams, cause major employees to leave, damage customer confidence, and derail growth plans.

Even businesses with strong financials and brand recognition are vulnerable if the leadership gap isn’t addressed early. Many owners assume someone within the company will “step up,” but without intentional planning and vetting, this hope rarely becomes a viable strategy. The right successor aligns with the company’s vision, engages stakeholders, and leads through change with confidence.

This is why successor selection should be proactive, not reactive. It’s a process of assessing, preparing, and aligning leadership with the business’s future goals. And for advisors, helping clients get this right is one of the most valuable services you can offer during succession planning.

Successor Types and Their Pros & Cons

Choosing a successor involves aligning the leadership style, experience, and long-term vision with the business’s needs. Each successor type brings different advantages and potential risks. Business owners often gravitate toward familiar options, such as a family member or a major employee, but as an advisor, your role is to help them assess these options objectively.

| Successor Type | Pros | Cons |

| Family Member |

|

Risk of family conflict |

| Integral Employee |

|

Financing the buyout can be complex |

| External Executive |

|

Cultural misfit risk |

| Strategic Buyer |

|

May not retain staff or legacy |

| Private Equity Buyer |

|

Shorter investment horizon |

| Employee Group (ESOP) |

|

Complex setup and ongoing admin |

The Process of Selection and Development

Choosing the right successor is only the first step. To ensure a smooth transition, the selection must be followed by a well-structured development plan. This process typically unfolds over months or even years and requires input from leadership, advisors, and the successor themselves.

It starts with clearly defined business goals: What kind of leadership will the company need in five years? What skills and values must the successor embody to support that vision?

Once aligned, the business owner and their advisory team should assess candidates against these criteria using methods such as performance reviews, leadership assessments, and cultural fit analyses. Development may include shadowing, cross-functional roles, formal coaching, or external training. The goal is confidence, clarity, and capability when the handover happens.

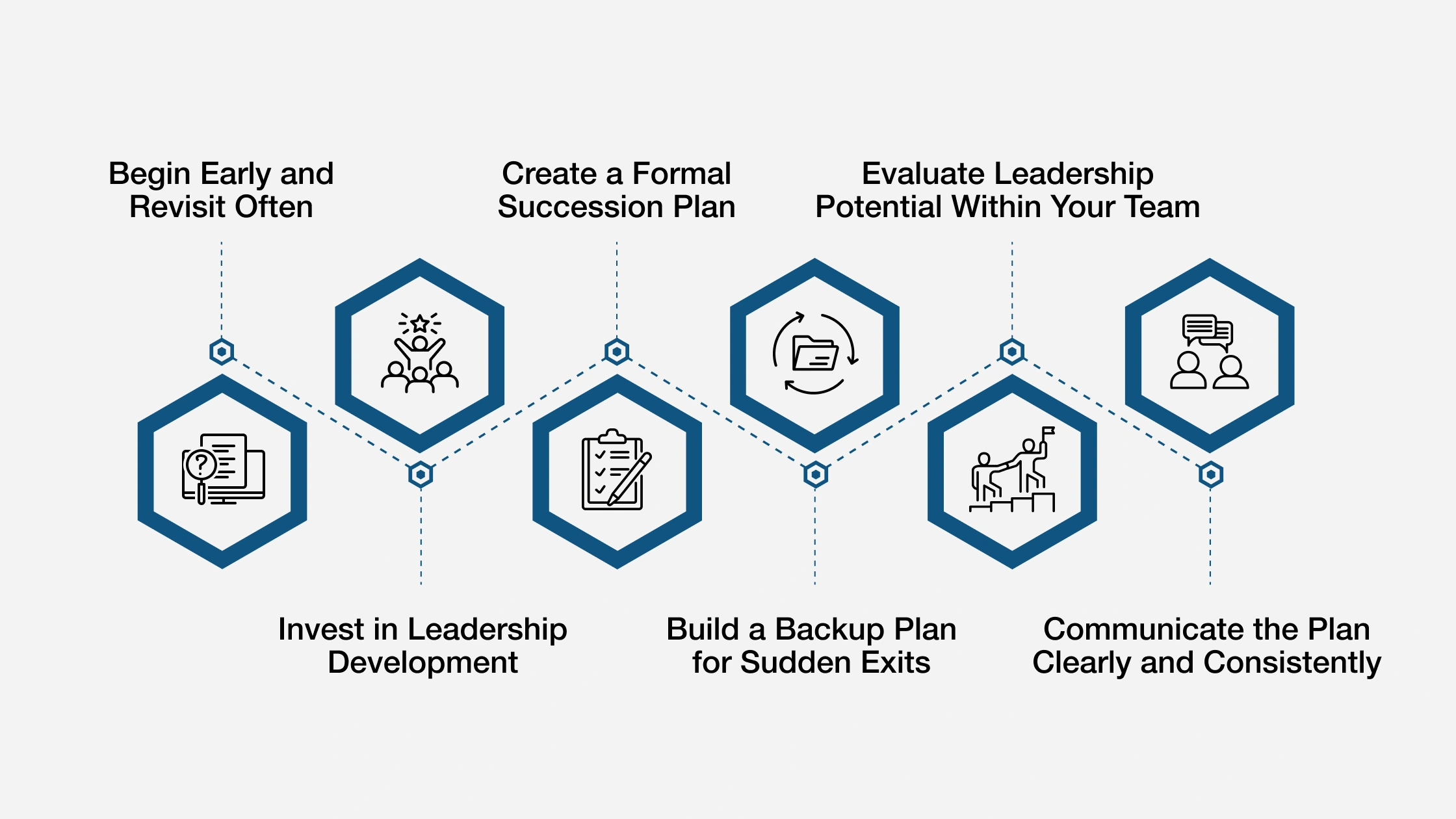

Smart Succession Planning Practices for Success

Even the most experienced business owners can find succession planning challenging. Emotions, relationships, and legacy often collide with strategy and timelines. But following best practices helps reduce uncertainty and ensures your transition plan supports long-term stability, both for the company and the people behind it.

Begin Early and Revisit Often

Succession planning should never be a one-time decision triggered by retirement or crisis. Starting early gives owners the time to assess talent, build competencies, and prepare successors through mentorship and the gradual transfer of responsibility. It also reduces the pressure of making rushed decisions that may not be in the company’s best interest.

But early planning alone isn’t enough. It has to be an ongoing process. As business needs shift and key personnel evolve, succession plans should be reviewed and adjusted accordingly. Revisiting the plan annually or during significant business changes ensures the strategy stays aligned with long-term goals, available leadership, and market conditions.

A living succession plan supports continuity, even through the unexpected.

Create a Formal Succession Plan

Informal intentions aren’t enough when it comes to leadership continuity. A well-documented succession plan outlines who will take over and how the transition will unfold step by step. It defines timelines, responsibilities, contingency plans, and developmental milestones for potential successors.

A formal plan reduces ambiguity and aligns major stakeholders, including the board, leadership team, and external partners. It also demonstrates to employees and investors that leadership continuity is being taken seriously, which can help build trust and stability during periods of change.

Beyond naming a successor, the plan should include leadership training goals, transitional duties, and clear communication protocols to prevent confusion or power struggles in the future.

Evaluate Leadership Potential Within Your Team

Choosing the right successor starts with understanding who’s already on your bench. Conduct a structured assessment of current team members to identify those who have both the aptitude and the ambition to lead. This includes evaluating technical competencies, decision-making ability, emotional intelligence, and alignment with company values.

Look beyond job performance alone. Not every top performer is ready for or suited to a leadership role. Use 360-degree feedback, performance reviews, and external leadership assessments to create a full picture of each candidate’s capabilities and gaps.

This early assessment also helps you identify training opportunities and mentorship needs. By investing in internal talent development now, you’re strengthening the entire leadership pipeline.

Invest in Leadership Development

Great successors are built through deliberate training, exposure, and support. Once you’ve identified potential future leaders, make ongoing development a core part of your succession strategy. This includes formal education, mentorship from current executives, cross-functional projects, and targeted leadership coaching.

Professional development should focus on both soft skills and strategic capabilities, such as communication, change management, and financial decision-making. It’s also important to give high-potential employees stretch assignments that challenge them to lead beyond their comfort zone.

An investment in development sends a clear message: you’re committed to grooming leaders from within. It reduces the risk of future leadership gaps and increases your chances of retaining top talent who feel seen, valued, and supported.

Build a Backup Plan for Sudden Exits

Unexpected events, like illness, death, or abrupt resignations, can destabilize even the strongest businesses. That’s why every succession plan needs an emergency component. This plan identifies who will step in temporarily or permanently if a primary leader exits suddenly. It should include updated role descriptions, documented procedures, and a transparent chain of command that is immediately effective.

Interim leadership is essential for business continuity. Having a clear plan minimizes confusion, protects team morale, and reassures stakeholders that the company is prepared. Regularly review and refresh emergency succession plans alongside your long-term strategy. It’s not about expecting the worst, but ensuring your business can function, adapt, and move forward when it matters most.

Communicate the Plan Clearly and Consistently

A well-crafted succession plan loses impact if it’s kept behind closed doors. Once finalized, the plan should be clearly communicated to all key stakeholders, like co-owners, executives, board members, and potential successors. Transparency fosters trust and reduces uncertainty, particularly during periods of transition. It also prevents confusion about future leadership and ensures alignment with the company’s direction.

Keep communication intentional and appropriate for each audience. Senior leadership may need detailed strategy discussions, while employees may benefit from broader reassurance. Use regular updates to reinforce the plan’s relevance and show that it’s actively supported by leadership. Open dialogue makes succession planning a shared responsibility, not a mystery, and helps maintain confidence across the organization.

Role of Advisors and Exit Strategy Consultants in Business Succession Planning

Selecting and preparing a successor is a complex business transition. That’s where advisors and exit strategy consultants step in. They help business owners view succession through a strategic lens, aligning leadership continuity with broader financial, operational, and ownership goals. Advisors offer structured planning, objective assessments of internal talent, and unbiased guidance during sensitive decision-making.

Exit strategy consultants also bring expertise in business valuation, deal structuring, tax planning, and continuity management. Their outside perspective helps prevent blind spots, emotional bias, and costly missteps. Most importantly, they keep succession planning moving forward, even when internal priorities shift, ensuring the company is always ready for change.

Professionals with the Certified Business Exit Consultant® (CBEC®) designation from IEPA are uniquely equipped for this role. CBEC® training prepares advisors to lead holistic transitions, from identifying potential successors to aligning leadership continuity with a full Exit Plan. With frameworks, methods, and real-world instruction, CBEC designees guide business owners through decisions that protect their legacy, preserve value, and maintain steady operations through change.

Turn Succession Planning Challenges Into Opportunities With CBEC®

With most business owners planning to exit within the next decade, there’s a growing demand for qualified professionals who can lead them through the process. The Certified Business Exit Consultant® (CBEC®) certification, offered by the International Exit Planning Association (IEPA), gives you the tools, structure, and confidence to do just that.

The CBEC® certification is a practitioner-led, application-based program planned for financial advisors, consultants, CPAs, and part-time CFOs who want to deliver real-world exit planning. Through the program, you’ll gain:

- A complete, phase-based framework to guide Exit Planning engagements from start to finish

- Practical strategies for valuation, risk mitigation, successor planning, and exit execution

- Methods to collaborate across tax, legal, and financial advisory teams

- Access to an experienced national peer network and ongoing support

And the results speak for themselves:

- 66% of CBEC® advisors break engagements into structured phases that deliver consistent value

- 22% earn over $250,000 per year from Exit Planning services

- 44% work with 6–10 exit planning clients annually, across both Main Street and Middle Market

If you’re ready to expand your advisory role and build a practice that helps owners exit on their terms, CBEC® can help you lead with confidence.