Most small business owners assume they’ll sell when the time feels right, but the reality is very different. Studies show that 80% of owners who try to sell can’t close the deal on their terms.

The problem here is the absence of a clear, intentional exit strategy for a small business. Without one, even strong companies can lose value, stall in negotiations, or fail to attract serious buyers.

The fix is early, structured planning. Exit Planning gives owners the framework to protect what they’ve built, maximize value, and create options for the future, long before they’re ready to walk away. Whether the goal is retirement, succession, or simply freedom, a defined plan puts control back in the owner’s hands.

In this blog, we’ll discuss the most common exit strategies for small business owners, how to evaluate which path is right, and how skilled advisors guide the process with clarity and confidence.

Why Does Every Small Business Need an Exit Strategy?

A well-planned exit strategy for a small business protects your business, your wealth, your legacy, and secures your future. Here’s how it makes the difference.

Plan for the Inevitable Transition: Every business will change hands, whether by choice or circumstance. Taking control now prevents a rushed, reactive exit that could harm your results.

Reduce Dependence on the Owner: Small businesses often rely heavily on the owner’s leadership, relationships, and expertise. Spreading that responsibility protects the company when it’s time to step away.

Avoid the Costs of an Unplanned Exit: Without preparation, operations can stall, major relationships may weaken, and business value can drop sharply, sometimes permanently.

Build a Structured Exit Roadmap: An exit strategy gives you a clear path to prepare the business, strengthen operations, train successors, and align financial and legal plans.

Control the Timing and Terms of Your Exit: With a strategy in place, you choose when and how the transition happens, ensuring it meets your financial and personal goals.

Protect Your Legacy and the Company’s Future: Proactive planning allows for a smooth handover that preserves stability, reputation, and long-term success.

Things to Consider Before Choosing an Exit Path

Choosing the right exit strategy for a small business requires a careful balance of internal readiness and external realities. Below are the major factors every owner should address before deciding on a path forward.

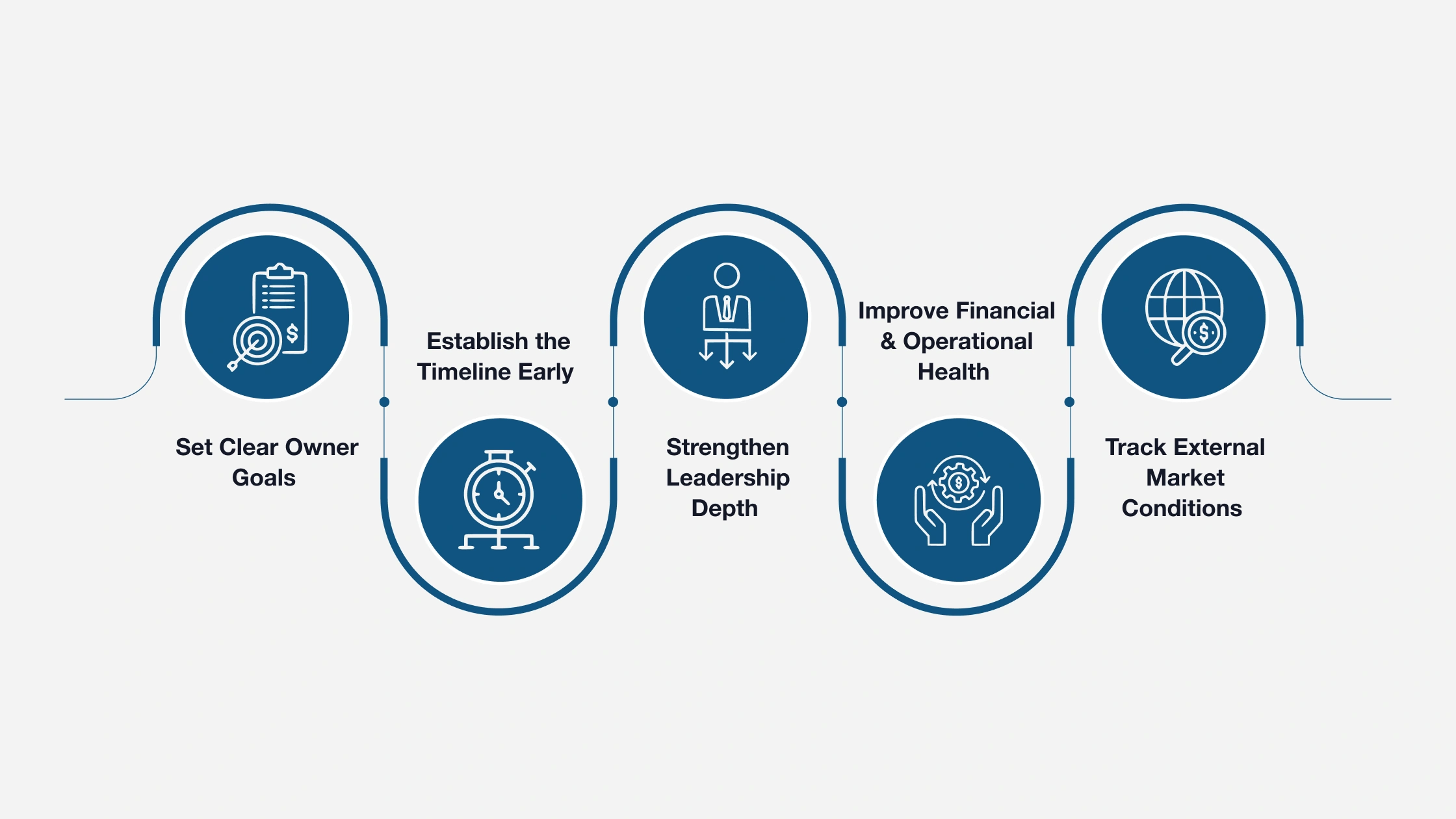

1. Set Clear Owner Goals

The exit strategy should align with the owner’s ultimate objectives, whether retirement, liquidity, family succession, or a phased transition, to ensure financial and operational decisions support those outcomes.

2. Establish the Timeline Early

Setting the timeline in advance allows for value-building, successor development, and proper tax and legal structuring, avoiding the reduced leverage that comes with compressed deadlines.

3. Strengthen Leadership Depth

A strong, capable management team reassures buyers or successors that the business can operate without the owner, increasing confidence and transferability.

4. Improve Financial & Operational Health

Accurate financials, recurring revenue, and documented systems all strengthen valuation, while gaps in these areas can limit interest or lead to renegotiations.

5. Track External Market Conditions

Market cycles, industry trends, and buyer demand shape the timing and structure of an exit, making current market insight essential to the decision-making process.

Top 5 Exit Strategy Options for Small Business Owners

Once the owner’s goals, timeline, and business fundamentals are clearly understood, the next step is to evaluate which type of exit strategy for a small business will best support the transition. Each strategy offers distinct advantages depending on the company’s financial profile, leadership depth, and future vision.

| Exit Strategy | Pros | Cons | Best For | Ideal Situation |

| Sell to a Strategic Buyer | Potential premium price; synergies like market access or IP leverage | Possible loss of brand identity; cultural misalignment | Owners with unique offerings or strong market position | Business has competitive differentiation, recurring revenue, or valuable IP |

| Merge With Another Business | Shared resources; growth potential; gradual exit possible | Integration challenges; risk of value erosion | Owners open to continued involvement | Complementary markets, aligned leadership, and culture |

| Passing the Torch | Preserves culture; maintains continuity; gradual transition | Emotional complexity; possible lack of capital | Family businesses or closely held firms | Successor has time for training and buy-in |

| Employee Stock Ownership Plan (ESOP) | Rewards employees; tax advantages; culture preservation | Requires consistent cash flow; complex setup | Owners valuing employee retention and legacy | Profitable business with stable operations and loyal staff |

| Wind Down & Liquidate | Immediate closure; extract remaining value; settle debts | No ongoing business; emotional/financial strain | Non-transferable businesses or declining markets | No buyers/successors, limited infrastructure, or owner-dependent operations |

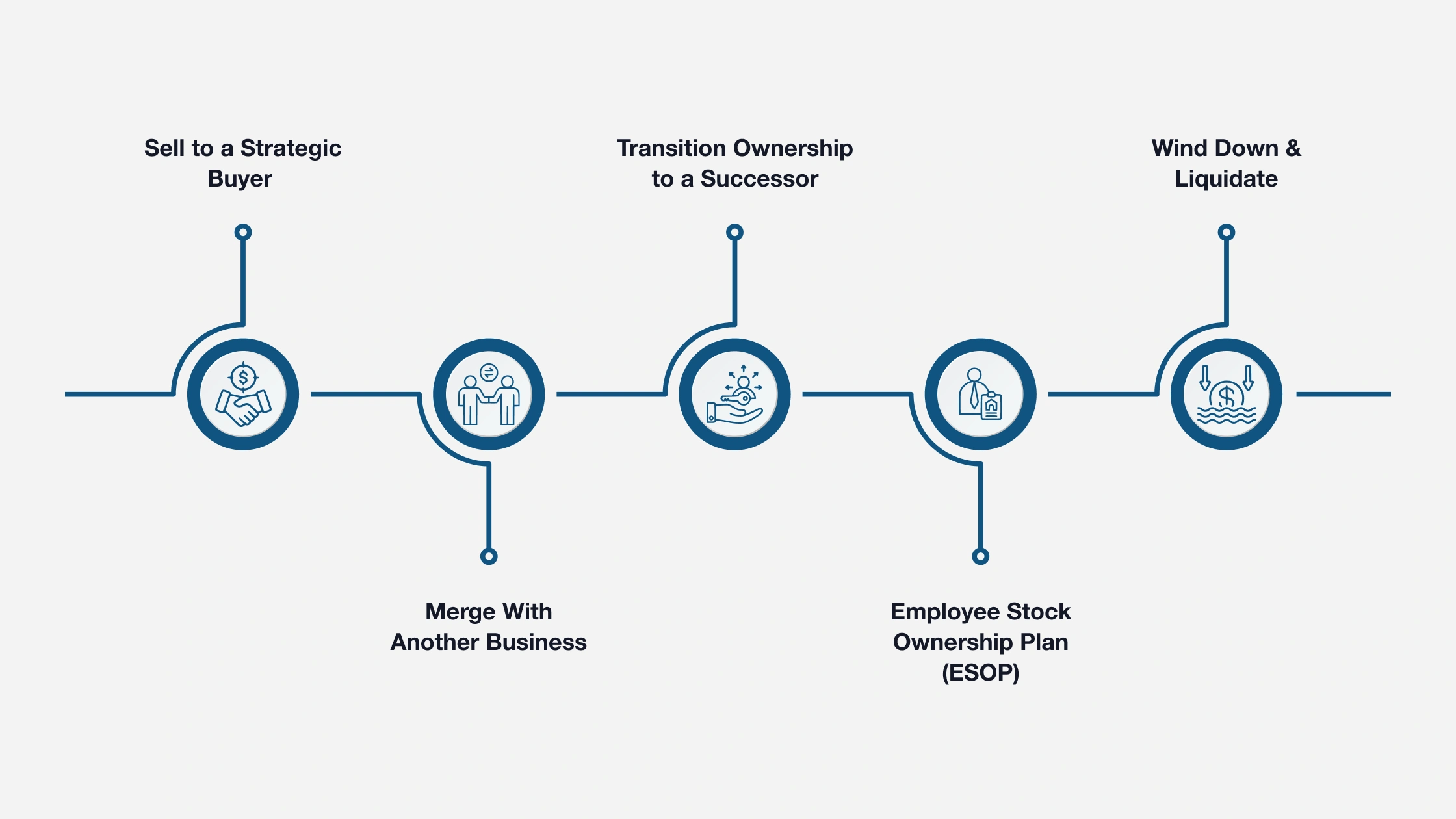

1. Sell to a Strategic Buyer

A strategic buyer is generally another business operating in the same or a related industry. Their interest in acquiring a small business extends beyond its financial performance, as they seek synergies. This might include access to new markets, expanded customer relationships, proprietary products, or operational efficiencies.

Strategic buyers are often willing to pay a premium if the acquisition strengthens their competitive position. For example, if a small business offers a niche service, recurring revenue, or a strong regional presence, those attributes justify a higher multiple than a purely financial buyer would offer.

However, this type of exit strategy for a small business also comes with trade-offs. Strategic buyers may plan to absorb operations, consolidate teams, or change branding. These decisions could affect the owner’s legacy or employee continuity. Cultural alignment can become a significant issue, especially when the seller wants to preserve the company’s identity.

For small business owners, selling to a strategic buyer can be attractive when there’s a clear growth story, competitive differentiation, or intellectual property to leverage.

2. Merge With Another Business

A merger involves combining two businesses to create a single, stronger entity. For small business owners, this path can be a strategic way to exit while still retaining partial ownership, transitioning gradually, or expanding the company’s future potential through shared resources.

Mergers are often driven by alignment in leadership, culture, and market positioning. When two businesses serve complementary markets, have overlapping capabilities, or can gain efficiencies by unifying operations, a merger can unlock growth that neither company could achieve alone.

From an exit perspective, a merger doesn’t always mean walking away. Owners may take on a leadership role in the new company, convert equity into shares in the merged entity, or step back over time as value is realized.

However, mergers require detailed planning, clear communication, and legal structuring. Misalignment on vision or integration can lead to internal conflict or value erosion.

3. Transition Ownership to a Successor

Passing the business to a family member, long-time employee, or integral internal leader is one of the most personal exit strategies available to small business owners. It’s about legacy, continuity, and trust.

Internal succession works best when there’s time to prepare. The incoming leader needs mentorship, operational experience, and buy-in from the broader team. These handovers often happen gradually, with the owner stepping back over time as the successor steps forward.

This strategy can reduce disruption, maintain company culture, and provide continuity for employees and customers. It’s especially common in family-owned businesses or tightly held firms where relationships and reputation matter deeply.

However, emotional complexity often complicates the process. Expectations may be unclear, roles may blur, and family dynamics can interfere with decision-making. From a financial standpoint, successors may lack capital to purchase the business outright, requiring creative deal structures or seller financing.

4. Employee Stock Ownership Plan (ESOP)

An Employee Stock Ownership Plan (ESOP) allows a business owner to sell all or part of their company to employees through a qualified trust. For owners who want to reward loyal teams, preserve the company culture, and transition ownership gradually, an ESOP can be an attractive option.

This strategy offers tax advantages for both the seller and the company, making it financially appealing in the right situations. It can also boost employee engagement by aligning staff interests with business performance. ESOPs keep the business in familiar hands, which can be especially important in smaller communities or industries built on relationships.

Keep in mind that ESOPs are not a fit for every business. The structure requires consistent cash flow, formal governance, and careful planning. Legal, tax, and valuation components must be coordinated early and reviewed regularly. For smaller companies with informal operations or inconsistent profitability, an ESOP may not be financially sustainable.

5. Wind Down & Liquidate

Not every small business will be positioned for sale or succession, and in some cases, winding down is the most practical exit strategy. Liquidation involves selling off assets, paying outstanding obligations, and formally closing the business. While it may not be the ideal scenario, it can still be a responsible and intentional decision.

This path is often chosen when the business is closely tied to the owner, such as solo practices or companies without transferable infrastructure or leadership. It may also be the only option when there’s no successor, limited buyer interest, or declining financial performance.

Liquidation allows the owner to extract remaining value, settle debts, and avoid passing on unnecessary risk or responsibility. However, without proper planning, the process can become emotionally and financially draining.

A well-managed exit, even through liquidation, can still reflect strong leadership and responsible ownership.

How Do Certified Exit Planners Help Owners Choose the Right Path?

Below are the ways Certified Exit Planners help business owners evaluate their options, avoid costly missteps, and choose an exit path that aligns with their goals and business realities.

Align the Exit Path to Achieve Owner Goals: Certified Exit Planners ensure the chosen path matches the owner’s personal objectives, financial targets, and business realities, leading to informed and confident decisions.

Clarify the Road Ahead Before It’s Urgent: Advisors help owners avoid overestimating value, underestimating complexity, or delaying critical steps, bringing structure and foresight to the entire process.

Guide Critical Conversations and Readiness Steps: From succession planning to preparing for buyer scrutiny, Certified Exit Planners lead the discussions and actions that position the business for a smooth, successful transition.

Coordinate Experts for a Seamless Transition: They bring together attorneys, accountants, and financial planners to create a tax-efficient, legally sound, and strategically aligned exit plan.

Turn Exit Planning into a Value-Building Process: By engaging early and planning intentionally, advisors help owners avoid missteps and turn their exit into a proactive strategy that protects and grows value.

Join IEPA’s CBEC® Program & Lead Clients Through Successful Exit Strategies

Most business owners won’t ask for an exit strategy until they need one, and by then, their options may already be limited. Advisors who are prepared to lead these conversations early, with structure and confidence, offer favorable outcomes along with proper guidance.

The Certified Business Exit Consultant® (CBEC®) designation, developed by the International Exit Planning Association (IEPA), is built specifically for experienced professionals, like financial advisors, CPAs, consultants, attorneys, and fractional CFOs, who want to lead exit planning engagements with real impact.

CBEC® certification goes beyond theory.

Here’s Why Our Program Delivers Results

- Hands-On Experience: Every candidate develops a real exit plan with an actual business owner, because exit planning is learned by doing, not just studying.

- Practitioner-Led Training: Our faculty actively manages exits across industries, bringing fresh, relevant insights into every session.

- Developed for Client Impact: More than 66% of CBEC® advisors structure engagements in phases, delivering sustained value over time.

- Proven Revenue Growth: In 2024, 22% of CBEC® designees earned over $250,000 from exit planning services alone.

If you want to provide owners with guidance they’ll never find in a spreadsheet or seminar, the CBEC® designation is your path forward.

Enroll in the next CBEC® session and position yourself as the trusted advisor for one of the most important decisions your clients will ever face.