Every business owner will exit their business someday; the only question is how. A transition is inevitable, whether a sale, succession, or shutdown. Yet, most owners still lack a plan.

According to PwC, only 34% of business owners planning to sell in the next five years have a formal business exit strategy. That means the majority are putting years of hard-earned value at risk. A well-planned business exit strategy goes beyond financial returns. It secures business legacy, smooths leadership transitions, and minimizes disruption.

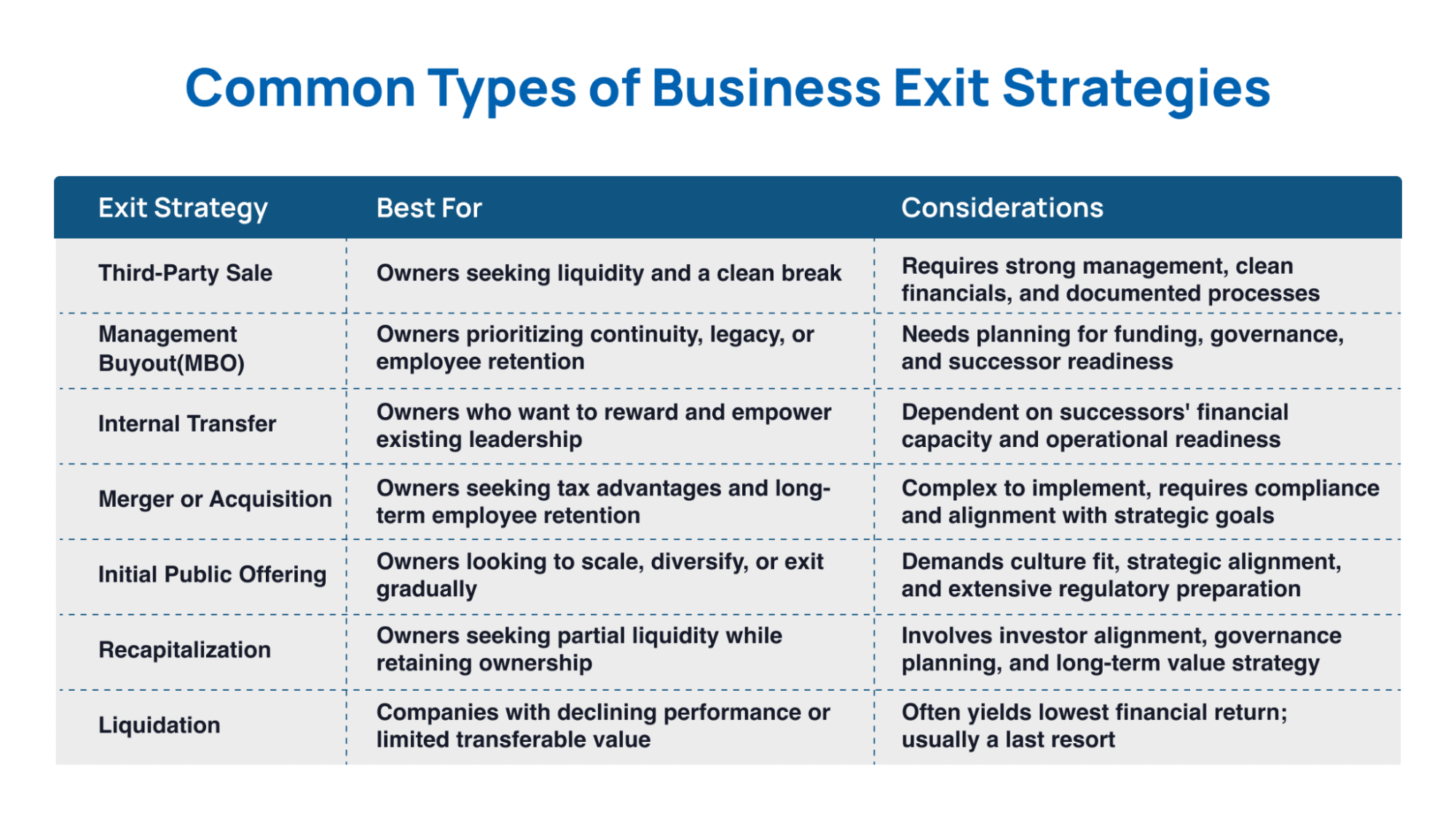

7 Common Business Exit Planning Strategies include:

|

In this blog, we’ll break down a business exit strategy, the common types you should know, and why planning early matters.

What is the Purpose of a Business Exit Strategy?

| A business exit strategy is a structured plan that outlines how an owner will transition out of their business while meeting defined financial, operational, and personal objectives. Its primary purpose is ensuring the transition is intentional, financially sound, and strategically executed. |

The primary objectives of a business exit strategy include:

Value maximization: A well-developed strategy helps owners enhance the business’s value before a sale or transfer.

Continuity and stability: Planning reduces operational risk by ensuring leadership continuity, employee retention, and minimal disruption to customers and partners.

Goal alignment: The strategy aligns the owner’s business exit with their long-term financial and personal planning goals.

Risk mitigation: It is a strategic measure for unplanned events such as illness, economic shifts, or legal issues that could force an unprepared exit.

Without a defined exit strategy, business owners are more likely to encounter lower valuations, longer timeframes to exit, and reduced flexibility during the transition process.

Common Types of Business Exit Strategies

Business owners have several exit options with different implications for control, value realization, timing, and transition complexity.

1. Third-Party Sale

A third-party sale involves transferring ownership of the business to an external buyer. This may include strategic acquirers (competitors or companies seeking vertical integration), private equity firms, or high-net-worth individual investors.

This option often delivers the highest potential enterprise value among all exit strategies—especially for businesses that demonstrate scalability, strong financial performance, and a unique market position.

2. Management Buyout (MBO)

A Management Buyout (MBO) is a transition strategy in which the current management team purchases the business from the owner. It is often chosen when preserving operational continuity and internal leadership is a strategic priority. Because the team is already familiar with the company’s day-to-day functions, client base, and culture, an MBO can offer a seamless transition with minimal disruption.

Valuation in an MBO can be more flexible, though it may not reach the high multiples seen in competitive third-party sales. The owner may also stay involved during the transition to support the new owners and reinforce stakeholder confidence.

3. Internal Transfer

An internal transfer involves passing ownership of the business to family members or primary employees. This approach is often chosen by owners who place a high value on legacy, continuity, and preserving the company’s culture. It allows for a more gradual transition of ownership and leadership responsibilities, reducing disruption to the business and giving successors time to grow into their roles.

These transactions are frequently structured over time rather than as a one-time sale. Standard methods include gifting ownership interests, seller financing, or compensation arrangements tied to business performance. Because the goal is often to accommodate the successor’s financial limitations, valuation may be more flexible than a sale to an outside buyer.

4. Merger or Acquisition

A merger or acquisition involves combining the business with another company or purchasing it. This strategy is often pursued to achieve strategic objectives such as expanding market reach, gaining operational efficiencies, or enhancing competitive position.

For the selling owner, it can represent an opportunity to realize substantial value—especially if the acquiring entity sees strong synergies or a compelling strategic fit.

5. Initial Public Offering (IPO)

Though rare for small to mid-sized businesses, an IPO allows the company to sell shares to the public. This strategy requires significant regulatory compliance and preparation and is usually reserved for high-growth companies with scalable operations.

Valuation potential in an IPO can be high, particularly during favorable market cycles, but success depends heavily on market timing, investor appetite, and robust financial performance.

6. Recapitalization

Recapitalization is a financial strategy in which a business owner restructures the company’s capital by bringing in a private equity investor or lender while retaining partial ownership. This allows the owner to extract some liquidity without having to exit the business entirely. It’s often used as a conventional exit strategy, providing the owner with an immediate financial return while continuing to participate in future growth or a second exit event.

Recapitalization requires careful planning to align investor interests, governance structures, and long-term exit goals. Still, when structured effectively, it can be a powerful method for realizing value and ensuring business continuity.

7. Liquidation

Liquidation involves winding down the business and selling off its assets, individually or as a whole. This strategy is pursued when the company is no longer viable, lacks a successor, or other exit options are not feasible due to market conditions or operational challenges.

While liquidation can provide a relatively quick resolution, it generally results in the lowest financial return compared to other exit strategies. Asset values are often discounted, and intangible assets such as brand equity, customer relationships, or goodwill may hold little to no transferable value. Creditors and outstanding obligations must be settled first, which can further reduce any remaining proceeds for the owner.

What Defines a Successful Business Exit Strategy?

A successful exit strategy is defined by its clarity, timing, and execution. It aligns with the business owner’s personal financial goals and the company’s long-term potential, ensuring a smooth and valuable transition.

Common characteristics include:

- Defined Objectives: A strong strategy begins with clearly understanding the owner’s goals, such as financial security, legacy, future involvement, or liquidity.

- Business Readiness: Operational efficiency, documented systems, and a capable leadership team increase the company’s transferability and market value.

- Personal Readiness: A successful exit also depends on the owner’s readiness to step away financially, emotionally, and professionally.

- Realistic Valuation and Deal Structure: Aligning expectations with market realities helps avoid delays and failed deals.

- Integrated Advisory Approach: Professionals across finance, legal, operations, and tax must collaborate to develop and execute the plan.

According to our survey, 66% of certified professionals structure their planning engagements in multiple phases, reflecting effective exit strategy work’s complexity and long-term nature.

When Is the Right Time to Develop an Exit Strategy for Your Business?

Effective Exit Planning is not a last-minute decision but a long-term strategic process that ideally begins years before the intended transition. Most experienced advisors recommend starting Exit Planning at least 3 to 5 years before the desired exit date. Early planning provides significant advantages:

Maximizing Business Value

A well-prepared business commands a higher valuation. Time allows owners to improve financial performance, reduce operational risk, and build transferable value.

Aligning Personal and Business Goals

Exit strategies must reflect the owner’s financial objectives, retirement timeline, and legacy preferences. Planning early ensures alignment across all stakeholders.

Preparing the Management Team

Strong internal leadership is critical for a successful exit. Building a capable management team enhances continuity and confidence for buyers or successors, whether selling to a third party or transferring internally.

Improving Tax Efficiency

Strategic tax planning requires time. Properly structuring the business and transaction can significantly reduce the tax burden upon exit.

Mitigating Risk

Without a clear exit strategy, owners risk being forced into reactive decisions due to market shifts, health issues, or unsolicited offers. Early planning provides flexibility and control

Many business owners delay planning until it’s too late to influence the outcome. By beginning the process early, advisors and owners can proactively shape the exit on their terms.

The Role of Professionals in Business Exit Strategy Development

Developing a successful business exit strategy requires more than financial modeling or transactional support. It demands collaboration among experienced professionals who understand the lifecycle of a business and can guide owners through operational and strategic considerations.

Exit Planning is not a solo effort. It often involves a multidisciplinary team that includes:

- Accountants and CPAs for tax optimization and financial clarity

- Consultants and fractional executives for operational alignment and readiness

- Wealth managers and financial planners for personal financial goal setting

- Legal professionals for deal structure, compliance, and risk mitigation

Each professional brings a unique perspective. Together, they and many other professionals help the business owner transition from day-to-day involvement to long-term financial security—whether the goal is succession, sale, or recapitalization. Depending on the business’s specific needs, additional specialists may also be involved to ensure a comprehensive exit strategy.

At IEPA, we train professionals across these disciplines to contribute to and lead the planning process, ensuring that the exit strategy is built into the business strategy from the start.

How Does IEPA Train Professionals to Lead Business Exit Strategy Planning?

At the International Exit Planning Association (IEPA), exit strategy isn’t treated as a one-time transaction—it’s a disciplined process that aligns owner goals, business value, and market readiness. Our practitioner-led training equips professionals to confidently and guide business owners through complex exits.

What Sets IEPA Apart?

Real-World Application: Our training includes live certification projects, not just theory, to ensure the Exit Planners are market-ready. In fact, our research suggests that 26% of CBEC advisors use Exit Planning to prepare a business for the market.

Focused Delivery: Where others prioritize M&A execution, we emphasize full-cycle planning, especially for the underserved Main Street market—where over two-thirds of advisors say 50%+ of their work is concentrated.

Advisory Leadership: Members learn to operate as lead advisors—facilitating teams, managing stakeholder expectations, and coordinating across disciplines.

Strategic Focus: We emphasize growth planning, timing optimization, and transaction readiness—not just deal execution.

IEPA-trained professionals are prepared to lead across the entire lifecycle of an exit, not just the final transaction.

Earn Your CBEC Certification and Lead Exit Strategies Confidently

Effective exit strategy development demands more than technical knowledge. It requires real-world advisory experience, structured planning, and a collaborative mindset. At the International Exit Planning Association (IEPA), we equip professionals with the resources to lead from the front.

Through our CBEC certification and training program, you’ll gain:

- Real-World Training: Practitioner-led instruction grounded in actual Exit Planning experience

- Applied Certification: A capstone certification project based on a real client case

- Strategic Advisory Skills: Development in facilitation, coaching, and multi-party coordination

- Proprietary Tools & Frameworks: Client-ready deliverables and structured planning resources

- Ongoing Professional Growth: Continued learning, development, and support post-certification

- Peer-to-Peer Community: A strong network of experienced professionals across industries

Join a network of seasoned practitioners setting a higher standard for business Exit Planning. Learn more about CBEC certification and start leading exit strategies with confidence.