Owners often believe they’re years away from exiting, until reality intervenes. A health scare, an unexpected offer, or simple burnout can accelerate the timeline. And when that moment comes, the first question isn’t about legal paperwork or potential buyers. It’s: “What’s the business worth?”

Business Valuation for Exit Strategy is the process of answering that question. It requires a detailed review of financials, assets, liabilities, cash flow, and industry conditions. The goal is to calculate a value that reflects how a buyer or investor would view the company, factoring in both risk and return.

Experts recommend that business exit preparations begin five to ten years before a potential sale, giving owners the time to close value gaps, strengthen operations, and position themselves for the best outcome. Yet many still lack a precise valuation or rely on gut instinct and last year’s revenue, leading to broken deals, unmet expectations, and missed opportunities.

This is why every serious Exit Plan begins with valuation, providing an objective view of what the business could command in today’s market and what steps might increase its value for tomorrow.

Top 5 Reasons Business Valuation for Exit Strategy Should Be the First Step

Here are five reasons why valuation should lead every effective Exit Plan.

1. Grounding Owner Expectations

Business owners often approach Exit Planning with assumptions about what their company is worth. These expectations, while understandable, are frequently based on emotion or anecdotal comparisons rather than market reality.

A formal valuation grounds the conversation, reflecting the company’s actual position, current performance, industry standing, and attractiveness to potential buyers or successors.

2. Aligning Goals and Market

A business valuation is closely tied to the owner’s personal goals, market expectations, and financial realities. It highlights where the business stands today and what must change to align with the owner’s desired outcomes.

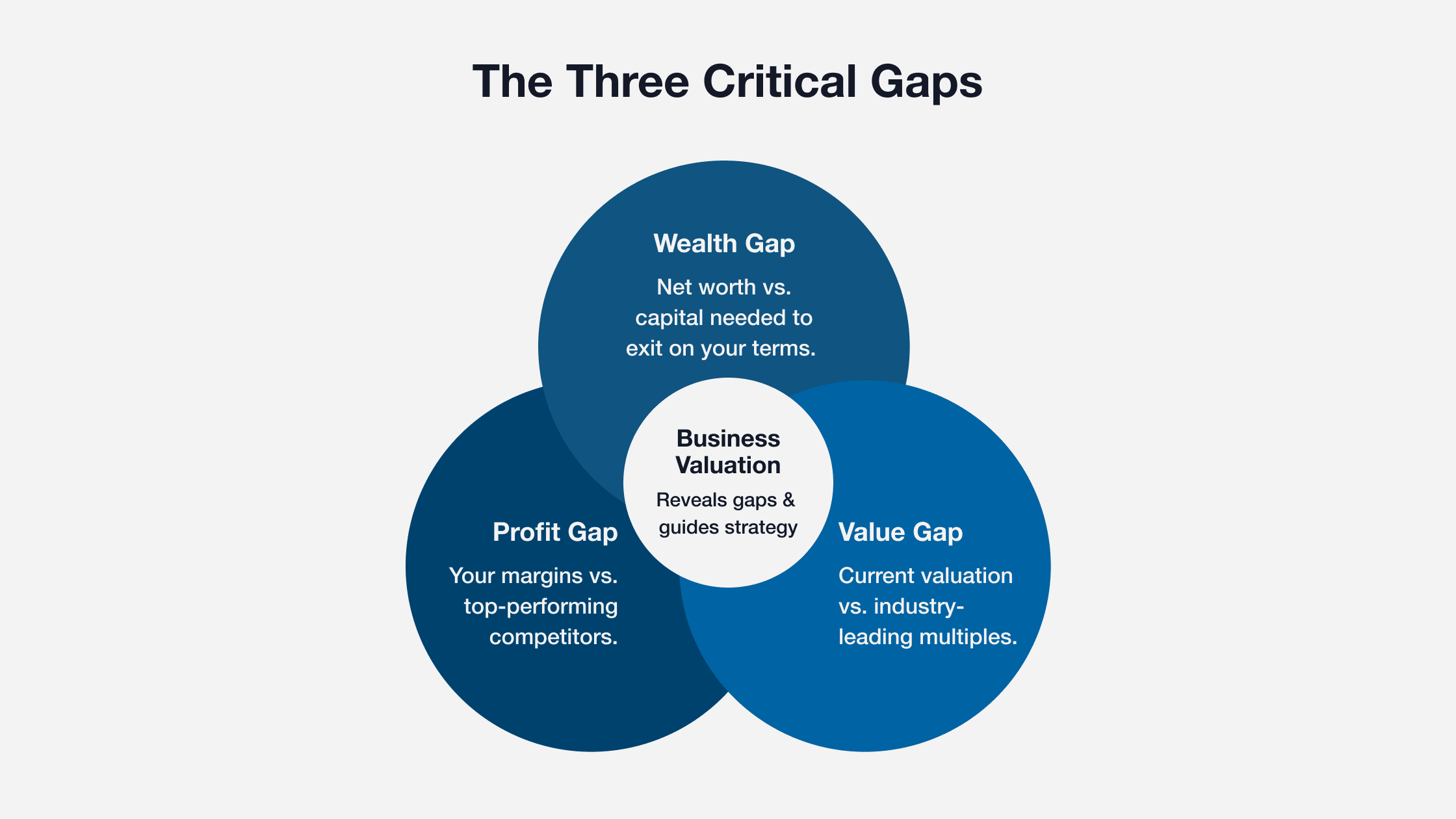

3. Revealing the Three Gaps

One of the most apparent benefits of an early valuation is uncovering gaps that directly shape exit outcomes.

- Wealth Gap: The shortfall between your current net worth and the capital required to exit on your terms while maintaining your lifestyle.

- Value Gap: The difference between your company’s current valuation and what leading businesses in your industry achieve based on trading multiples.

- Profit Gap: The distance between your margins and those of top-performing competitors in your sector.

Together, these gaps highlight priorities for improvement and provide a realistic picture of what’s achievable. According to IEPA, 66% of CBEC® advisors structure client engagements into multiple phases, ensuring value is delivered step by step rather than in a single rushed process.

4. Shaping Exit Strategy and Timing

Business valuation informs the entire plan. An owner aiming to retire in three years will act very differently if their company is valued at $5 million versus $2 million. Valuation guides which provide exit paths to consider, like third-party sale, internal transfer, or recapitalization, and influences both timing and structure.

5. Reducing Exit Risks Early

Delaying valuation introduces significant risks. Without a clear number early in the process, owners may:

- Pursue deals that collapse during due diligence.

- Miss opportunities for tax or legal preparation.

- Overlook value enhancement initiatives that require time to execute.

If an unexpected event forces a quicker exit, owners risk making rushed decisions without an accurate understanding of business value.

What Does a Business Valuation Measure?

Valuation accounts for risk, performance, industry trends, and the business’s reliance on the owner. These are the same factors a buyer will scrutinize, whether it’s a private equity firm or a potential successor inside the company.

A formal valuation examines:

- Cash Flow and Profitability: Are earnings strong, stable, and likely to continue?

- Customer Base: Is revenue concentrated or diversified? Are contracts in place?

- Market Position: How does the business compare to others in its space?

- Operational Maturity: Are systems and processes in place, or does everything run through the owner?

- Growth Potential: What’s realistic in the next 3 to 5 years based on the current setup?

A proper valuation reflects how a buyer would evaluate risk and return. And without it, owners often overestimate worth or assume they can fix value gaps at the last minute. While many assume exit planning is reserved for larger firms, IEPA data shows that over two-thirds of CBEC® advisors place at least 50% of their work in Main Street businesses, showing how valuation matters at every level of the market.

Top 5 Factors Influencing Business Valuation for Exit Strategy and Why It Matters

Valuation is never static. It reflects both what your business is today and how it’s positioned for the future. To develop a valuation that holds up through negotiation and supports a successful exit, it’s essential to evaluate the right inputs.

Financial Performance and Consistency

Historical revenue, profit margins, cash flow, and debt levels form the quantitative core of valuation. But buyers also assess how consistent those numbers are over time.

Businesses with volatile earnings or unclear financial reporting face deeper scrutiny, leading to more conservative valuations or unfavorable deal structures.

Projecting Future Growth

A company trending upward, backed by reliable forecasts and a clear plan, commands stronger multiples than one that’s stagnant.

Growth potential shapes buyer expectations, especially in industries with evolving customer demands or tech disruption. Valuation isn’t just about where you’ve been but also about where you’re headed.

Market Position and Competitive Advantage

Differentiated offerings, pricing power, brand reputation, and customer loyalty all influence how buyers perceive strategic value. Companies with clear market positioning and limited direct competition often secure higher multiples, especially if recurring revenue plays a role in long-term stability.

Management Strength and Operational Independence

If the business cannot run without the owner, the value drops. A seasoned team that can operate independently is a signal to buyers that transition risk is low. This becomes a major leverage point, especially for financial buyers or internal succession models where continuity is important.

Industry Conditions and Buyer Demand

Industry trends, regulatory shifts, and general market activity all shape valuation benchmarks. Even strong businesses can see diminished offers during downturns or when few buyers are active. Timing is crucial, and valuation must be aligned with both internal readiness and external conditions.

The Role of the 4Cs in Business Valuation for Exit Strategy

When business owners begin planning for an exit, many focus on tangible assets or current revenue, but real enterprise value often sits beneath the surface.

Buyers and valuation professionals alike pay close attention to four critical areas that shape a company’s long-term sustainability and attractiveness: Customer, Human, Structural, and Social Capital.

1. Human Capital

Human Capital refers to the depth and reliability of the leadership team and staff. A business that runs smoothly without the owner’s daily involvement has a stronger foundation for transition. This includes skills, decision-making capacity, accountability, and leadership bench strength.

2. Customer Capital

Customer Capital includes the strength, diversity, and durability of customer relationships. Concentration risks, such as over-reliance on one or two major clients, can drag value down, while long-term contracts and broad customer loyalty lift it.

3. Structural Capital

Structural Capital reflects how well the business is organized. Documented systems, scalable processes, and efficient workflows make operations transferable and reduce risk for any future owner.

4. Social Capital

Social Capital captures the culture, values, and trust that hold the company together. A strong internal culture supports retention, performance, and adaptability during change, especially during leadership transitions.

These intangible factors influence a buyer’s confidence, a lender’s risk assessment, and an owner’s ability to scale. Strengthening the 4Cs makes the business healthier today.

Commonly Used Methods for Business Valuation for Exit Strategy

Choosing the right valuation method is critical to accurately estimating a business’s worth and making informed exit decisions.

In Exit Planning, three primary approaches are commonly used, each suited to different business types, industries, and ownership goals.

| Approach | Description | Best Suited For |

| Income-Based | Projects future cash flows (DCF) and discounts to present value. | Businesses with predictable earnings and growth. |

| Market-Based | Uses comparable transactions and industry deal activity. | Active industries with reliable transaction data. |

| Asset-Based | Values assets minus liabilities (book or liquidation value). | Asset-heavy firms or companies in wind-down mode. |

1. Income-Based Approaches

One of the most widely used methods is the Discounted Cash Flow (DCF) approach. It projects future cash flows and discounts them back to present value using a rate that reflects the business’s risk.

This approach works best for businesses with predictable earnings and growth trajectories. It helps owners see the value of future performance, not just current profits.

2. Market-Based Approaches

Comparable transaction analysis, or market comps, looks at recent sales of similar businesses. This method provides a benchmark based on real-world deal activity, offering insight into what buyers are paying.

It’s helpful in active industries with sufficient transaction data and is often used in tandem with other methods to validate pricing.

3. Asset-Based Approaches

This approach determines value based on the fair market value of the company’s tangible and intangible assets, less liabilities. Book value and liquidation value fall into this category. Asset-based valuation is standard for companies with significant physical assets or those in wind-down scenarios.

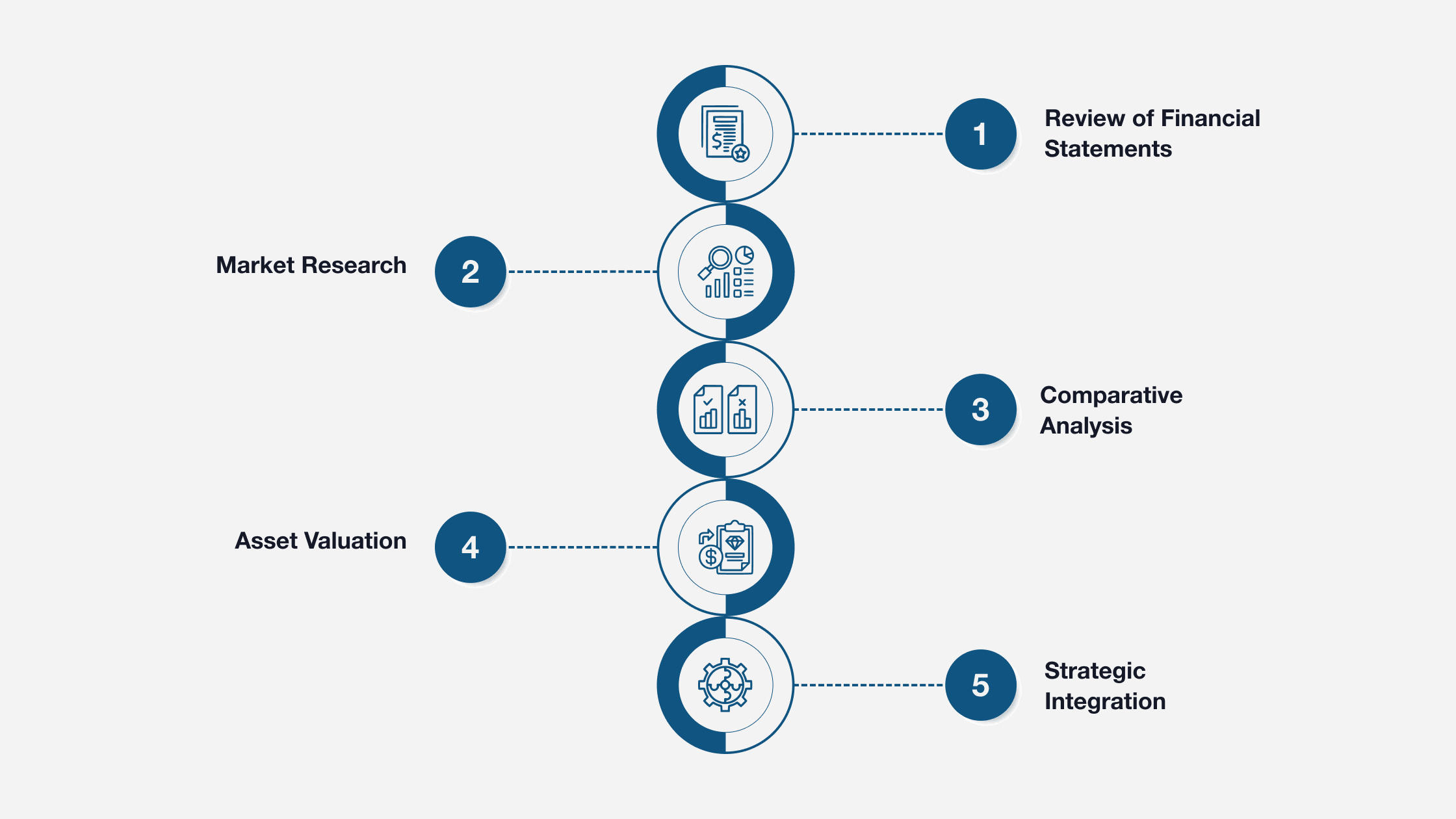

The Valuation Process to Determine Business Value

Here are the steps involved in determining business value.

Step 1: Review of Financial Statements

Valuation begins with a close examination of income statements, balance sheets, and cash flow reports, usually over the past three to five years. This review highlights revenue consistency, expense patterns, debt structure, and cash flow reliability.

Adjustments are made to reflect the true economic benefit to the owner, excluding personal or one-time expenses.

Step 2: Market Research

Business value is shaped by external conditions as much as internal performance. Market research considers buyer demand, industry risks, and capital availability. What drives value in a growing manufacturing sector may differ significantly from what appeals to buyers in a downturn.

Step 3: Comparative Analysis

Comparing similar businesses provides perspective. Private transactions, public company benchmarks, and industry multiples reveal whether your business is performing above, at, or below peer standards, validating valuation assumptions.

Step 4: Asset Valuation

Beyond tangible assets like cash and equipment, many businesses hold intangible value, customer contracts, proprietary processes, brand equity, or internal systems. These often weigh heavily in buyer interest and exit potential, especially in service-based or IP-driven industries.

Step 5. Strategic Integration

When combined, these steps provide owners with a realistic valuation that supports decision-making, clarifies expectations, and guides the overall Exit Planning strategy.

As an advisor guiding owners through Exit Planning, it’s essential to understand how valuation works and why it shapes every decision that follows. Having this knowledge builds credibility, ensuring you can lead clients with confidence from the very first conversation.

Lead Business Owners with Confidence Through Valuation and Exit Planning

Business valuation is the critical first step in every Exit Plan, and it’s where owners need clear, experienced guidance. The Certified Business Exit Consultant® (CBEC®) designation from the International Exit Planning Association (IEPA) provides financial advisors, CPAs, consultants, and part-time CFOs with the frameworks and hands-on training to lead valuation-driven conversations and guide owners from planning through execution.

With CBEC® certification, you’ll gain:

- A structured framework to lead valuation and Exit Planning engagements

- Practical methods for valuation readiness, successor planning, and deal preparation

- Integrated financial, tax, and legal strategies across advisory teams

- Confidence to lead owners through the conversations they often avoid

- Ongoing resources and access to a national network of practitioner

Help owners start with valuation, build trust, and exit on their terms.