Selling a business is often viewed as the finish line, but liability does not always end when the deal closes. Research shows that nearly 30% of private business sales result in post-closing indemnification claims, meaning a significant number of sellers face unexpected obligations after they believe the transaction is complete. These claims can arise from issues related to representations and warranties, tax matters, or undisclosed risks that surface after ownership changes hands.

Without thoughtful planning, sellers may remain financially exposed long after receiving their sale proceeds. Contract terms, deal structure, and pre-sale preparation all influence the risk a seller retains after the sale. Understanding how to limit that exposure is essential for owners who want to protect both their financial outcome and peace of mind after the transition.

In this blog, we will discuss the practical strategies every business owner should know to guard against future liabilities when selling a company, helping ensure that the value created over years of ownership is preserved beyond closing.

Importance of Post-Sale Liability

Many business owners assume that selling the company marks a clean break. In practice, sale agreements often extend a seller’s responsibility beyond closing through representations, warranties, and indemnification provisions. These clauses give buyers a path to recover losses if issues emerge after the transaction, even when the seller is no longer involved in day-to-day operations.

Post-sale liability can affect both financial security and personal plans. Claims may tie up sale proceeds through escrows or holdbacks, create legal expenses, or result in unexpected repayment obligations. Even minor issues can escalate into prolonged disputes if terms are unclear or poorly negotiated.

Understanding post-sale liability early allows sellers to manage risk rather than react to it. When owners recognize where exposure typically arises, they can negotiate protections, address issues before going to market, and exit with greater confidence that the next chapter will not be overshadowed by unresolved obligations.

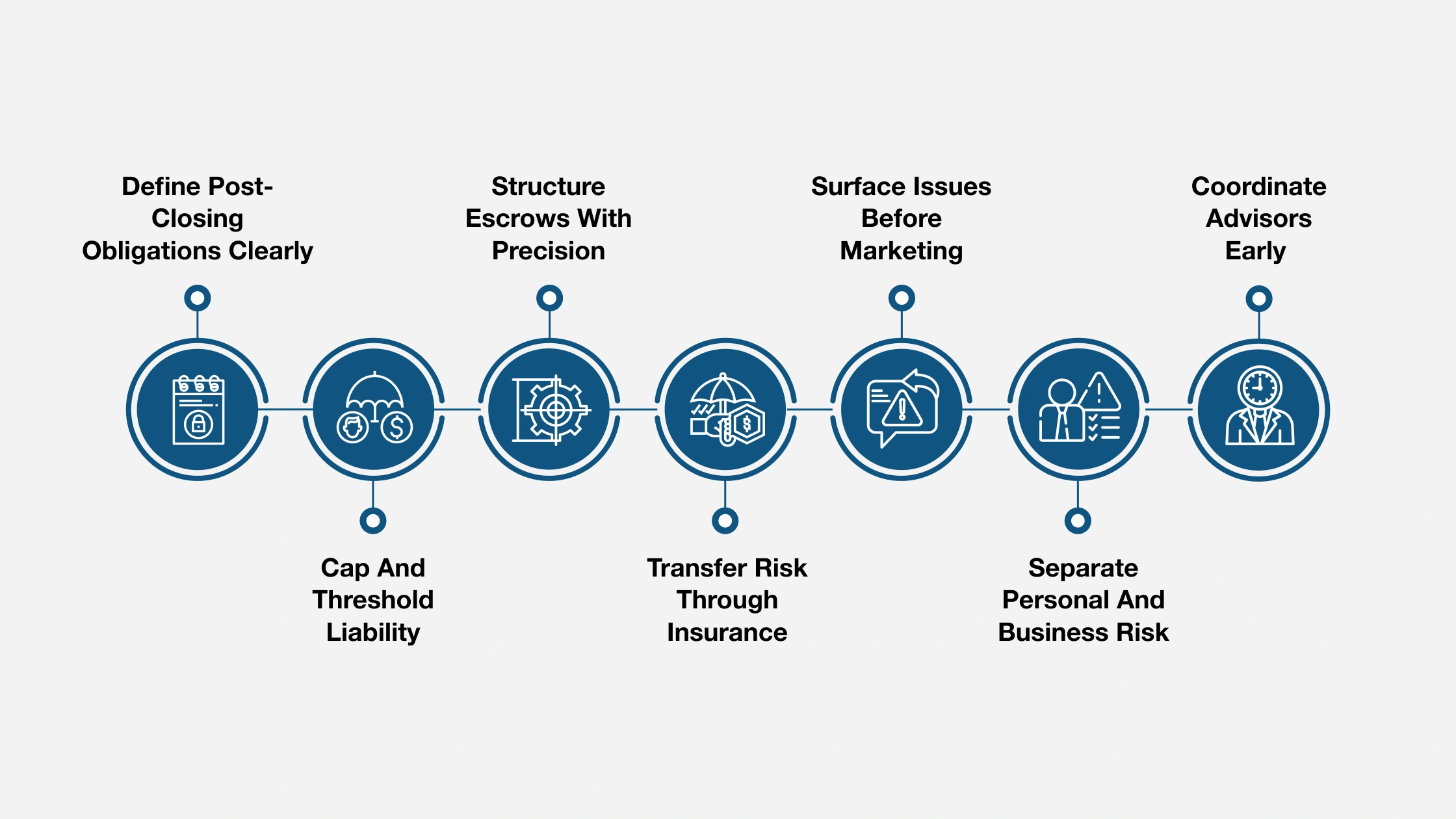

7 Strategies For Sellers To Protect Against Future Liabilities

The following strategies highlight practical steps every owner should consider to reduce post-sale risk and exit with greater certainty.

1. Define Post-Closing Obligations Clearly

Representations, warranties, and indemnities define the boundaries of a seller’s responsibility after closing. Without clear limits, these provisions can leave sellers exposed to broad and open-ended claims. Careful negotiation helps ensure that obligations are specific, reasonable, and aligned with the realities of the business.

Sellers should work to narrow the scope of warranties, apply materiality thresholds, and establish defined survival periods. Limiting the time within which claims can be brought and the types of issues that qualify for indemnification reduces uncertainty. Clear, well-defined terms protect sellers from lingering exposure while still providing buyers with appropriate assurances.

2. Cap And Threshold Liability

Indemnification caps and baskets are important for controlling the financial impact of post-sale claims. A cap sets the maximum amount a seller may be required to pay for indemnification, often expressed as a percentage of the purchase price. Without a cap, sellers risk facing liability that far exceeds what they expected to retain after closing.

Baskets function as thresholds that claims must exceed before indemnification applies. This prevents sellers from being drawn into disputes over minor or immaterial issues. Some baskets operate like deductibles, while others apply once a minimum level of claims is reached. Together, caps and baskets help sellers define clear financial boundaries, reduce exposure to small claims, and bring greater predictability to post-closing risk.

3. Structure Escrows With Precision

Escrow and holdback provisions are commonly used to address potential post-sale claims, but they must be structured carefully to avoid unnecessary restrictions on sale proceeds. These arrangements set aside a portion of the purchase price to cover future liabilities, giving buyers confidence while preserving a defined source of recovery.

Sellers can negotiate both the amount and duration of escrow or holdback funds. Limiting the size of the holdback and aligning the release timeline with warranty survival periods helps balance protection and liquidity.

When used thoughtfully, escrow structures manage risk without tying up more capital than necessary or extending exposure beyond what is justified.

4. Transfer Risk Through Insurance

Representation and Warranty Insurance can be an effective method for reducing a seller’s post-closing liability. RWI shifts certain breach-of-representation-and-warranty risks to an insurance provider, which can limit or even eliminate the need for large escrows or holdbacks. This approach often allows sellers to walk away with more certainty and faster access to proceeds.

Using RWI can also streamline negotiations. Buyers gain comfort knowing there is a dedicated source of recovery, while sellers reduce the likelihood of future claims against personal assets. Coverage terms, exclusions, and deductibles require careful review, but when structured properly, RWI helps create a cleaner exit and minimizes lingering financial exposure after the sale.

5. Surface Issues Before Marketing

Pre-sale due diligence is one of the most effective ways sellers can reduce future liability. Identifying and addressing potential issues before a buyer uncovers them helps prevent claims tied to undisclosed risks. This process allows sellers to correct inaccuracies, resolve outstanding matters, and present a clearer picture of the business.

Reviewing financial records, contracts, compliance obligations, and operational practices ahead of time strengthens disclosures and reduces surprises after closing. When sellers proactively surface known risks and document them properly, buyers have less basis for post-sale claims. Thorough preparation also improves negotiation leverage, as transparency builds trust and reduces the likelihood of disputes tied to alleged misrepresentation.

6. Separate Personal And Business Risk

Separating personal assets from business-related risk is an important step before entering a sale process. Without clear boundaries, sellers may remain exposed to liabilities tied to the business long after ownership transfers. Taking time to review entity structures, ownership arrangements, and personal guarantees helps limit this exposure.

Owners should assess how personal assets are connected to the business and unwind unnecessary entanglements where possible. This may involve addressing outstanding personal guarantees, reviewing shareholder agreements, or restructuring ownership to ensure liabilities stay within the business entity. Isolating risk before the transition protects personal wealth and reduces the chance that post-sale claims affect assets intended for the next chapter.

7. Coordinate Advisors Early

Protecting against future liability requires coordination across legal, tax, financial, and exit planning disciplines. Engaging an integrated advisory team early in the sale process helps sellers anticipate risks and structure protections before negotiations begin.

When advisors collaborate from the outset, they can align deal terms, disclosure strategies, and tax considerations into a cohesive approach.

Early involvement allows advisors to identify potential liability exposures, recommend appropriate safeguards, and prepare sellers for buyer scrutiny. This proactive coordination reduces last-minute compromises and helps ensure that risk management decisions support the seller’s broader exit goals. An experienced, aligned advisory team gives sellers greater confidence that the transaction is structured to protect both value and peace of mind after closing.

How IEPA-Trained Advisors Help Sellers Reduce Post-Sale Risk

Selling a business involves far more than agreeing on a price. Post-sale risk often emerges through indemnification claims, disclosure disputes, tax matters, or obligations that surface after closing. Advisors trained through the International Exit Planning Association (IEPA) approach these risks as part of a broader exit planning process rather than treating them as isolated legal issues.

IEPA-trained Certified Business Exit Consultant® (CBEC®) advisors help sellers identify potential liability exposure early in the exit timeline. This includes evaluating where risk is likely to arise, how deal structure affects ongoing responsibility, and how personal and business assets may remain connected after the sale. By addressing these issues before negotiations begin, sellers gain more control over how risk is allocated.

CBEC® advisors also coordinate closely with legal, tax, and financial professionals to ensure disclosures, indemnity terms, and protective mechanisms align with the seller’s long-term goals. This integrated approach helps sellers avoid reactive decisions, reduce surprises after closing, and step away from the business with greater confidence that future liabilities have been thoughtfully managed.

Build an Executable Exit Plan With A CBEC® Trained Advisor

An effective business exit is shaped long before a transaction takes place. It begins with early planning, informed choices, and a clear understanding of how today’s decisions affect future outcomes. Advisors trained through the International Exit Planning Association’s Certified Business Exit Consultant® (CBEC®) program are equipped to guide owners through this process with structure and discipline.

CBEC® trained advisors take a comprehensive view of exit planning, integrating valuation insights, timing considerations, tax awareness, and deal structure into a coordinated strategy. This approach helps business owners identify value gaps early, improve readiness over time, and make decisions that align with both financial objectives and personal priorities.

Whether an ownership transition is several years away or actively under consideration, working with a CBEC®-trained advisor supports a more deliberate, informed exit planning process. Owners gain clarity, confidence, and a plan built around what matters most.

Connect with a Certified Business Exit Consultant® and take the first step toward a well-prepared exit.