Advisors must collaborate on exit planning projects because no single advisor possesses all the expertise required to address the various financial, legal, business, valuation, tax, succession, retirement, and personal complexities of an exit. Collaboration ensures that the client receives the professional guidance needed to reduce the business owner’s risks and navigate the complex issues involved in the transaction.

When different exit planning advisors collaborate on an exit, a healthy working relationship and successful engagement hinge on clarity, structure, and mutual respect.

This article provides guidelines for crafting this relationship to ensure the best outcome for the client.

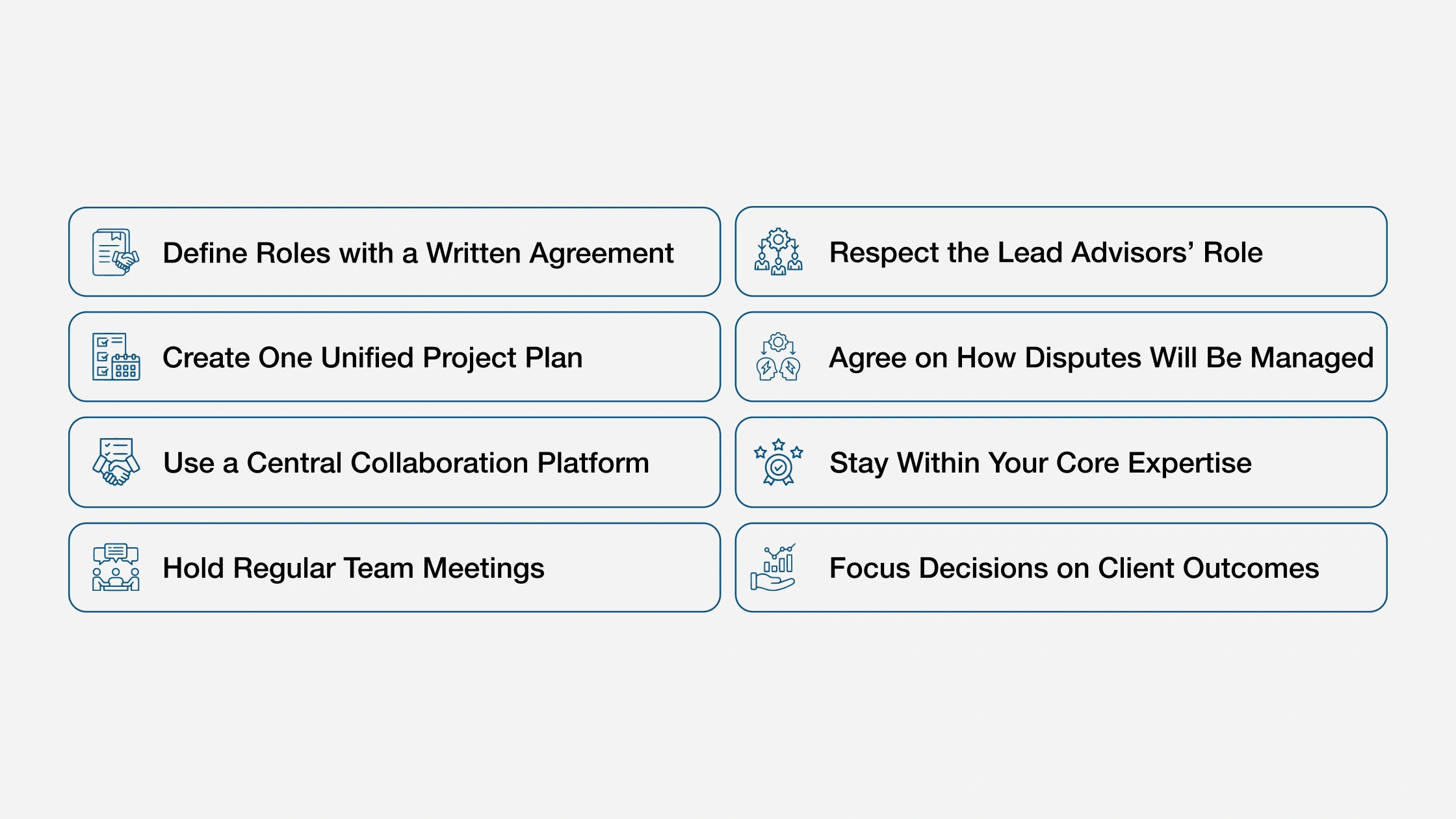

Best 8 Engagement Guidelines for Aligned Exit Planning

These eight engagement guidelines provide a structured framework for exit advisors to collaborate effectively and deliver the best results for business owners.

Define Roles with a Written Agreement

Collaborating advisors should establish an explicit, written working agreement at the outset of the engagement that outlines the purpose of the agreement, roles and responsibilities, compensation, confidentiality, dispute resolution procedures, communication protocols, and the terms of termination. This agreement helps build trust, prevent misunderstandings, align expectations, and provides a framework for resolving conflicts in a professional manner.

This agreement should also document the role of the lead advisor, including how they will communicate with the client and the team, as well as the process for collecting project data, implementing the project, and managing any project-related issues.

Create One Unified Project Plan

Collaborating exit advisors should also come together to create a single project plan that spells out the scope of work, the role of each advisor, project deliverables, milestones, due dates, metrics, payment terms, and the communications strategy of the exit planning advisory team.

Use a Central Collaboration Platform

If you are not using an industry-specific platform like BizEquity, MAUS, or ExitMap to share files, consider using collaboration tools such as Google Sheets, Slack, or Trello.

Advisors should use a single central email chain, such as Slack, for all team communication. Advisor correspondence should remain professional, and team members should share updates on time.

The lead advisor and the other team members should also collaborate on summary reports, and the lead advisor should hold team meetings to celebrate milestones, recognize team performance, and share lessons learned.

Hold Regular Team Meetings

The team of advisors should hold periodic meetings (in person or virtually) to review project progress and align the team’s thinking on strategy, messaging, project progress, task & delivery status, client feedback & concerns, obstacles & upcoming tasks, and handoffs.

Tasks can also be further discussed by project area, such as exit readiness, personal financial planning, business valuation, value growth, succession planning, legal agreements, and post-transaction follow-ups, among others. Significant decisions should be made after a team discussion.

Respect the Lead Advisors’ Role

Advisors should meet with the lead advisor to discuss final decisions that could impact their relationship with the client, avoid meaningful side conversations with the client that exclude the lead advisor, and be transparent about any potential conflicts of interest.

Agree on How Disputes Will Be Managed

Don’t wait for a crisis. Agree to meet immediately to resolve any differences in opinion. Some advisors include dispute resolution provisions in their advisory agreements. If you reach a deadlock, consider bringing in a Certified Business Exit Consultant, CBEC,® or the appropriate expert to help resolve the dispute.

Stay Within Your Core Expertise

Socrates defined wisdom not as possessing knowledge of all things, but rather as “knowing what you know, and knowing what you don’t know.” Stick to your wheelhouse. Refer legal, tax, insurance, financial planning matters, etc., to qualified professionals. If advisors’ expertise overlaps, agree in advance who will take the lead on that part of the project.

Focus Decisions on Client Outcomes

The north star when problems arise should always be “what is best for the client.” When there is a disagreement among advisors, this question should be used as the decision filter, so discussions stay constructive.

Achieve Your Exit Goals Through Collaboration

Approximately 75% of sellers report that their exit failed to meet personal or financial goals, often due to insufficient planning and a lack of an integrated team approach.

Approximately 75% of sellers report that their exit failed to meet personal or financial goals, often due to insufficient planning and a lack of an integrated team approach.

Multidisciplinary teams drive better exit outcomes. According to topdollarexits.com, over 85% of top-performing business owners who have a formal exit plan engaged outside advisors, demonstrating that collaboration across expertise areas is critical for success.

These statistics confirm that team-based, collaborative planning with complementary exit advisors sharing roles, communication, and a coordinated strategy significantly improves the likelihood of achieving the business owner’s exit and succession goals.

You can find a directory of CBECs® and other exit and succession planning experts on the International Exit Planning Association website.

Find Certified Professionals Now!

About the Author:

James J. Talerico, Jr. CMC ® CBEC ® is an award-winning author, blogger, speaker, and a nationally recognized small to mid-sized (SMB) business expert, with outstanding business consulting, succession planning, value acceleration, and exit planning credentials. He is the owner of Greater Prairie Business Consulting, Inc. (www.greaterprairiebusinessconsulting.com) located in Irving, Texas and has helped thousands of business owners throughout the US and in Canada maximize their business performance and exits for more than 30 years. Jim currently sits on The IEPA’s Education Committee.