Every business moves through predictable phases—startup, growth, maturity, and eventually, transition. While most owners plan obsessively for the first three, they often ignore the fourth.

Less than one in four private firm boards report having a formal succession plan, exposing ownership and enterprise value to unnecessary risk. Leadership gaps emerge without a clear transition strategy, and potential exit opportunities diminish.

Succession is a strategic process to preserve value, ensure business continuity, and align ownership goals with operational realities. It creates optionality for the owner, the leadership team, and the future of the business itself.

In this blog, we’ll discuss the core components of effective succession planning, starting from the basics.

What Is Business Succession Planning?

| Business succession planning is the deliberate process of preparing for the transfer of a company’s leadership, ownership, and operational control. It ensures that a business can continue to thrive beyond its current leadership, whether the transition is planned or unexpected. |

At its core, succession planning is about continuity. It aligns long-term business strategy with leadership development, equity transfer, and owner objectives. While the term is often associated with retirement, effective succession planning addresses various scenarios, including disability, death, unexpected departures, or strategic exits.

Succession planning is an ongoing, dynamic process that involves:

- Identifying and developing future leaders within or outside the business

- Clarifying ownership goals across generations, partners, or stakeholders

- Creating contingency plans for key-person risk or sudden disruptions

- Establishing clear timelines, structures, and governance protocols

A succession plan safeguards the enterprise’s longevity and the existing owner’s financial future if done right. It also provides clarity and confidence for employees, clients, and future investors about long-term enterprise value.

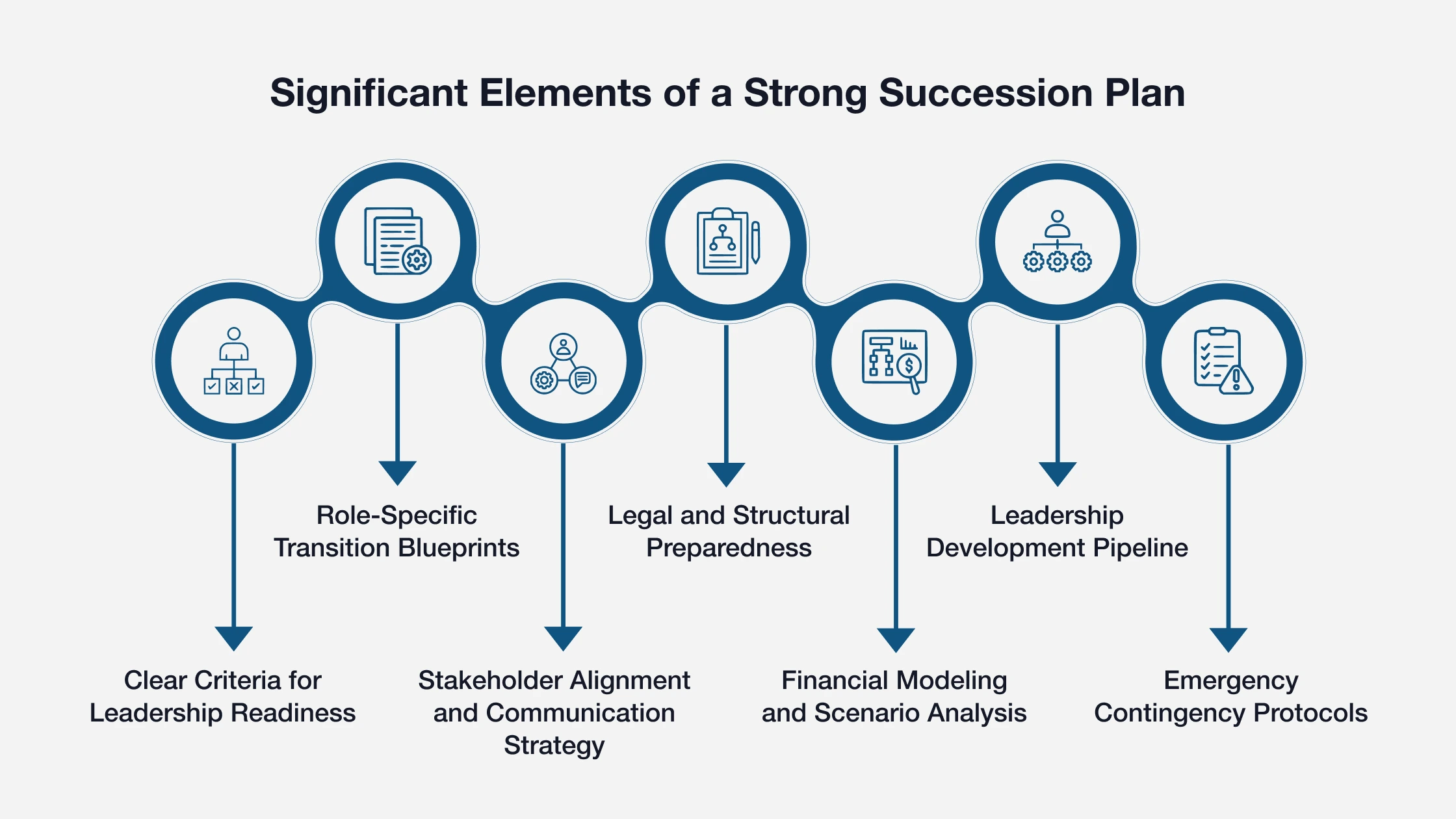

Significant Elements of a Strong Succession Plan

Here are the foundational components that set effective plans apart:

1. Clear Criteria for Leadership Readiness

Strong plans define the specific skills, behaviors, and experiences needed to lead the business into its next phase rather than relying on tenure or familiarity. These criteria help ensure that succession decisions are merit-based and aligned with strategic goals.

2. Role-Specific Transition Blueprints

Each central position should have a tailored transition path. This includes timelines, onboarding frameworks, and a clear breakdown of responsibilities during the handoff—ensuring that no knowledge gaps disrupt operations.

3. Stakeholder Alignment and Communication Strategy

Successful transitions require more than internal planning. Owners, partners, family members, board members, and employees must be kept informed, at the right time and in the right way. An intentional communication plan prevents confusion and builds trust.

4. Legal and Structural Preparedness

From updating operating agreements to restructuring ownership shares or trust documents, legal readiness is a core pillar. Many succession plans fail due to overlooked technicalities. Clear documentation reduces risk and prevents post-transition disputes.

5. Financial Modeling and Scenario Analysis

Succession plans should incorporate financial forecasts tied to different transition scenarios. Will the successor buy in? Will there be an earn-out? These details impact tax treatment, estate planning, and funding strategies—and must be modeled in advance.

6. Leadership Development Pipeline

A strong plan invests in future leaders before a transition is imminent. This may include mentorship, stretch assignments, or rotating roles to prepare individuals for decision-making under pressure. It’s not just about identifying talent—it’s about actively building it.

7. Emergency Contingency Protocols

Unplanned exits due to health issues, accidents, or sudden resignations require a clear backup strategy. Strong succession planning includes interim leadership designations and a documented emergency response plan to maintain continuity.

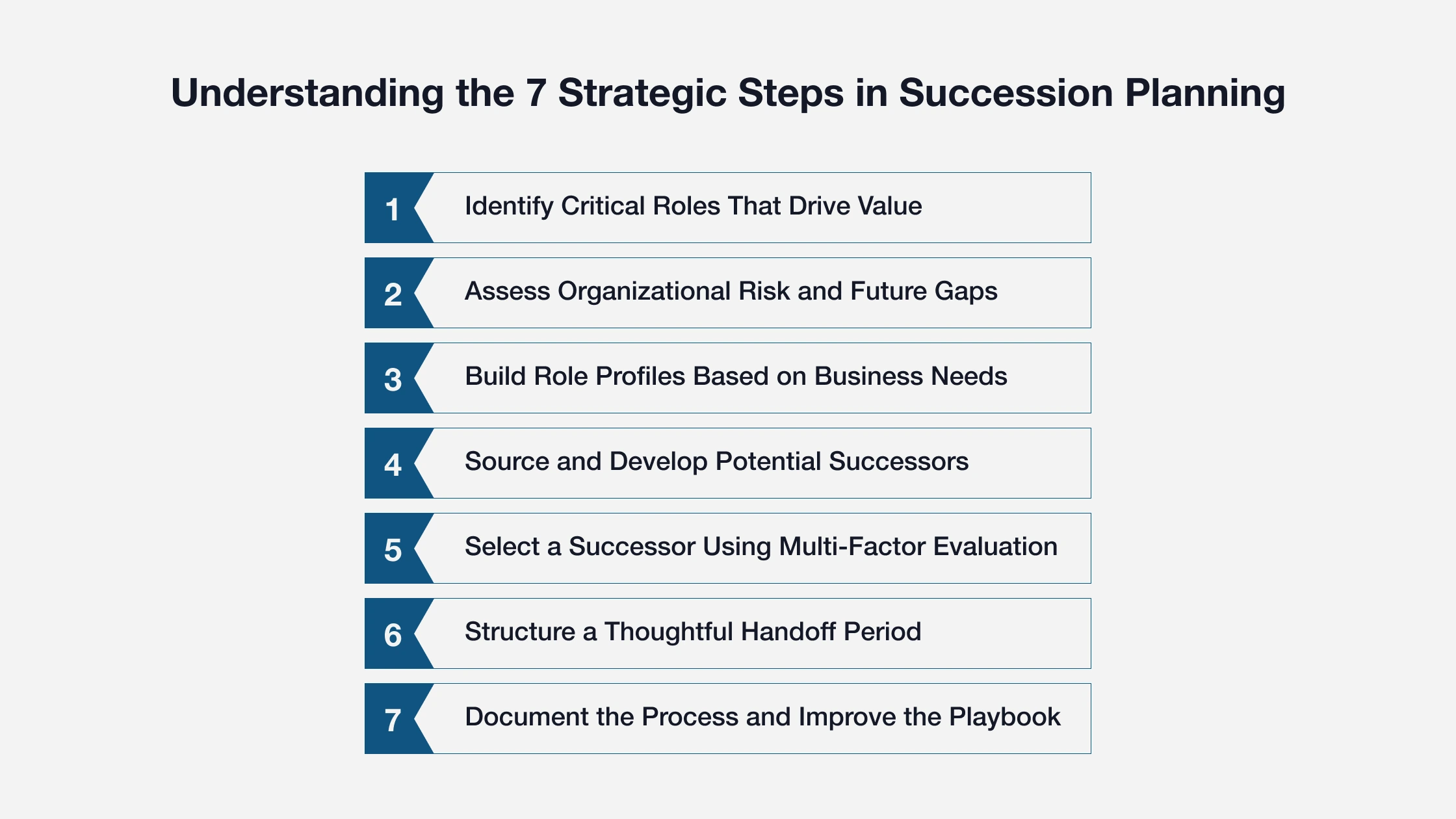

Understanding the 7 Strategic Steps in Succession Planning

Succession planning reduces disruption, strengthens leadership pipelines, and preserves institutional knowledge. But execution matters. Here’s a structured seven-step process to help guide your planning.

1. Identify Critical Roles That Drive Value

Not every position requires a formal succession plan. Start by pinpointing the roles most essential to operational continuity and strategic execution. These may include executive leadership, client-facing specialists, or niche technical experts.

Think beyond job titles—what functions would directly impact the business if left unfilled? Once identified, map out the main competencies, licenses, and interpersonal capabilities required for each role. This becomes your baseline for planning.

2. Assess Organizational Risk and Future Gaps

Now that you’ve identified mission-critical roles, shift focus to potential vulnerabilities. Analyze retirement timelines, performance concerns, attrition trends, and business expansion plans.

Ask: Which roles are at risk of becoming vacant within the next 12–36 months? What internal or external changes could accelerate these transitions? This step creates a prioritized roadmap where urgency and impact intersect.

3. Build Role Profiles Based on Business Needs

Next, translate abstract requirements into structured role profiles. This means defining core responsibilities, qualifications, soft skills, and future growth expectations. Consider how these roles might evolve in the next 3–5 years and what capabilities will be needed to keep pace.

Avoid simply duplicating the current role-holder’s skills. Instead, design each profile to reflect the business’s strategic direction and emerging demands.

4. Source and Develop Potential Successors

With clear profiles in place, focus on sourcing viable candidates. This may involve internal development, targeted recruiting, or both. Effective strategies often include:

- Talent pipeline mapping

- Internal leadership programs

- Role-specific training plans

- Employee referral initiatives

Succession planning is most effective when it’s proactive. Waiting until a role becomes vacant limits options. Instead, create momentum now, even if the transition timeline is still fluid.

5. Select a Successor Using Multi-Factor Evaluation

Selection isn’t just about technical skills. Strong successors align with the company’s culture, communication style, and long-term vision. To evaluate fit, use a combination of interviews, peer input, behavioral assessments, and real-world simulations.

Cultural alignment matters just as much as competency. Look for candidates who can adapt to the organization’s working rhythms while bringing their strengths.

6. Structure a Thoughtful Handoff Period

Once a successor is selected, create a structured transition period. This often includes shadowing, phased responsibility handoff, process walkthroughs, and one-on-one mentoring from the outgoing leader.

Timing is important. Too short of a time, and critical knowledge may be lost; too long, and the new leader may feel stifled. Strike a balance that allows space to learn, make decisions, and build credibility without rushing or dragging the process.

Use shared knowledge systems to preserve institutional insights in an accessible, reusable format.

7. Document the Process and Improve the Playbook

After the transition, reflect and document what worked and what didn’t. Capture insights like:

- Which skills or processes were more complex to transfer?

- What would you change about the timeline?

- Were there any gaps in readiness or role clarity?

Use these findings to strengthen your next succession effort.

Common Pitfalls in Succession Planning

Despite the best intentions, many succession plans fall short due to preventable missteps. Understanding these pitfalls can help advisors and business owners approach the process with greater clarity and foresight.

1. Treating Succession as a One-Time Event

Succession is not a transaction. It’s a strategic process. Businesses that approach it as a singular milestone often miss the opportunity to build leadership capacity over time. Without ongoing planning, unexpected changes can destabilize operations.

2. Failing to Define Successor Criteria Upfront

Many owners choose successors based on familiarity or loyalty rather than capability. Transitions become subjective and potentially damaging to future business performance without clearly defined competencies and performance benchmarks.

3. Avoiding Difficult Conversations

Succession often involves emotionally charged topics—especially in family-owned businesses. Avoiding honest dialogue around leadership readiness, equity distribution, or exit intentions can lead to fractured relationships and legal disputes.

4. Neglecting Financial Preparedness

Succession without financial modeling creates conditions for instability. Whether it is buyout funding, tax liabilities, or compensation restructuring, ignoring the financial implications can erode business value during the transition.

5. Lack of Documentation

Verbal agreements and informal plans don’t stand up when tested. Businesses risk confusion, misinterpretation, and costly litigation without properly documented roles, responsibilities, and contingency protocols.

6. Overlooking Team and Culture Impact

Transitions don’t just affect owners—they ripple through the entire organization. Failure to prepare the leadership team and engage employees in the change process can undermine morale, retention, and operational momentum.

7. Waiting Too Long to Start

Procrastination is one of the most common and costly mistakes. Succession planning should begin long before a planned transition. Waiting until retirement is on the horizon often leads to rushed decisions and missed opportunities for mentorship and continuity.

The Importance of Client-Facing Professionals in Effective Succession Planning

Succession planning isn’t a solo effort. Professional leadership must guide complex decisions with clarity, strategy, and empathy. Whether you’re a CPA, attorney, consultant, advisor, or any other client-facing advisor, your role goes beyond technical input.

1. Strategic Facilitator Over Technical Specialist

Client-facing professionals bring structure to what can often be an emotionally driven and ambiguous process. They help owners align their personal goals, business objectives, and stakeholder interests into a cohesive plan. This includes mapping timelines, defining successor criteria, and preparing contingency scenarios.

2. Translator Between Generations and Stakeholders

In family-owned or multi-partner businesses, advisors or consultants often act as neutral third parties who bridge gaps between generations, co-owners, or major employees. Their role includes facilitating crucial conversations, managing expectations, and ensuring alignment across decision-makers.

3. Risk Manager and Value Protector

Succession introduces reputational, financial, and operational risks. Your job is to identify these threats, leadership gaps, tax liabilities, and liquidity issues and build strategies that protect enterprise value through every transition phase.

4. Leadership Development Partner

Client-facing experts help assess the capabilities of internal successors and build leadership development pathways to ensure long-term continuity. They work closely with owners to identify training needs, implement mentorship programs, and create benchmarks for successor readiness.

5. Integration Point for the Advisory Team

Succession planning touches every domain: legal, financial, tax, and human capital. A skilled lead professional brings all parties together, coordinates timelines, and drives accountability, turning what could be a fragmented process into a unified strategy.

How Does IEPA’s CBEC® Certification Prepare Professionals to Lead Succession Planning

Dealing with succession is all about knowing which questions to ask, when, and how to lead others through uncertainty. That’s the mindset behind the IEPA’s Certified Business Exit Consultant® (CBEC®) program.

This practitioner-led certification goes far beyond theoretical knowledge. It equips experienced professionals, including CPAs, attorneys, consultants, financial advisors, etc., with the frameworks and real-world insights needed to take the lead on complex succession and exit planning engagements.

How Does the CBEC® Certification Help

1. Built by Practitioners, for Practitioners

Learn from seasoned Exit Planners who’ve led fundamental transitions, not just taught them. Every module is grounded in field experience, not theory. CBEC-certified advisors are more likely to specialize fully in exit planning, with many focusing their entire practice on M&A advisory. 19% of CBEC holders use exit planning as a bridge to introduce other advisory services, while 26% use it specifically to prepare businesses for the market.

2. Comprehensive Curriculum with Succession Planning at the Core

From business readiness and valuation drivers to leadership transition and family dynamics, the program offers a 360° approach to planning that owners genuinely value.

3. Real-World Certification Project

CBEC® candidates must complete a live client project, applying the framework in practice—not just passing an exam.

4. Strategic Advisory Skills Development

Training includes coaching methods, client facilitation skills, and advisory team coordination—empowering professionals to operate as lead advisors from day one. These capabilities are especially critical given that more than two-thirds of advisors say at least 50% of their clients fall within the ‘Main Street’ category, as defined by IBBA and similar organizations. Main Street business owners often require more hands-on guidance and strategic leadership throughout the exit process, making these skills a core part of successful engagements.

5. Positioning and Practice Growth Support

Graduates don’t just gain technical expertise—they learn how to reposition their firm, create new service offerings, and multiply revenue through deeper client relationships. In fact, 22% of CBEC certification holders claim to earn over $250,000 with the help of the course.

Business professionals who want to elevate their role and deepen their value in succession conversations will find the CBEC® certification an essential next step.

Lead Strategic Business Transitions with Confidence and Credibility

Succession planning is a leadership responsibility. Advisors who understand how to guide ownership transitions don’t just protect value; they help create it. With the proper training, you can become the go-to expert clients rely on during critical inflection points.

By earning certification through the IEPA, you’ll learn how to:

- Navigate real-world succession scenarios with precision

- Translate complex planning into practical client action

- Anticipate leadership gaps before they disrupt performance

- Strengthen your role as a strategic advisor

Business owners are looking for guidance. Step into that role with confidence and credibility.

Get certified. Lead the transition.