Every global owner reaches a moment when the future of the business needs clarity, leadership needs direction, and decades of work deserve protection. A multinational enterprise carries layers of complexity that influence how owners transition, how successors step in, and how wealth ultimately moves from the business to the next stage of life.

Owners remain underprepared for an event expected within the next 10 to 15 years, despite growing demographic pressure and rising transition volume. Companies operating in different jurisdictions face even greater demands because regulations, tax systems, compliance requirements, and operational dependencies differ across regions.

A transition without preparation can expose the business to avoidable tax liabilities, valuation discounts, leadership gaps, or regulatory delays.

In this blog, we will discuss the best succession planning strategies for multinational business owners and how owners can build a practical succession plan that strengthens enterprise value, reduces risk, and prepares the organization for long-term continuity.

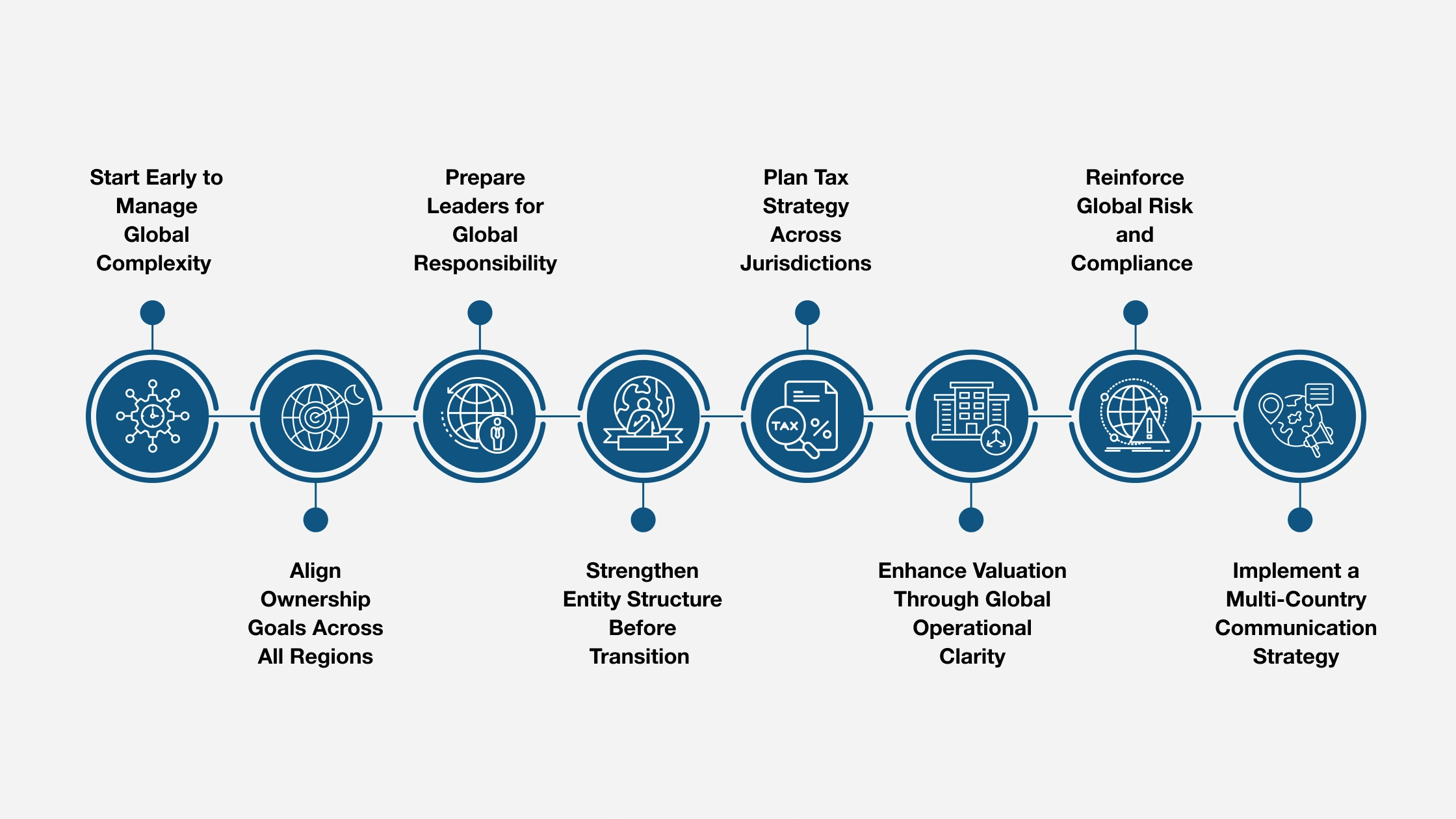

Top 8 Succession Planning Strategies for Multinational Business Owners

The following eight strategies offer a practical roadmap for preparing global companies for a smooth, value-preserving succession.

1. Start Early to Manage Global Complexity

Early preparation gives advisors the time and clarity needed to manage complexities without creating pressure later in the transition.

Create Time for Strategic Preparation

- Multinational transitions require far more preparation time than domestic ones.

- Early planning lets advisors evaluate owner goals and long-term expectations.

- Additional lead time supports coordinated planning across regions and functions.

Coordinate Timelines Across All Regions

- Each jurisdiction introduces unique regulatory and ownership-transfer processes.

- Late planning causes jurisdictional timelines to overlap and slow due diligence.

- Starting early allows advisors to assess registration, compliance, and tax cycles upfront.

Strengthen Value Through Early Readiness

- Early investment in documentation and operational stability increases buyer confidence.

- Strong reporting systems and cross-border clarity reduce deal friction.

- Advisors can position the company as compliant, scalable, and ready for succession, supporting stronger valuation.

2. Align Ownership Goals Across All Regions

Owners with global operations must ensure their personal objectives, legal constraints, and succession plans remain aligned across every country in which they operate. Advisors support this process by clarifying priorities early, evaluating region-specific restrictions, and guiding owners toward a succession path that fits both strategic goals and long-term governance needs.

Advisors begin by helping owners articulate the priorities that will shape every decision ahead, including:

- Wealth needs and future involvement

- Geographic preferences and relocation plans

- Family expectations and legacy goals

- Philanthropic interests and long-term governance vision

With priorities defined, advisors evaluate legal constraints in each region. Ownership transfers must comply fully with local laws, foreign-ownership limits, licensing requirements, regulatory reviews, and notarization standards. Mapping these constraints early prevents delays and keeps the transition legally viable across borders.

Choosing the right succession path is equally critical. Options such as internal leadership development, family succession, MBOs, private equity recapitalization, or strategic acquisition each carry distinct tax, cultural, and governance implications. Advisors assess successor readiness, regional leadership expectations, and market appetite to guide owners toward the path that best fits global needs.

Once priorities and legal realities are established, advisors integrate them into the broader strategy so that leadership development, market expansion, risk management, and reporting improvements all reinforce the owner’s intended exit path.

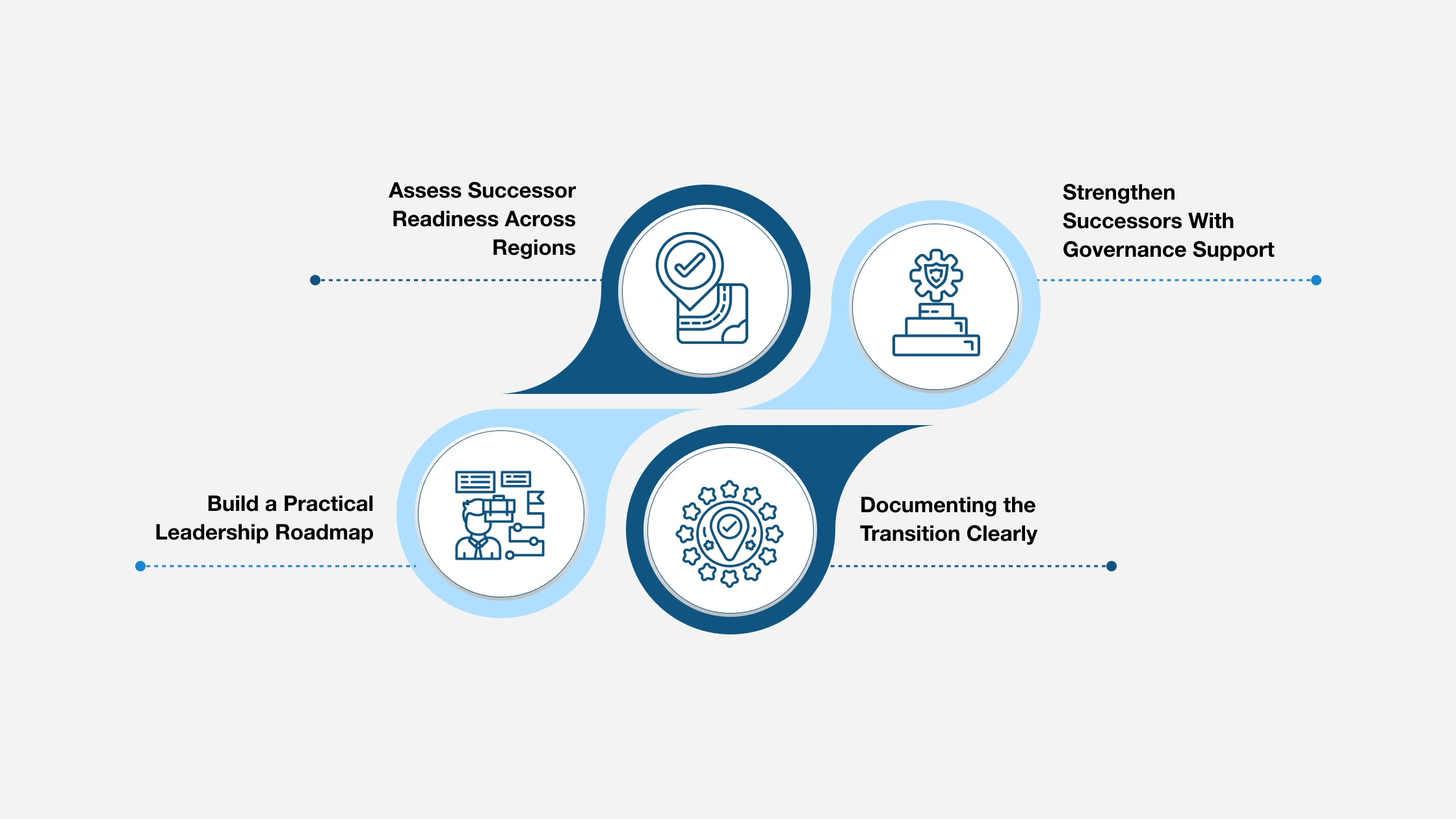

3. Prepare Leaders for Global Responsibility

Advisors help owners build a leadership bench capable of managing cross-border complexity and sustaining performance through succession.

Assess Successor Readiness Across Regions

Advisors evaluate leadership capability through diagnostics that measure strategic decision-making, multinational communication, regulatory understanding, and multi-regional operational management. These assessments reveal development needs that could affect global performance.

Build a Practical Leadership Roadmap

A strong roadmap gives successors exposure to regional operations through rotations, cross-border initiatives, and compliance involvement. Assigning multi-currency budgeting responsibilities deepens financial understanding, while mentorship from current leadership builds continuity and decision-making confidence.

Strengthen Successors With Governance Support

Advisory boards, regional councils, and specialist committees provide decision frameworks and institutional oversight. These structures help successors maintain direction and accountability, reducing risk during early leadership transitions.

Documenting the Transition Clearly

A structured plan outlines authority levels, reporting lines, milestones, and expected timelines. Clear documentation reduces uncertainty, supports internal communications, and helps international teams adjust to the upcoming leadership shift.

4. Strengthen Entity Structure Before Transition

A thorough structural review helps owners understand how efficiently ownership can transfer across borders and how the current setup affects tax exposure, reporting obligations, and exit feasibility.

Advisors assess holding companies, subsidiaries, partnerships, and joint ventures to determine whether the structure supports a clean, confident transition. Along the way, they examine intercompany agreements, shareholder arrangements, licensing obligations, and regional filing requirements to uncover inconsistencies or outdated elements that could slow buyer diligence.

Major actions advisors take include:

- Evaluating transfer readiness across entities to surface risks tied to ownership movement and liability.

- Identifying structural gaps early, including missing documents, outdated agreements, and compliance inconsistencies.

- Implementing targeted improvements such as streamlining holding companies, updating governance materials, or refining regional management responsibilities to present a cleaner, more efficient structure.

- Aligning the structure with long-term strategy to confirm it supports the owner’s intended exit path and future leadership model.

These combined efforts ensure the entity structure is prepared for transition, minimizes surprises for buyers, and protects value throughout the succession process.

5. Plan Tax Strategy Across Jurisdictions

Advisors help owners manage multi-country tax rules with clarity, reducing risk and ensuring the transition is structured with long-term financial confidence. Here’s a typical 4-stage tax strategy timeline:

Stage 1: Map Tax Exposure

Advisors assess corporate taxes, personal taxes, capital gains exposure, exit taxes, withholding rules, CFC regulations, and reporting obligations across jurisdictions. This comprehensive mapping prevents unexpected liabilities and reveals structural gaps early in the process.

Stage 2: Align Personal and Corporate Decisions

A unified strategy evaluates shareholder residency, deal structure, entity classification, retirement planning, and long-term wealth distribution. Advisors model multiple scenarios to ensure personal goals and corporate tax outcomes move in the same direction.

Stage 3: Optimize Treaty Advantages

Double-taxation treaties can reduce withholding taxes, lower capital gains exposure, or improve repatriation efficiency. Advisors identify treaty opportunities early so owners can structure the transition in the most tax-efficient manner available.

Stage 4: Prepare Early to Avoid Pressure

Tax restructuring, documentation updates, and residency planning require time. Advisors who begin early reduce timeline compression, improve compliance, and create a smoother path for both owners and successors.

6. Enhance Valuation Through Global Operational Clarity

A focused review across regions helps owners understand how global operations influence valuation and where improvement creates a measurable impact.

- Strengthen Global Clarity: Enhances visibility into performance drivers, risk exposure, and scalability to support stronger valuation outcomes.

- Assess Regional Performance: Evaluates revenue stability, customer concentration, currency exposure, and regional profitability to identify strengths and operational gaps.

- Upgrade Reporting Quality: Improves contract accuracy, documentation strength, and financial consistency to increase buyer confidence.

- Demonstrate Scalable Systems: Shows buyers repeatable, integrated global processes that support sustainable operations and future growth.

- Optimize Transition Timing: Aligns the exit with favorable economic cycles, geopolitical conditions, and sector trends to maximize valuation.

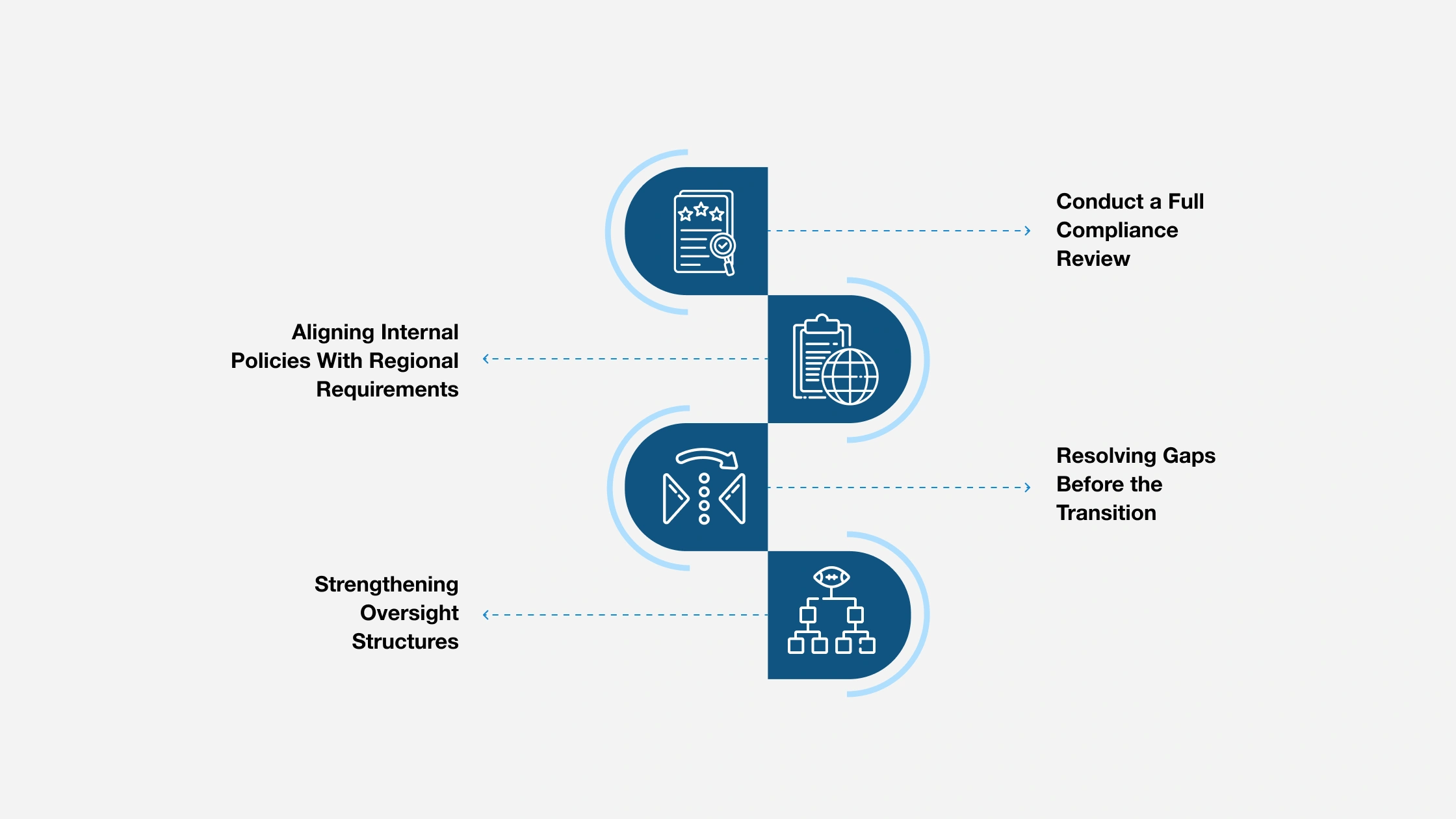

7. Reinforce Global Risk and Compliance

Strengthening global risk and compliance begins with clear systems that support consistency across every location. Here’s how it should be done:

Step 1: Conduct a Full Compliance Review

Advisors assess data privacy, anti-corruption requirements, labor standards, cybersecurity rules, tax reporting, licensing, and regulatory filings across all regions. This review identifies compliance gaps that must be addressed early.

Step 2: Aligning Internal Policies With Regional Requirements

Global companies benefit from consistent frameworks that adapt to local laws. Advisors help owners update internal policies to create clarity for employees and reduce operational risk.

Step 3: Resolving Gaps Before the Transition

Outdated documents, incomplete registrations, or non-compliant practices weaken enterprise value. Early remediation ensures buyers and successors inherit a stable, well-governed organization.

Step 4: Strengthening Oversight Structures

Boards, compliance committees, and advisory groups reinforce governance during transition. These structures support successors and help maintain discipline across global operations.

8. Implement a Multi-Country Communication Strategy

Here are a few steps that advisors should follow for effective communication:

- Building a Phased Communication Plan: Advisors must identify major groups requiring early communication, leadership teams, regional managers, employees, customers, and suppliers. A phased plan protects confidentiality and maintains stability.

- Tailoring Messages to Cultural Expectations: Each region responds differently to leadership changes. Advisors help craft messages that respect cultural norms and provide clarity without creating internal disruption.

- Sustaining Customer and Supplier Confidence: Transitions can create uncertainty for external partners. Clear, consistent communication reassures stakeholders that operations remain stable and that commitments will continue.

- Supporting Successors Through Internal Change: New leaders depend on transparent communication to build credibility. Advisors guide messaging that reinforces alignment, encourages trust, and supports a smooth integration into the role.

How Does IEPA Support Advisors Leading Global Succession Planning?

Global succession planning requires more than technical knowledge. Advisors must coordinate ownership goals, tax exposure, leadership readiness, valuation drivers, compliance obligations, and communication demands across multiple countries. This level of complexity calls for structured methodology, real-world frameworks, and a professional credential that signals mastery.

The International Exit Planning Association (IEPA) fills that need. IEPA equips financial advisors, CPAs, attorneys, consultants, and part-time CFOs with practical, experience-driven training that reflects how real transitions unfold, especially in environments where regulations, tax systems, and entity structures vary by region.

Through the Certified Business Exit Consultant® (CBEC®) program, advisors gain the skills to evaluate global structures, coordinate multi-jurisdiction tax planning, assess successor readiness, and build actionable transition strategies. Every component of the CBEC® curriculum focuses on application, not theory, giving advisors the confidence to lead multinational owners through complex decision cycles.

Advisors certified with IEPA learn how to identify structural and regulatory barriers early, guide owners through global readiness assessments, and integrate tax, valuation, and compliance considerations into a unified transition plan. Their insight transforms uncertainty into preparation, enabling clients to preserve enterprise value and exit on their terms.

Lead Global Succession Planning With Confidence and Credibility With IEPA

Business owners spend years building value, yet without intentional planning, a significant portion can be reduced through taxes at exit. The Certified Business Exit Consultant® (CBEC®) program from the IEPA equips advisors with the specialized knowledge and structured frameworks required to guide tax-efficient, value-focused transitions.

CBEC® certification emphasizes practical, real-world application, giving advisors the skills to navigate complex exit scenarios with clarity, confidence, and precision.

The CBEC® program delivers measurable impact:

- 66% structure client engagements across multiple phases, ensuring consistent value delivery.

- 44% work with 6–10 exit planning clients annually, demonstrating active application of CBEC® methodology.

- 22% earn more than $250,000 each year from Exit Planning services.

- 33% charge $10,000–$15,000 for initial engagements, reflecting the strategic value of this work.

CBEC® membership helps you:

- Build succession plans that protect enterprise value across borders.

- Guide owners through global tax, structure, timing, and leadership decisions.

- Collaborate effectively with legal, financial, and M&A partners.

- Elevate your advisory practice with a practitioner-led, credibility-driven certification.

Owners deserve advisors who can help them transition confidently and retain more of what they’ve worked for. CBEC® certification gives you the structure, insight, and authority to deliver that outcome.